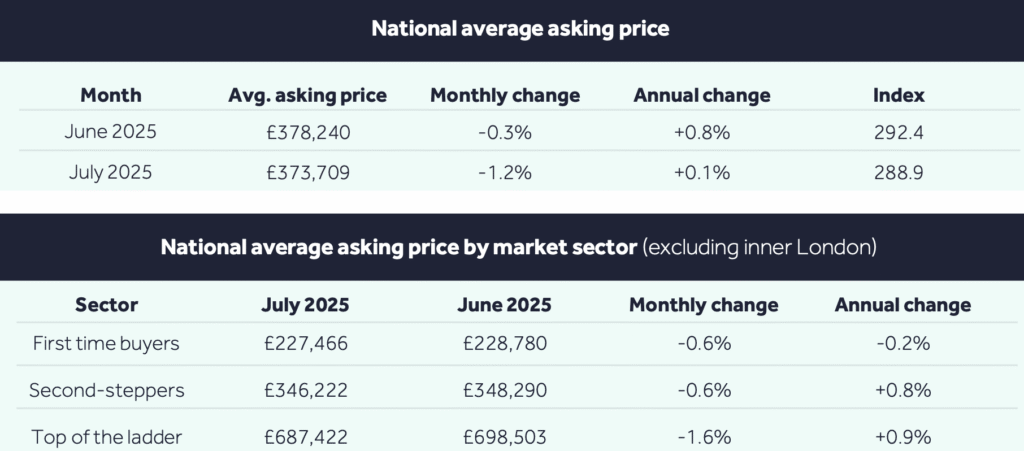

The average asking price for a UK home has dropped by 1.2% in July – the steepest fall for this time of year in over two decades – as sellers respond to a decade-high level of competition by pricing more aggressively to attract buyers, according to new data from Rightmove.

The monthly decline of £4,531 brings the average new seller asking price to £373,709.

While a seasonal softening of prices is typical in July as the market slows for the summer holidays, this year’s drop is more pronounced, driven primarily by price reductions in London, where average new seller prices are down 1.5%, and by 2.1% in Inner London specifically.

The competitive pricing strategy appears to be having the desired effect, with buyer activity continuing to strengthen.

SALES AGREED

The number of sales being agreed is up 5% year-on-year – the highest at this point in the year since 2021 – while buyer enquiries to estate agents are up 6%.

Colleen Babcock, property expert at Rightmove, says: “We’re seeing an interesting dynamic between pricing and activity levels right now.

“The healthy and improving level of property sales being agreed shows us that there are motivated buyers out there who are willing to finalise a deal for the right property.”

And she adds: “What’s most important to remember in this market is that the price is key to selling. The decade-high level of buyer choice means that discerning buyers can quickly spot when a home looks over-priced compared to the many others that may be available in their area.

“It appears that more new sellers are conscious of this and are responding to this high-supply market with stand-out pricing to entice buyers and get their home sold.”

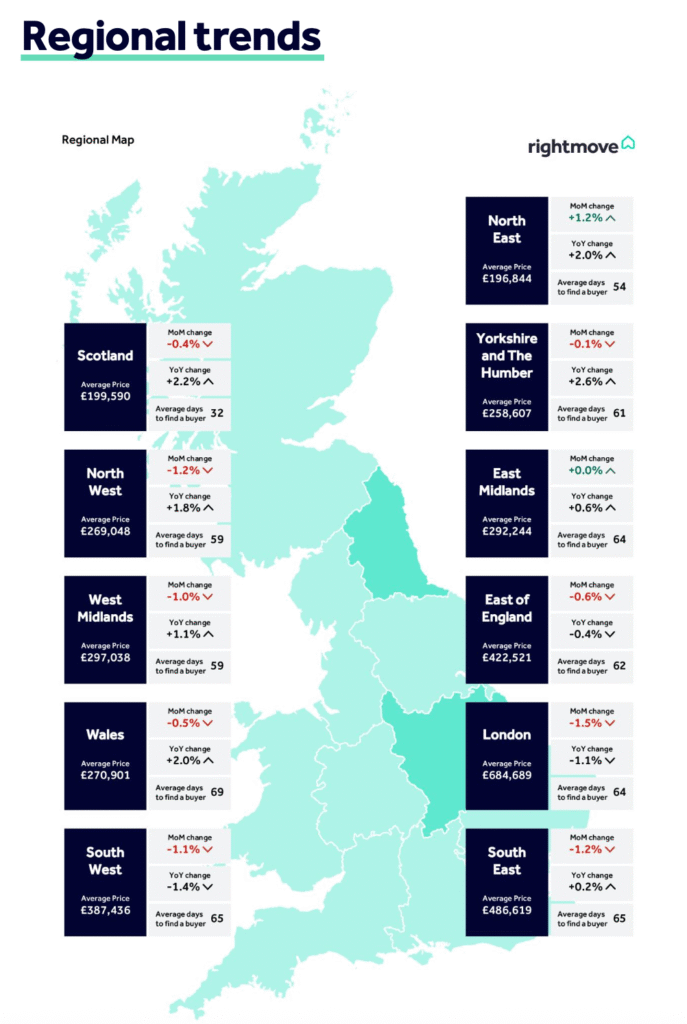

REGIONAL VARIATIONS

While London leads the monthly price declines, other parts of the UK are seeing upward movement. The North East, the country’s most affordable region, recorded a 1.2% price increase in July – continuing the pattern of stronger growth in lower-cost areas.

Rightmove attributed some of the price weakness in London to recent changes in tax policy, including the April increase in residential stamp duty in England and last year’s rise in stamp duty for investment and second homes, both of which disproportionately affect higher-value markets.

Ongoing uncertainty around non-dom tax rules is also believed to be weighing on investor sentiment in the capital.

AFFORDABILITY IMPROVING

Despite the slowing price growth, overall buyer affordability is improving. Average asking prices are now just 0.1% higher than a year ago, while average wages have grown by over 5%. Mortgage rates are also falling, with Rightmove’s mortgage tracker showing the average two-year fixed rate now at 4.53%, down from 5.34% last July – a reduction that equates to nearly £150 in monthly savings on a typical mortgage.

Looking ahead, Rightmove has revised down its 2025 house price forecast from 4% to 2%, citing persistent high levels of supply as a dampener on price growth. However, it is maintaining its full-year forecast of 1.15 million property transactions.

STAMP DUTY DEADLINE

Babcock adds: “It’s been a promising first half of the year for activity levels, particularly when you consider that some will have brought their plans forward to try to avoid added stamp duty from April. Even after the stamp duty deadline, we’re seeing more sales being agreed and more new potential buyers entering the market than at the same time last year.

“The knock-on effect of high buyer choice is slower price growth.”

“Still, the knock-on effect of high buyer choice is slower price growth, so we’re revising down our prediction of how much the asking price of a home will increase over the whole of the year.

“Looking ahead to the second half of 2025, there will still very likely be the usual quieter seasonal periods around the summer holidays and Christmas, but we expect market activity to continue to be resilient.

“Crucially, buyer affordability is heading in the right direction, and another two Bank Rate cuts before 2026 would be a big boost to this.”

With two further interest rate cuts currently forecast by markets before the end of the year, many industry watchers believe improving affordability could help sustain momentum through the traditionally quieter autumn and winter periods.

INDUSTRY REACTION

Jeremy Leaf, north London estate agent and a former RICS residential chairman, says: “What’s particularly interesting about these figures is that they confirm what we’ve been seeing on the ground recently.

“Asking prices are not of course values but invariably an owner’s aspirational starting point to determine if genuine buyers are attracted.

“Sales are still being agreed but nearly always with sellers who have recognised the importance of setting a realistic initial figure to differentiate themselves from so much other, often similar, property.

“Otherwise, buyers will take even more time waiting for the ‘right’ property and perhaps worrying about the possibility of autumn tax rises despite improving affordability – including the likelihood of imminent mortgage rate cuts.”

RETURN TO NORMALITY

Nathan Emerson, CEO of Propertymark, says: “The housing market is witnessing a steady return to normality following stamp duty threshold changes for those living in England and Northern Ireland at the start of April.

“As we enter the summer months, when the housing market tends to achieve a peak in sales in activity, it is good to see yet further resilience in house prices year on year.

“We have seen encouraging signs from Rachel Reeves’ Leeds Reforms which are designed to potentially better help lenders serve those on lower incomes. However, such reforms alone will not help keep house prices manageable without the UK Government and the devolved administrations meeting their individual housing targets to keep pace with real world demand.”

HIGHER STOCK LEVELS

Phillip Bishop, Managing Director at Perry Bishop in Cirencester, says: “Buyer activity levels remain strong since the April 2025 stamp duty changes.

“However, there is significant property choice and availability for buyers, which is allowing them to be uncompromising on their criteria and expectations.

“We’re seeing significantly higher stock levels than a year ago but mitigated in part by a good increase in buyer registrations and viewing levels compared with last year.

“Buyers are taking their time and viewing more before deciding, and the serious and motivated sellers are pricing sensibly and getting success.

“However, compromised properties are harder to sell, with any issues standing out and being exaggerated by buyer choice.

“Rarely available properties are still receiving mass interest and multiple offers. The Cotswolds summer market can slow over the holidays, but we expect a second wave of serious buyer activity in the autumn, with serious motivated buyers wanting to agree their purchase. Typically, these buyers are a little more prepared to compromise on some of their expectations.”