Pepper Money has taken its case for shared ownership reform straight to Downing Street, warning that unless the scheme evolves, it risks shutting out the very people it is designed to help.

The lender’s new white paper, Shared Ownership – A Vital Bridge to the Housing Market, sets out three policy changes it believes are essential if shared ownership is to remain a realistic route onto the housing ladder.

Top of the list is a call to update income thresholds in line with earnings growth. Caps of £80,000 outside London and £90,000 in the capital have not moved since 2016, losing 35% of their real value to inflation. Without change, Pepper argues, households with no other path into ownership could find themselves excluded.

The lender also wants an independent body to collect and publish sector-wide data, giving policymakers and investors a clear evidence base.

CAPITAL FUNDING GUIDE

A third recommendation is a review of Homes England’s Capital Funding Guide, with the aim of standardising approaches and making the tenure more accessible to customers who don’t fit high street criteria.

Pepper’s focus is on borrowers with complex incomes or those recovering from financial setbacks – groups often overlooked by mainstream lenders. It reported a 21% rise in shared ownership customers last year, underlining growing demand.

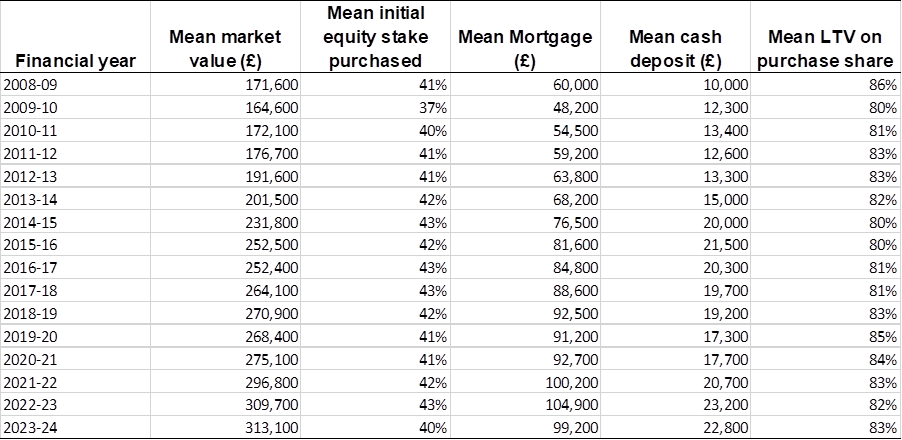

The affordability gap remains stark. The average shared ownership buyer in 2023–24 purchased a 40% stake in a £313,100 home, putting down £22,800 and borrowing £99,200.

The typical first-time buyer needed a £69,000 deposit and a mortgage of £223,000.

By comparison, the typical first-time buyer needed a £69,000 deposit and a mortgage of £223,000. In London, the deposit jumps to £155,000.

Pepper’s message to No.10 is clear: shared ownership is still working, but only just – and unless policy catches up with reality, it risks failing the buyers who need it most.

VITAL BRIDGE

Rob Barnard (main picture), Intermediary Relationship Director at Pepper Money, says: “Shared ownership offers a vital bridge to the housing market for so many people who otherwise would struggle to buy their own home, but we know without action, this bridge will get harder to use for those who need it.

“Our policy recommendations are pragmatic, cost effective, and provide certainty for the sector to ensure that shared ownership continues to be the vital pathway to home ownership so many rely on.

“The Government has rightly outlined their ambition to build 1.5 million homes by the next election, and that can only be achieved by supporting a range of types of home ownership, including shared ownership.”

UNINTENDED CONSEQUENCES

But he added: “The unintended consequence of the status quo is a less viable tenure, with shared ownership becoming less accessible for financially capable people seeking their own home and has the potential to undercut the Government’s own bold house building ambitions.

“We’ve taken our message and our request directly to the heart of the Government, and into the hands of the Prime Minister’s team, and we urge them to act in the forthcoming Affordable Homes Programme to give certainty and a successful future to the tenure.”

Source: Pepper analysis of DLUHC and MHCLG data