Around one third of tenants spend 50% or more of their take-home pay on rent, data from Reposit has revealed.

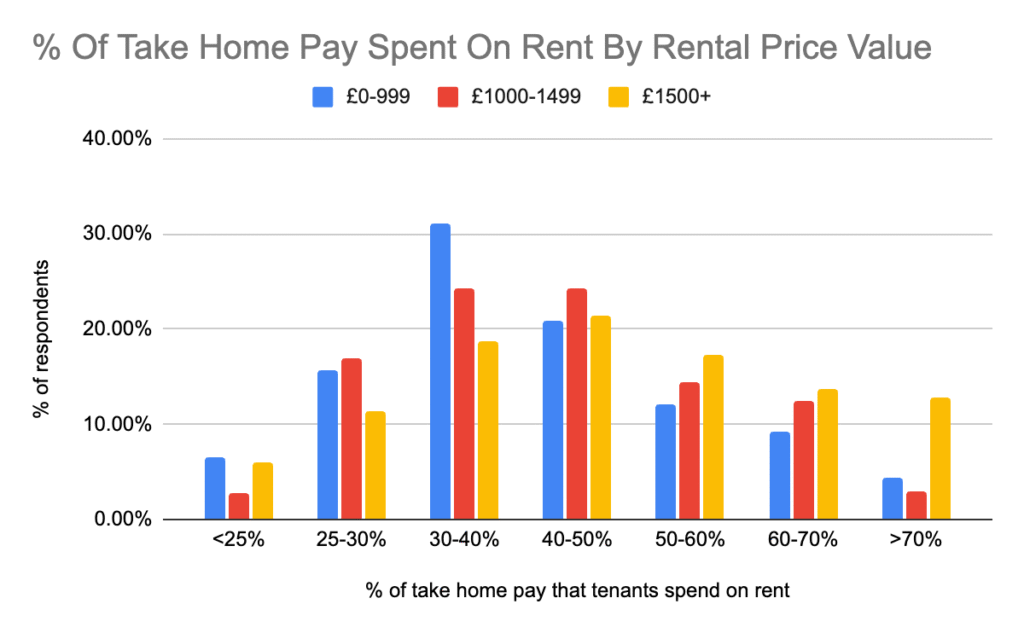

The findings, based on a survey of 1,000 tenants conducted by the deposit alternative provider, revealed that 14% spend 50-60%, 11% spend 60-70%, and 6% spend more than 70%. A further 22% spend between 40-50% of their net salary on rent.

In total, Reposit’s survey found that 31% of renters were spending half or more of their net income on their monthly rent, roughly equivalent to 40% of gross income.

Analysts, NGOs, and financial advisors often refer to the ‘30% rule’, a long-standing affordability guideline suggesting households spend no more than around 30% of their gross (pre-tax) income on rent.

LIMITED FUNDS

Exceeding this threshold can leave tenants with limited funds for essentials such as food, transport, and utilities. Based on the survey results, many renters are already living beyond these recommended affordability limits.

To give some affordability context, the average UK rent is £1,196 pcm, according to Reposit data, and the latest figures from the Office for National Statistics (ONS) report average weekly earnings are £733, (equivalent to £38,116 annually as gross pay).

Based on these averages, tenants are therefore spending 38% of their monthly gross income on rent, considerably more than the established, 30% rule.

Further analysis from the poll found that for tenants paying rents of up to £1,000 pcm, 78% were spending above 30% or more of their take-home pay. At a rental cost of £1,500 and above, that figure rises to 84%. The graph below illustrates the findings, split by rental cost and net monthly salary.

HIGH-QUALITY REFERENCING

Ben Grech Main picture), Chief Executive of Reposit, says: “It’s still a really tough time for renters. With so many already spending half of their take-home pay on rent, the traditional upfront deposit only adds to the pressure.

“With average cash deposits now around £1,380, anything that helps ease this burden or give tenants more financial breathing room can make renting more manageable.

“Landlords shouldn’t assume affordability simply because a tenant can pay a deposit.

“Previous Reposit research shows that one in five renters borrow money as repayable debt, to cover this cost. A tenant’s true capacity to pay rent in full and on time is best assessed through high-quality referencing and affordability checks carried out by specialist providers.”

REDUCE VOID PERIODS

And he adds: “By removing the need for large upfront deposits, landlords can attract a wider pool of renters and fill properties faster, helping to reduce costly void periods.

“At the same time, Reposit offers up to eight weeks of protection, exceeding the traditional five-week cap, and provides peace of mind as a fully FCA-regulated and insured product.”