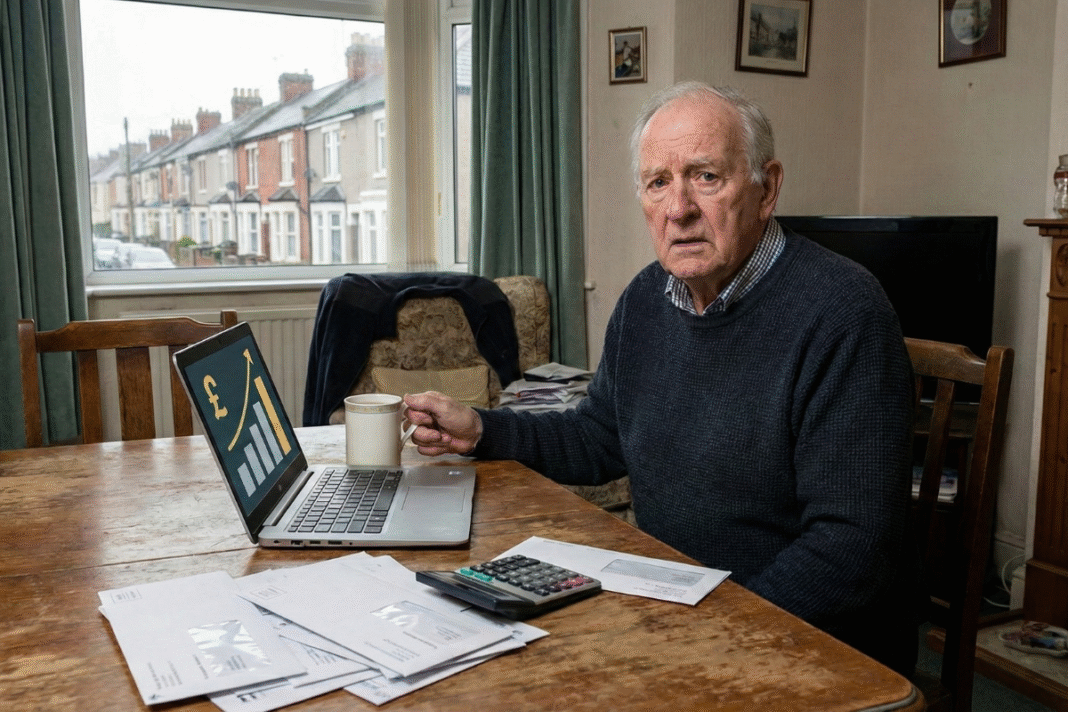

Older renters could face housing costs exceeding £260,000 over the course of their retirement, according to new analysis from Suffolk Building Society.

The figures highlight the long-term financial pressure on those remaining in the private rented sector as they move into later life.

The Society’s modelling shows that a typical retiree, leaving work at the average retirement age of 64, could expect to spend around 16 years in retirement.

At current average rents of £1,360 a month, this equates to £261,120 in total housing costs – rising to £434,880 for those renting in London.

LIMITED RELIEF

Even downsizing brings only limited relief. The average monthly rent for a one-bedroom property is £1,103, resulting in more than £211,000 of housing spend over a standard retirement period.

While some older tenants rent by choice or necessity, the Society argues that many others who wish to buy are unaware of the widening range of mortgage options available to later-life borrowers.

LATER LIFE RENTAL PRESSURES

Suffolk Building Society highlights the challenges facing older renters, including reduced income in retirement, financial insecurity linked to shifting rental costs and limited protection over long-term tenure. Renting can also restrict a tenant’s ability to adapt their home to future mobility needs.

The Society says the lending landscape has changed significantly in recent years, with a broader range of products and criteria designed to support those seeking to buy later in life.

REAL CONCERN

Charlotte Grimshaw, Head of Intermediaries at Suffolk Building Society, says: “These rental costs are particularly striking when you consider most retirees have a reduced income in retirement.

“It’s a real concern to think that a large share of their pension income could be consumed by rent. Renting has a clear role to play at various stages of life, but given these figures, some may want to explore alternative options.”

“There’s understandably a huge focus on first time buyers right now, but given the substantial rental costs retirees may face, it is equally important for this underserved group to be helped.

“Many older renters may have tried to buy a home in the past but found it out of reach. Our message is that the mortgage market has changed significantly in recent years, and it may be worth taking a fresh look.”