Raising VAT would deliver a sharper blow to household incomes and economic growth than increasing income tax according to new analysis by the National Institute of Economic and Social Research (NIESR).

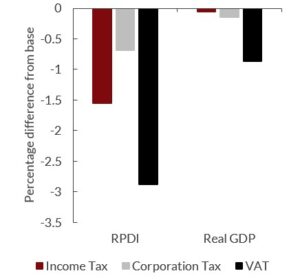

Using its global econometric model, NiGEM, the think tank examined several tax-raising options available to the Chancellor ahead of the November Budget and found that a rise in VAT would reduce real personal disposable income by nearly 3% and real GDP by almost 1% in the short term.

The analysis concludes that the economic impact of a VAT rise would be roughly double that of an equivalent income tax increase.

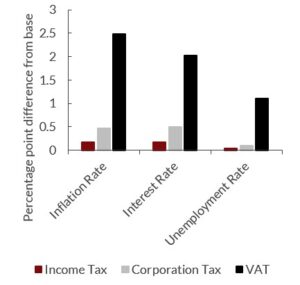

The findings also suggest that higher VAT would drive inflation, interest rates and unemployment higher, as consumer spending falls and businesses face weaker demand.

SMALLER OUTPUT DRAG

In contrast, an income tax rise would spread the adjustment more evenly across income groups and have a smaller overall drag on output.

The scenarios assume the government seeks to raise an additional £30 billion a year by 2029–30, in line with forecasts for what is needed to meet the Chancellor’s “stability rule” on public finances.

NIESR’s modelling indicates that, among the major tax levers available, raising income tax would be the least economically damaging option – while a VAT increase would risk undermining household purchasing power and investor confidence at a fragile point in the recovery.

“Tinkering around the edges simply won’t shift the dial.”

Ed Cornforth, economist at NIESR and lead author of the report, says: “Our analysis clearly shows that a rise in income tax is the Chancellor’s least damaging, most reliable option for putting the economy on a sustainable, secure footing.

“VAT would put pressure on prices, an undesirable option given current inflation expectations, and additional business taxes would harm investment incentives, at a time when employer NICs have already dampened business confidence.

“Although it is politically unsavoury, avoiding raising income tax will force the Chancellor’s hand into worse options; tinkering around the edges simply won’t shift the dial.”

SUSTAINABLE PATH

David Aikman, NIESR’s director, added: “The Chancellor’s priority should be to rebuild fiscal resilience by putting the public finances on a stable and sustainable path.

“Doing so would also signal to markets that the Government is serious about restoring fiscal discipline — which could, in turn, help reduce borrowing costs.

Our analysis shows that increasing income taxes would be the least damaging option, while raising VAT would be significantly more harmful – by far the option with the largest negative impact on the economy.”