Four million of the 7.5 million wannabe homeowners in the UK don’t think they will ever be able to own their home and almost two million don’t think they will follow in the footsteps of their home owning parents, damning research from the Homeowners Alliance reveals.

The idea of homeownership amongst young people is fast becoming an impossible dream with 1.9 million aspiring homeowners believing they will never be able to do so.

Three quarters (73%) of wannabe homeowners say their parents owned their own home but less than half (48%) expect to be able to do the same, a drop of 25%.

HIGH HOUSE PRICES

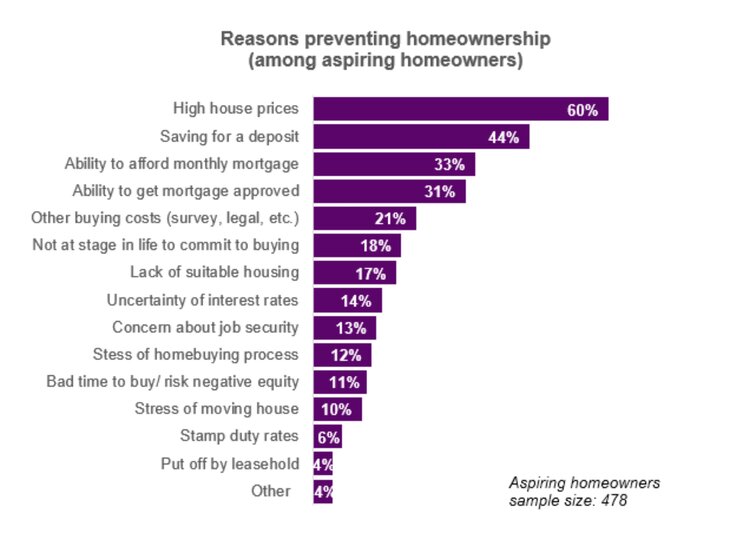

Perhaps unsurprisingly top reasons for not owning include high house prices (60%), saving for a deposit (44%), ability to afford monthly mortgage repayments (33%) and the ability to get approved for a mortgage (31%).

Around a third (28%) of younger homeowners rely on government schemes to afford a home – more than three times than UK homeowners overall (9%).

While difficulties saving for a deposit coupled with affordability issues means 30-year plus mortgage terms are becoming the norm, with more than one in three (38%) homeowners aged 18-34 having a term of 30 years or more compared to 15% of UK homeowners overall.

And with one in five homeowners in the same age bracket relying on the Bank of Mum and Dad parents have become one of the UK’s biggest lenders.

TIPPING POINT

Paula Higgins, HomeOwners AlliancePaula Higgins, Chief Executive of the HomeOwners Alliance, believe the UK has reached ‘a tipping point’.

Paula Higgins, HomeOwners AlliancePaula Higgins, Chief Executive of the HomeOwners Alliance, believe the UK has reached ‘a tipping point’.

She says: “Brits are giving up on their dream of homeownership, our damning survey reveals.

“The government has failed aspiring homeowners and continues to degrade the life chances of young people by continually not building enough homes.

“This shortage of new homes has led to rocketing house prices, leaving aspiring homeowners dependent on Mum and Dad to bolster savings or by locking themselves into longer term mortgages which cost them more in the long run.”

BROKEN BRITAIN

And she adds: “In today’s broken Britain, homeowners rely on government schemes to get them out of this mess and bridge the affordability gap – except the government’s flagship Help to Buy programme has ended with nothing to fill the void.”