NatWest has signed a three-year strategic partnership with Rightmove that will see the bank become the property portal’s exclusive mortgage lender from April.

Under the agreement NatWest will power Rightmove’s Mortgage in Principle (MIP) service, allowing prospective buyers to obtain an instant digital decision in principle as they search for homes online.

The move deepens the integration of mortgage lending into the UK’s largest property portal, as lenders compete to reach buyers earlier in their home-moving journey and secure business before offers are agreed.

Rightmove said the partnership forms part of its wider strategy to digitise more of the home-buying process, while NatWest is seeking to expand its footprint among first-time buyers and digitally active customers.

FINANCIALLY QUALIFIED ENQUIRIES

The NatWest mortgage in principle will sit alongside Rightmove’s existing affordability tools, including stamp duty, mortgage and renovation calculators, as well as instant and in-person valuation services. The aim is to provide estate agents and developers with more financially qualified enquiries at an earlier stage.

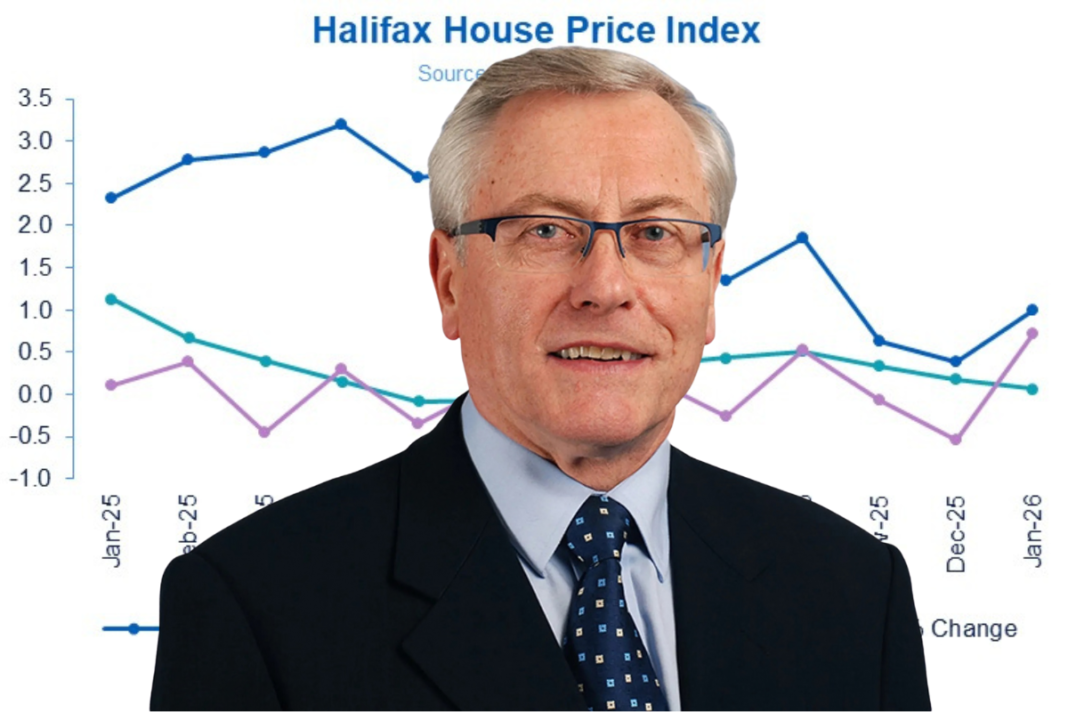

Solange Chamberlain (main picture, inset, right), Chief Executive of Retail Banking at NatWest, says: “Partnering with Rightmove ensures NatWest can be there for customers at the exact moment they’re thinking about buying a home – combining our mortgage expertise, with a seamless digital experience.

“As we look to grow further, this new partnership expands the way customers can start their relationship with NatWest and will help us make homeownership a reality for even more people – bringing more joy and less stress to the home buying process.”

HELPING AGENTS

Johan Svanstrom (main picture, inset, left), Chief Executive of Rightmove, adds: “Our aim is to give people more confidence when they’re moving home.

“We help consumers to better understand what they can afford earlier in their home-moving journey, which in turn also helps estate agents or home developers have more qualified discussions with them.

“We’re excited to be partnering with NatWest as we continue to invest in innovative digital solutions to help make things quicker and more simple for everyone involved.”

Rightmove accounts for more than 80% of time spent on UK property portals and attracts more than one billion minutes of user activity each month, giving NatWest significant exposure to active home movers.

THIRD LARGEST LENDER

NatWest, now the UK’s third largest mortgage lender, has pledged to lend £10 billion to first-time buyers in 2026.

It has recently launched a Family Backed Mortgage, allowing a second person to support a buyer while ownership remains independent, and a Shared Ownership Mortgage for those purchasing an initial stake in a property.

As part of the new agreement, eligible customers applying via Rightmove will receive an instant digital decision in principle and, in some cases, a formal mortgage offer within 24 hours. Borrowers needing additional support will be directed to a mortgage adviser.