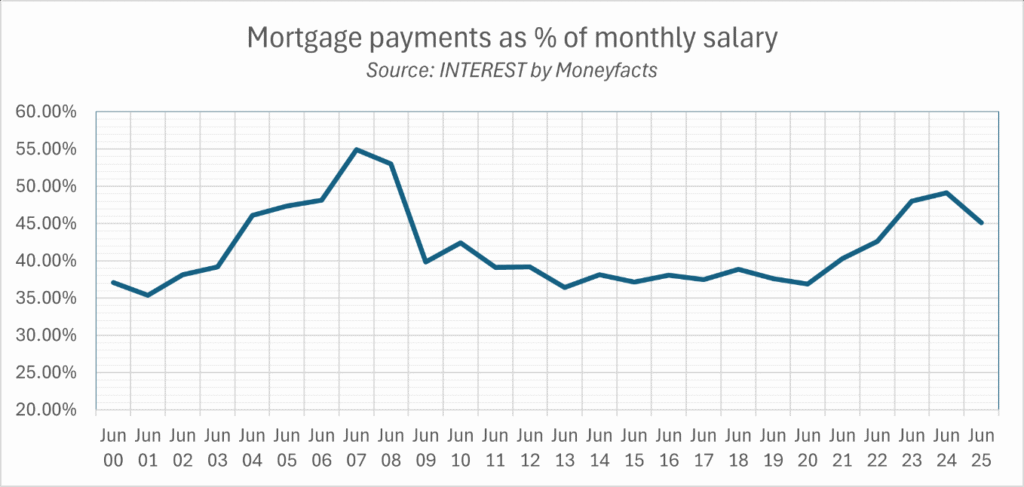

British households are devoting the highest share of their income to mortgage repayments since the 2008 financial crisis, new analysis has found, highlighting the fragility of the housing market as the Chancellor weighs sweeping reforms to property taxation.

Research by INTEREST, the data service from Moneyfacts, shows that an average earner buying in the past two years with a standard deposit now faces monthly mortgage repayments consuming almost half of gross salary – a level not seen since the financial crash.

The affordability squeeze reflects the widening gulf between house prices and wages over the past quarter century. In 2000, the average home cost £78,000, around five times the typical salary of £15,800.

By 2025, the average price has reached £269,000, more than seven times average earnings of £37,600. While wages have risen 237% since 2000, house prices have surged 345%.

RATE RELIEF

If incomes had kept pace with property inflation, the average UK salary today would exceed £54,000. To illustrate the distortion, Moneyfacts says that a loaf of bread would cost £2.28 and a dozen eggs £4.73 if food prices had risen as fast as homes.

Lower mortgage rates in recent months have offered some relief. The cheapest 2-year fixed deals at 90% LTV are around 4.20%, compared with June’s average of 5.12%, saving borrowers about £100 a month.

Yet repayments would still swallow 38% of gross income – well above the 35% affordability benchmark. Many households are now forced to stretch mortgage terms to 50 years to make repayments manageable.

LACK OF SUPPLY

Adam French, Head of News at Moneyfacts, says: “Affordability may have eased a touch over the past 12 months, but buying a home in 2025 is still too much of a financial stretch for many.

“Monthly mortgage repayments are eating up almost half of gross earnings – the toughest burden since the 2008 financial crisis.

“Years of ultra-low borrowing costs, Government incentives and a lack of housing supply have driven house prices far ahead of wages, leaving many buyers caught between high prices, expensive borrowing and strict lending rules.”

50-YEAR MORTGAGES

He adds: “It all means that a typical borrower today will need to take a mortgage over a 50-year term to keep their repayments to a more affordable 35% of gross monthly income.

“There remains an acute risk that the market could overcorrect or overheat depending on the future path of interest rates, inflation and wage growth.

“What is needed is a period of stability where modest house price growth allows incomes to catch up, so the market can return to more sustainable levels that benefit homeowners, homebuyers and the wider economy.”

The findings come as ministers consider radical changes to housing taxation, including replacing Stamp Duty with a levy on sellers and curbing Capital Gains Tax relief on higher-value main residences.

But economists warn that any misstep could exacerbate affordability pressures at a time when households are already carrying their heaviest mortgage burden in nearly two decades.

FINANCIAL SQUEEZE

Mary-Lou Press, President of NAEA Propertymark (National Association of Estate Agents), says: “While a reduction in interest rates will have helped many with mortgage costs and made the prospect of borrowing money to step onto or move up the housing ladder easier, it is clear that wage growth is not keeping pace with house price growth.

“Homeowners are witnessing a squeeze on their finances, and for many aspiring first-time buyers, they now need to save up what can be an unrealistic large lump sum to purchase their first home.”

ECONOMIC GROWTH

She adds: “With speculation circulating regarding potential changes to stamp duty in England and Northern Ireland, we need the UK Government to focus on reviewing current rates and bands rather than targeting higher-value properties, as historically, reducing or removing property taxes has led to increased transactions, which in turn stimulates spending and drives broader economic growth.

“Alongside this, all governments throughout the UK need to meet their individual housing targets to increase the supply of homes and bring down property prices in the longer term.”