In a sign of shifting tides in the UK mortgage market the rate gap between average 2- and 5-year fixed mortgages has dropped to its lowest level since early 2023, according to the latest Moneyfacts UK Mortgage Trends Treasury Report.

The narrowing gap could signal a more competitive market for borrowers but raises questions about the future trajectory of interest rates as the economic landscape remains uncertain.

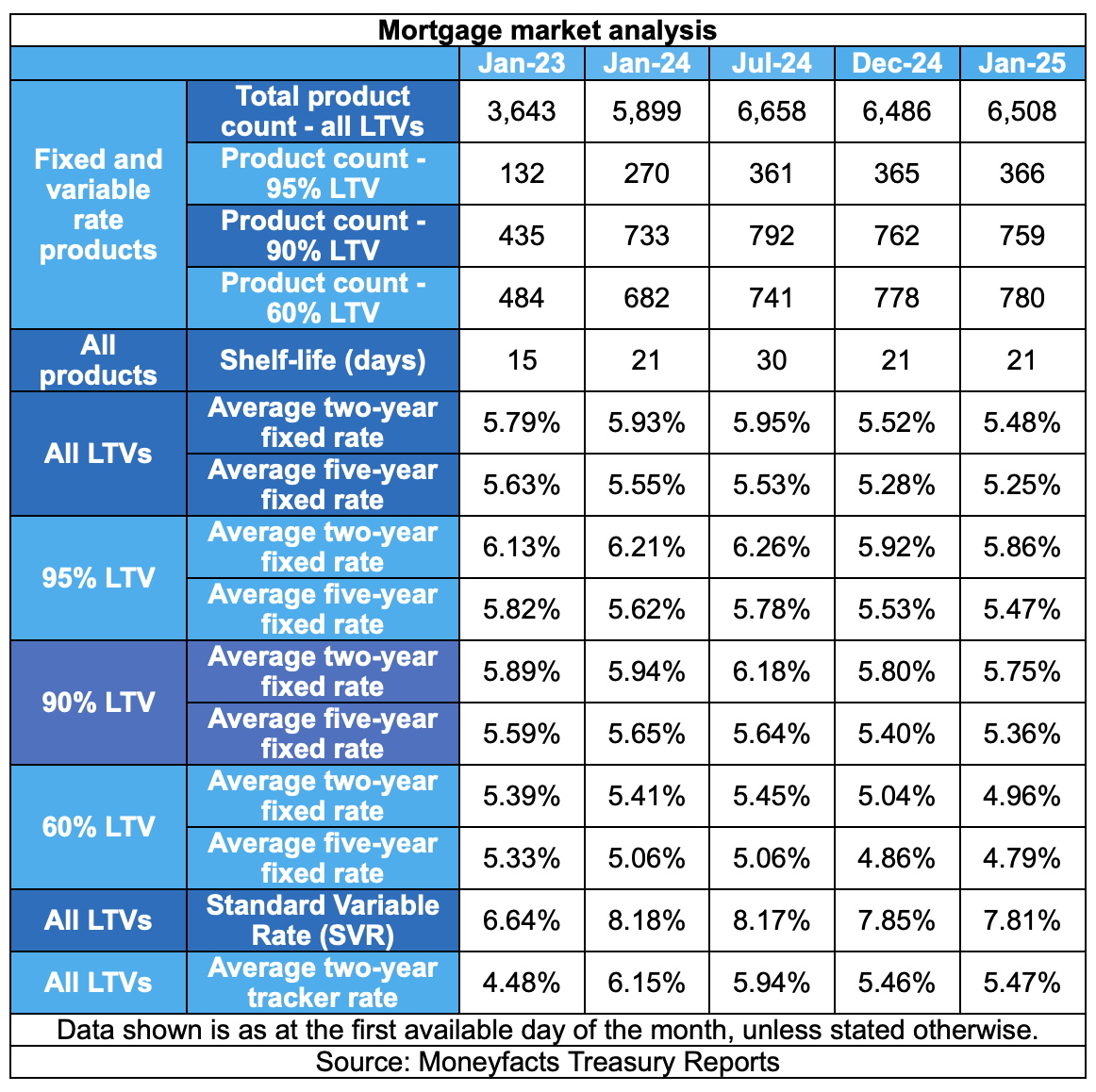

As of early January 2025, the average 2-year fixed mortgage rate stands at 5.48%, down from 5.93% at the start of 2024. Similarly, 5-year fixed rates have fallen from 5.55% to 5.25% over the same period.

The shrinking gap, now at just 0.23%, marks a notable departure from trends seen in October 2022 when 2-year rates overtook their 5-year counterparts. While both rate types have seen reductions, the 2-year fixed rate’s steeper decline highlights increased competition among lenders targeting borrowers seeking shorter-term stability. However, experts caution that ongoing market volatility could temper further rate cuts.

BORROWER CHALLENGES

The average Standard Variable Rate (SVR) has dropped slightly to 7.81%, but it remains a daunting prospect for those falling off fixed-term deals.

Borrowers coming off a 5-year fixed rate from January 2020, which averaged just 2.74%, now face a stark 5% increase in rates if they default to SVR terms.

Rachel Springall, Finance Expert at Moneyfacts, warns that delaying refinancing could be a costly gamble.

She says: “It’s wise for borrowers not to delay securing a new deal. The average SVR is significantly higher, and even marginal rate fluctuations can have a substantial impact on monthly repayments.”

MARKET STABILITY

Despite rate fluctuations, the market has shown signs of stability. Product availability has surged to 6,508 options – up from 5,899 a year ago – and the average mortgage product shelf-life remains steady at 21 days. For borrowers, this signals a more robust market compared to the turmoil of late 2022, when fiscal announcements triggered mass withdrawals of mortgage products.

However, Springall cautions against complacency and adds: “Stubborn inflation and unsettled swap rates could still influence lender behaviors. While fixed rates may drop further, it’s not a certainty if market conditions remain volatile.”