First-time buyers are seeing signs of relief as monthly mortgage payments fall by almost £100 compared with this time last year, according to new analysis by Rightmove.

Ahead of the Bank of England’s interest rate decision today, the property portal said the average monthly mortgage payment for a typical first-time buyer is now £909, down from £1,002 a year ago – a drop of £93.

The figures are based on buyers purchasing a property with two bedrooms or fewer, using a 20% deposit and repaying the loan over 30 years.

The fall in costs is largely being driven by gradually easing mortgage rates.

FLAT ASKING PRICES

The average 2-year fixed mortgage rate for borrowers with a 20% deposit has dropped from 5.21% last year to 4.38% today. And 5-year fixed deals have also declined, from 4.91% to 4.52% over the same period.

Crucially, first-time buyer asking prices have remained broadly flat. The average price for a home in this segment is now £227,466, compared to £227,924 a year ago. Meanwhile, average earnings have increased by around 5%, further improving affordability.

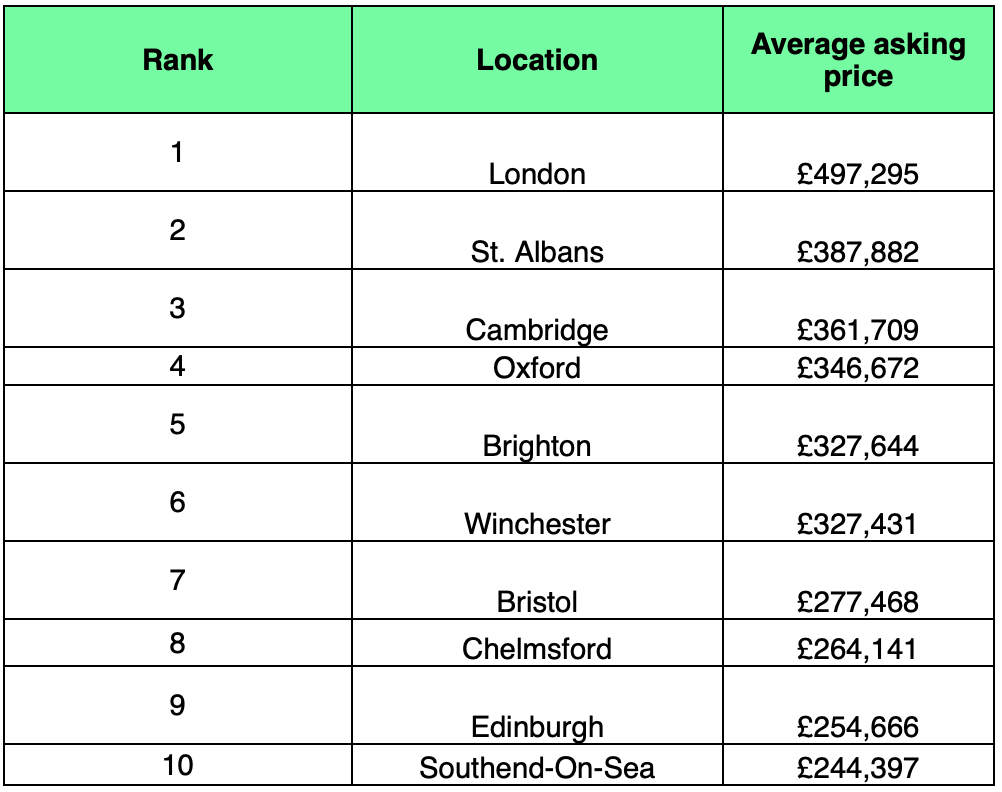

In London – the most expensive region to get on the property ladder – typical monthly mortgage payments have fallen by £240 compared to this time last year. A first-time buyer home in the capital now has an average asking price of £497,295.

Source: Rightmove

Buyers seeking better value in regional cities will find the most affordable first-time buyer homes in Aberdeen, Hull and Carlisle, while St Albans and Cambridge follow London as the most expensive.

AFFORDABILITY FACTOR

Colleen Babcock, Rightmove’s property expert, says: “Affordability is still playing a key role in market activity right now.

“The factors which contribute to buyer affordability are improving, and if we see further Bank Rate reductions this year followed by mortgage rate drops, this could spur more buyers on during the second half of this year.”

Source: Rightmove