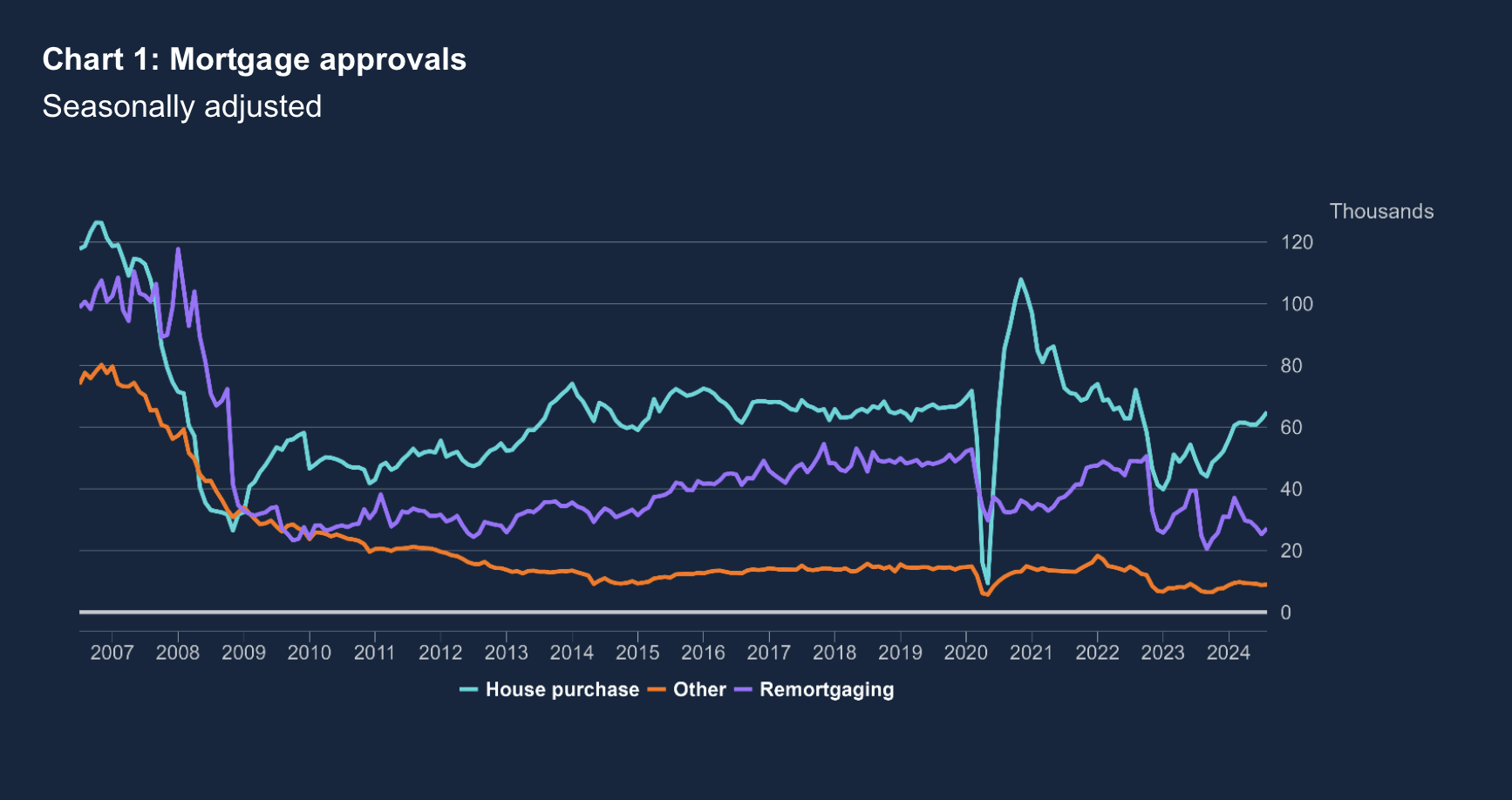

UK net mortgage approvals increased to 64,900 in August – the highest level in two years – as the interest rate cut at the start of the month attracted more buyers to the market, latest figures from the Bank of England show.

Approvals remain considerably higher (43.4%) than the 45,219 seen in August 2023 and there is also optimism for further mortgage approval increases in the coming months, especially if a bank rate cut materialises in November.

Colby Short, GetAgent.co.ukColby Short, Co-founder and CEO of GetAgent.co.uk, says: “We’re continuing to see a robust level of mortgage market activity where approvals are concerned and there’s no doubt that last month’s base rate reduction will have helped to further steady the ship in this respect.

Colby Short, GetAgent.co.ukColby Short, Co-founder and CEO of GetAgent.co.uk, says: “We’re continuing to see a robust level of mortgage market activity where approvals are concerned and there’s no doubt that last month’s base rate reduction will have helped to further steady the ship in this respect.

“The mortgage sector has responded well to this decision and, while we may have seen a hold in September, we’re now seeing a wider range of products available to homebuyers, which is providing even greater choice and flexibility to those looking to climb the ladder.”

Mark Harris, chief executive of mortgage broker SPF Private Clients, says: “Mortgage approvals for new purchases rose again, which bodes well for housing market activity in the final quarter.

“Remortgage approvals also picked up after a dip in July, suggesting a growing number of borrowers are drawn to ‘best buy’ rates offered by other lenders, rather than sticking with their existing provider.

“The effective interest rate paid on new mortgages edged up slightly to 4.84 per cent in August but with a Bank of England base rate cut, coupled with lenders reducing mortgage rates, we expect lower pricing to be reflected in next month’s data.”

BUYERS RETURNING

Jonathan Samuels, Octane CapitalJonathan Samuels, Chief Executive of Octane Capital, says: “Mortgage approval levels have continued to climb for the third consecutive month which signals that buyers are returning to the market at mass in order to make their move this side of Christmas.

Jonathan Samuels, Octane CapitalJonathan Samuels, Chief Executive of Octane Capital, says: “Mortgage approval levels have continued to climb for the third consecutive month which signals that buyers are returning to the market at mass in order to make their move this side of Christmas.

“We haven’t quite seen the reduction in mortgage rates that you might expect following August’s base rate reduction, however, it remains very early days and what we have seen is a significant cut to rates across all lending segments when compared to this time last year.”

And he adds: “This increased level of borrowing affordability has come as a result of increased market stability following the Bank of England’s original decision to hold rates at 5.25% in September of last year and, with market conditions continuing to improve, it’s only a matter of time before we see further rate reductions.”

CEMENT CONFIDENCE

Tomer Aboody, director of specialist lender MT Finance, says: “Higher borrowing levels and mortgage approvals in August further cement confidence in the market. Lower base rate, and subsequent mortgage rates, are convincing buyers who have been waiting to buy that now is the time.

“While we await the dreaded Budget, we can expect some caution but hopefully a further rate decrease will ignite the market again for a final push in 2024.”

AFFORDABILITY CHALLENGE

Alice Haine, Bestinvest by Evelyn PartnersAlice Haine, Personal Finance Analyst at Bestinvest by Evelyn Partners, adds: “Improving mortgage rates and strong income growth have eased the affordability challenge for some buyers in recent months with the Bank of England’s interest rate cut at the start of August and prospect of at least one more rate reduction to come this year energising the residential property market.

Alice Haine, Bestinvest by Evelyn PartnersAlice Haine, Personal Finance Analyst at Bestinvest by Evelyn Partners, adds: “Improving mortgage rates and strong income growth have eased the affordability challenge for some buyers in recent months with the Bank of England’s interest rate cut at the start of August and prospect of at least one more rate reduction to come this year energising the residential property market.

“This has not fully filtered through to the mortgage market just yet, as the effective rate on newly drawn mortgages rose by 3 basis points to 4.84% in August, highlighting that the financial pressures of the past few years have not eased entirely for borrowers.

“Borrowing costs remain relatively high when compared to two years ago and who gains and who loses out depends on the type of mortgage someone has and what stage of the home ownership journey they have reached.

“While first-time buyers and existing homeowners on tracker products may by buoyed by the prospect of better rates this year, homeowners locked into expensive fixed-rate deals with some time left to run won’t feel any respite until their product expires.

“Those with cheap fixed-rate loans secured before the rate hikes began and set to expire soon are also bracing themselves for significantly higher repayments when they come

to refinance. This was evident in the 3-basis point rate increase for the outstanding stock of mortgages to 3.72%, as more people rolled off cheap fixed rate deals.”

Source: Bank of England

Source: Bank of England