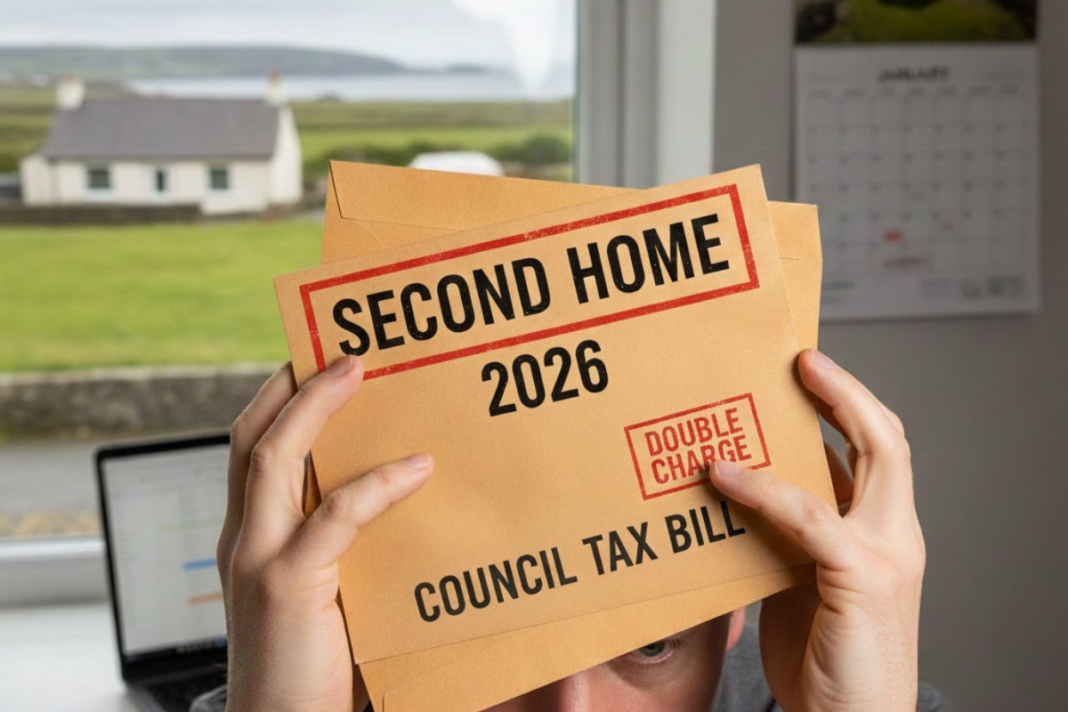

Thousands of second-home owners in England are set to face sharply higher bills next year as more local authorities move to double council tax on properties that are not rented out or used as holiday lets.

From April, 38 additional councils are due to introduce a 100% premium on second homes, with others planning implementation in 2027.

Analysis suggests the move could affect up to 12,300 properties in those areas, although not all will immediately be liable due to exemptions.

The ability for councils to levy the surcharge took effect last April. Around 211 councils – roughly 71% of those in England – adopted it straight away, largely concentrated in coastal and tourism hotspots.

NEW REVENUE SOURCES

The Times reports that the latest wave reflects a broader shift as councils under financial strain look for new revenue sources.

Research from Hamptons indicates more than 12,300 second homes sit within the 38 councils preparing to impose the premium from April.

Aneisha Beveridge of Hamptons, said: “We’re entering a second wave of charges as councils look for fresh ways to boost their budgets. The big second-home destinations were quick to introduce the surcharge, but now others are set to follow.”

Authorities poised to introduce the premium include Wiltshire, which has more than 1,300 second homes, Hillingdon in west London with nearly 750, South Norfolk with about 600, and Stratford-upon-Avon, which has more than 800.

EXEMPTIONS WILL APPLY

Some second homes are automatically excluded, such as employer-provided accommodation or properties where planning conditions prevent use as a main residence. Owners may also avoid the charge where the property is actively marketed for sale or rent.

Earlier analysis by Hamptons found that around 17% of second homes in areas that have already adopted premiums currently benefit from exemptions, suggesting the headline number of households facing doubled bills will be lower than the total number of properties in scope.