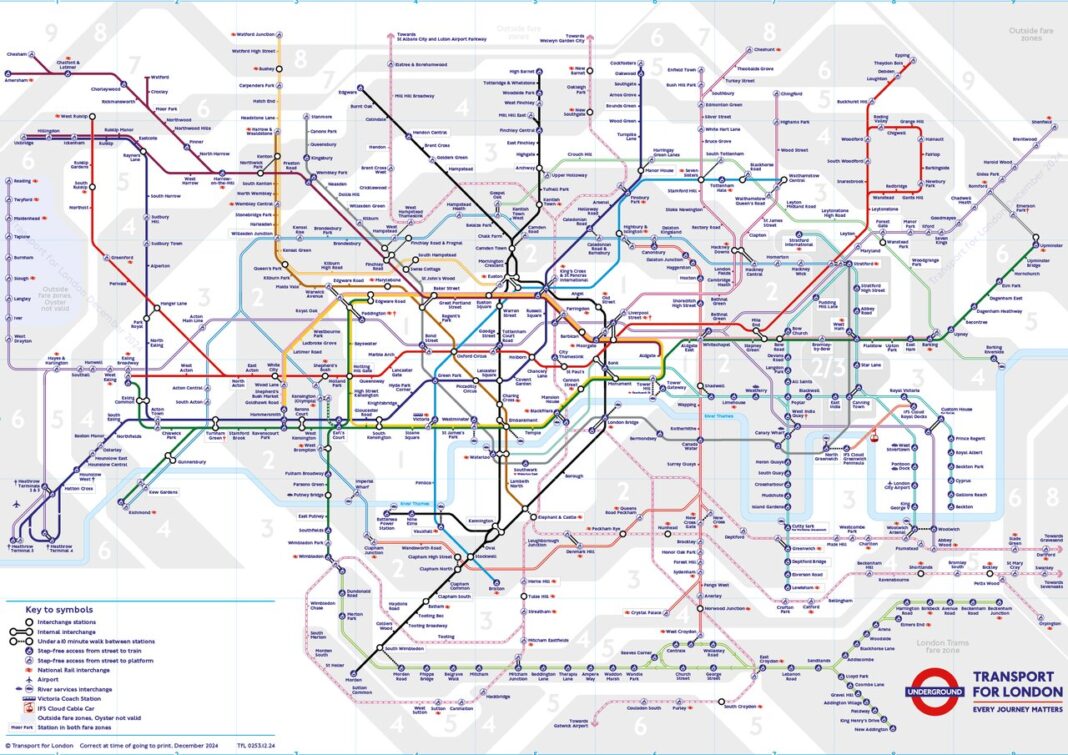

Mortgage broker Alexander Hall has revealed just how much buyers will have to pay when it comes to the monthly cost of a mortgage across the London Underground network, as well as which line is home to the largest mortgage market gap between the most and least affordable stations.

The research shows that across the network, High Street Kensington is home to the highest monthly mortgage payment at a staggering £9,890 per month.

In contrast, Heathrow is the most affordable with an average monthly payment of just £1,316 – some £8,500 cheaper than High Street Ken.

At an average of £5,632 per month, the Waterloo and City line tops the table when it comes to the highest average monthly mortgage payment across all network lines.

MIND THE GAP

The Circle line comes in second, with the average cost of a mortgage across the line costing £5,323 per month.

The Victoria line is the third most expensive with a mortgage costing an average of £4,027 per month, with the Northern (£3,894) and District (£3,891) lines also amongst the most expensive for a mortgage.

The DLR ranks as the most affordable with an average monthly mortgage cost of £2,610 per month, just beating the Elizabeth line (£2,620).

When it comes to the line with the largest mortgage market gap between the most and least affordable station, the District line tops the table. There’s a difference of £8,248 per month between the average monthly mortgage payment in High Street Kensington (£9,890) and Upney (£1,642).

The Piccadilly line and the Elizabeth line are home to the second largest mortgage gap. The average monthly cost of a mortgage in both Piccadilly Circus and Tottenham Court Road (£8,496) comes in some £7,181 higher than Heathrow (£1,316).

Across the Hammersmith and City line, a property around Great Portland Street will set you back £6,854 more per month for the average mortgage versus buying in Barking.

HOLDING STEADY

Stephanie Daley, Alexander Hall Director of Partnerships, says: “London property values have been holding steady over the past year and we know the capital remains home to the strongest housing market with respect to the price commanded for bricks and mortar.

“This is particularly evident when looking at the average monthly mortgage payment required, with this cost hitting almost £10,000 across the most prestigious pockets of the London property market.

“However, one weapon in the arsenal of London homebuyers is the capital’s outstanding transport links and the London Underground, in particular.

“As our research shows, you can dramatically reduce the cost of your mortgage by looking further along the tube line that runs through your ideal destination.

“Whilst you may not want to adjust your expectations from High Street Kensington to Barking, you may well find that even a stop or two can help to cut the cost required to climb the London ladder.”