Despite rising taxes and tighter regulation landlord activity in England and Wales has remained steady, underpinned by a surge of younger investors entering the market.

New analysis from Hamptons shows that in the third quarter of 2025, landlords accounted for 11.3% of home purchases, broadly unchanged from the same period in 2024, despite the increase in the second home stamp duty surcharge to 5%.

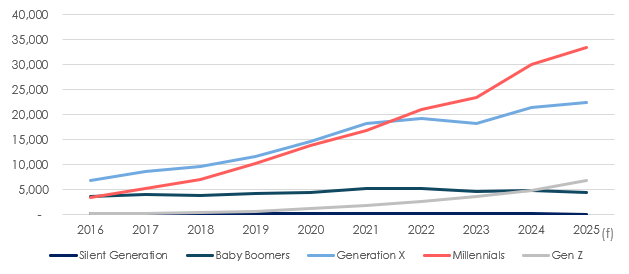

The data reveals a significant generational shift. Millennials – those born between 1981 and 1996 – now represent 50% of shareholders in new buy-to-let limited companies formed so far this year, more than double the number set up in 2020.

Hamptons estimates that 33,395 new buy-to-let companies will be incorporated in 2025, the highest on record, highlighting the growing appetite among younger investors for property investment even as affordability challenges persist. In total, 75% of new company shareholders are under 50, compared with 68% a decade ago.

NORTHERN POWERHOUSE

Investor activity is increasingly concentrated in northern regions, where yields are higher and stamp duty costs are lower.

In the North East, landlords bought 28.4% of homes in Q3 2025, more than triple the London figure of 8%.

Source: Hamptons & Companies House

Similarly, purchases in the North West and East Midlands accounted for 13.3% and 15.4% of sales respectively. By contrast, London, the South East, and the South West accounted for just 34% of investor purchases, reflecting the combined effect of high property prices and the SDLT surcharge in these markets.

Rental trends are also showing a divergence between new lets and renewals. The average rent for a newly let home fell by 0.3% over the year to September 2025, down £4 per month to £1,398, with London rents declining most sharply. Inner London rents dropped 4.6%, bringing the average to £2,766 per month.

RENT RENEWALS

Conversely, renewal rents continue to rise, increasing by 4.6% over the year to £1,307 per month nationally, driven by ongoing demand for existing tenancies. Over the past two years, the cost of renewing a tenancy has risen nearly three times faster than moving into a new property, highlighting the premium placed on established rental agreements.

The combined trends point to a reshaped landlord landscape, with younger investors sustaining buy-to-let activity despite taxation pressures, and rental growth increasingly differentiated between new and existing tenancies.

The northern regions, in particular, are emerging as hotspots for investors seeking better returns and more affordable entry points, signalling a long-term geographic shift in the UK rental market.

CHANGING LANDSCAPE

Aneisha Beveridge, Head of Research at Hamptons, says: “Landlord purchases haven’t collapsed in the face of higher taxes and tighter regulation – but they have shifted.

“New landlords have increasingly become an endangered species in markets across Southern England, where big stamp duty bills and flatlining prices have nudged investors northwards.

“But in places like the North East, landlord activity remains close to all-time highs, showing that the buy-to-let market is adapting rather than retreating.”

WEALTH BUILDING

And she adds: “What’s striking is the rise of younger landlords. Millennials – many of whom have struggled to buy their own home – are now leading the charge in buy-to-let.

“Thirty years on from the invention of the buy-to-let mortgage, which kick-started investment by Baby Boomers, it’s clear that a new generation is finding alternative ways to build wealth through bricks and mortar.

“Despite the challenges, Millennials and Gen Z are showing a similar appetite for long-term property investment, which is helping to stabilise the market.

“Rental growth remained negative in September, with tenants finding they have more room to negotiate than they’ve had during the last five years.

“While lower rents are always welcome news for tenants, there are still too many cost pressures facing landlords for a nominal fall in rents to turn into a more meaningful correction in the months ahead.”