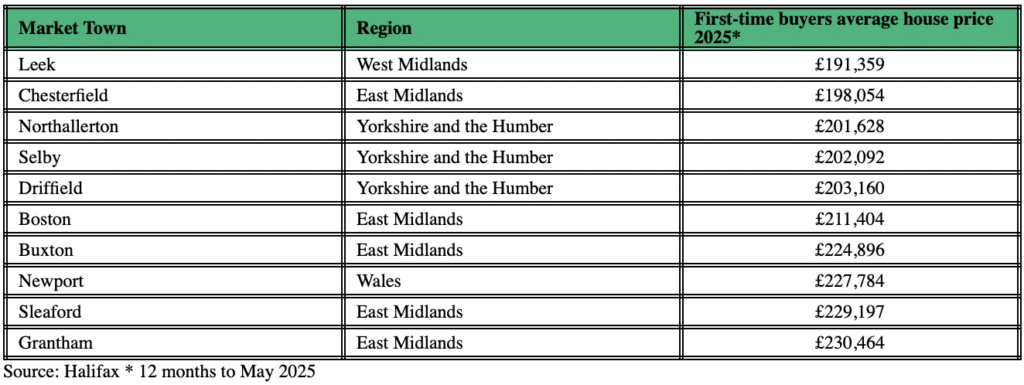

First-time buyers are getting more market town for their money in the Midlands, with average property prices in Leek, Staffordshire, just £191,359, according to new research from Lloyds Bank.

The report shows that six of the 10 most affordable market towns for first-time buyers are in the Midlands, where the combination of relatively low house prices and good transport links continues to attract buyers.

Across England and Wales, the average cost of a home in a market town is now £363,456 – up 5% in the past year and 24% over the last five years.

First-time buyers are paying an average of £280,582, up 2% on last year and 26% since 2020, reflecting heightened demand for these historic locations during and after the pandemic.

MOST AFFORDABLE

Immingham, in Yorkshire and the Humber, is the most affordable market town for buyers overall, with an average property price of £176,918.

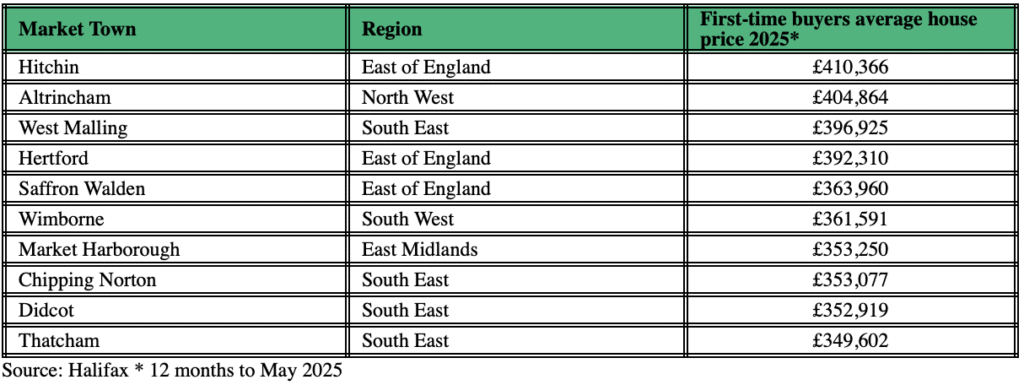

At the other end of the scale, some of the priciest market towns are now among the most expensive locations outside Greater London.

BEST OF BOTH WORLDS

Andrew Asaam, homes director at Lloyds Bank, says: “It’s no wonder market towns have stood the test of time with home-buyers, whether people are stepping onto the first rung of the housing ladder, or are making a move to their next home.

“These charming locations are filled with historic landmarks and architecture, quaint charm and community spirit, offering a calmer pace of life, often within the reaches of bigger towns and cities.

“That ‘best of both worlds’ feeling has led to house prices in these areas holding up – in fact, the priciest market towns are amongst the most expensive locations, outside of Greater London, to settle into a home.

“It’s worth looking beyond the most popular spots as some market towns are great value for money while offering the farmer markets, independent shops and community spirit that make these historic places so appealing.”

HITCHEN PRICIEST

Hitchin, Hertfordshire is the most expensive market town for first-time buyers, with an average price of £410,366.

Amongst all buyers looking for a home in a historic location, Beaconsfield comes out the costliest. A property here, in the South East of England, will set buyers back £839,468 on average.

AFFORDABLE PRICES

Mary-Lou Press, President of NAEA Propertymark, says: “More and more people are looking to relocate to picturesque areas across the UK in order to not only get more for their money, but also be part of a flourishing community within proximity to busier cities for work and social commitments.

“With the average deposit on a home increasing to over £60,000, many buyers, especially those stepping onto the property ladder for the first time, will be casting their nets wider in order to purchase a home that meets their expectations, but for a more affordable price compared to those located in busier cities.”