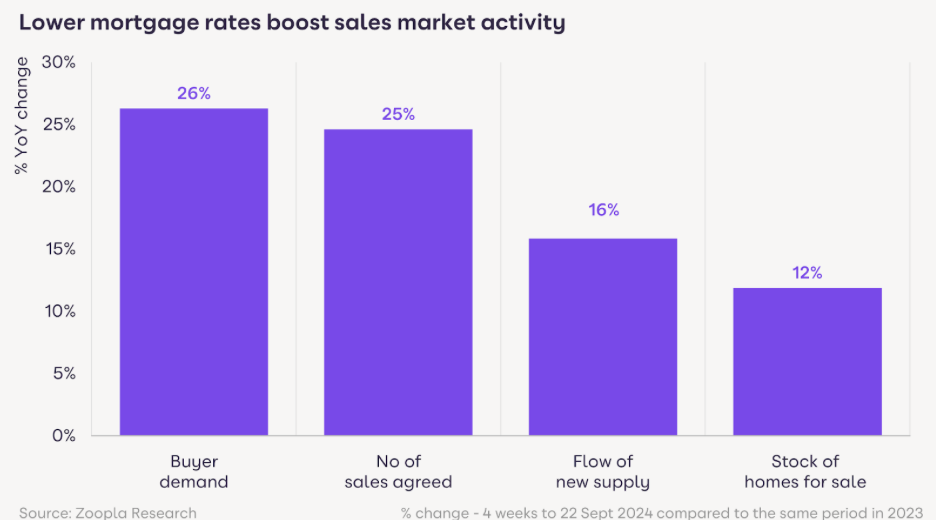

The lowest mortgage rates for 15 months are supporting a rebound in sales market activity across the UK, latest data from Zoopla reveals.

Sales agreed and buyer demand are both up by more than a quarter over the last four weeks compared to the same period a year ago as households that have held off making moving decisions over the last two years return to the market.

The number of sales agreed is 25% higher than a year ago and sales are up by over 10% across all areas and are up to 30% higher across the East Midlands and North-East.

The number of homes for sale also continues to grow as greater confidence amongst sellers sees more homes listed for sale.

CHAIN FREE

A third (32%) of homes for sale on the site are currently ‘chain free’ as investors and second home owners look to sell homes amidst recent tax changes and speculation around further tax changes in the upcoming October Budget.

The most common ‘chain free’ homes are 2-bed houses with 41% currently listed as chain free on Zoopla. Previously rented homes account for 13% of homes for sale on Zoopla.

DOUBLE COUNCIL TAX

Many English councils are expected to double council tax for second homes in 2025. Coastal and rural postal areas popular with second home owners, such as Truro (47%), Torquay (44%), Exeter (41%), Lincoln (41%) and Bournemouth (40%), have all seen available supply increase by over 40%, as a result of these incoming tax changes. However, annual house price growth is still negative in these areas with rising supply keeping house prices in check.

AFFORDABILITY CONSTRAINTS

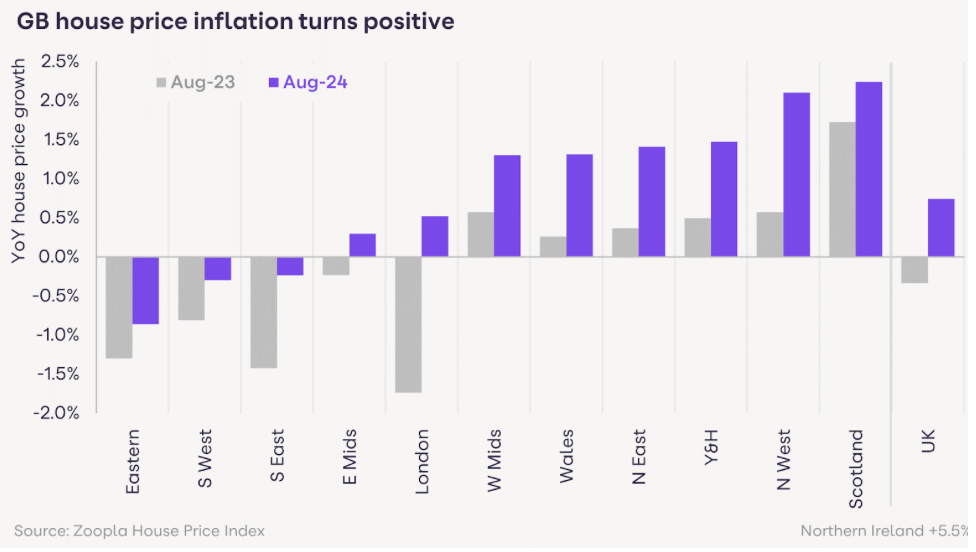

Affordability continues to be a constraint on house price growth, especially in southern England. London prices have registered the biggest turnaround over the last year moving from annual price falls of -1.7% a year ago to modest price gains of +0.5% today.

Whilst house prices are lower than a year ago in the South West, South East and Eastern regions of England, in the rest of Great Britain, house price growth is higher than a year ago with prices up to 2.5% higher. Home values in Northern Ireland are 5.5% higher, having under-performed the rest of the market in recent years.

CURBING INFLATION

Greater choice for home buyers is expected to keep house price growth in check in the months ahead. Most new listings are home-owners looking to sell and buy another home. However, not all homes are ‘brand’ new to the market. A fifth of homes currently for sale were previously on the market at some stage in the last two years.

While market conditions are improving, setting the right price is important to attract buyers. The same applies to the fifth of homes for sale that have been on the market for more than 6 months, still unsold. This explains why a similar proportion have had their asking price cut by up to 5% to attract buyers who remain price sensitive in the face of greater choice.

Over a third of sales (37%) are being agreed at more than 5% below the initial asking price, highlighting further how buyers continue to be competitive with offers. This proportion has improved from a year ago but remains at a level that suggests low single digit house price growth ahead.

CONFIDENCE BOOST

Richard Donnell, ZooplaRichard Donnell, Executive Director at Zoopla, says: “Lower mortgage rates are delivering a much needed confidence boost to homeowners, many of whom have sat on the sidelines over the last two years.

Richard Donnell, ZooplaRichard Donnell, Executive Director at Zoopla, says: “Lower mortgage rates are delivering a much needed confidence boost to homeowners, many of whom have sat on the sidelines over the last two years.

“Market activity is up across the board and expectations of lower borrowing costs will continue to bring buyers and sellers into the market.

“Speculation over possible tax changes in the Budget and the impact of previous tax changes are continuing to add to the growth in the number of homes for sale.

“We remain in a buyers market and greater choice of homes for sale will keep house price inflation in check into 2025.”

CHANGING LANDSCAPE

Nathan Emerson, PropertymarkNathan Emerson, Chief Executive of Propertymark, says: “It’s positive to see further growth within the housing market. 2024 has been a year of progression that has seen changes within the wider economy help uplift the ability for people to approach the marketplace with a new level of assurance.

Nathan Emerson, PropertymarkNathan Emerson, Chief Executive of Propertymark, says: “It’s positive to see further growth within the housing market. 2024 has been a year of progression that has seen changes within the wider economy help uplift the ability for people to approach the marketplace with a new level of assurance.

“We are starting to see early signs of lenders having the confidence to shift up the landscape by offering sub-four per cent mortgage deals in some circumstances, which of course sits firmly below the current base rate and points towards future confidence within the economy.”

DRASTIC CHANGES

Nigel Bishop, Recoco Property SearchNigel Bishop of Recoco Property Search adds: “Second homeowners and buy-to-let investors are facing drastic changes as some local authorities have or are going to start charging double council tax for properties that are left empty for more than a year.

Nigel Bishop, Recoco Property SearchNigel Bishop of Recoco Property Search adds: “Second homeowners and buy-to-let investors are facing drastic changes as some local authorities have or are going to start charging double council tax for properties that are left empty for more than a year.

“We are seeing more second homeowners contemplating if maintaining their holiday home remains a sound financial investment.

“If a substantial number of second homes is being put up for sale, we could see the property market in areas such as Cornwall become increasingly attractive to house hunters who are seeking a permanent residence but are currently priced out of the market.

“That being said, a lot of properties are being offered at considerably high asking prices and sellers will need to adjust their expectations.”

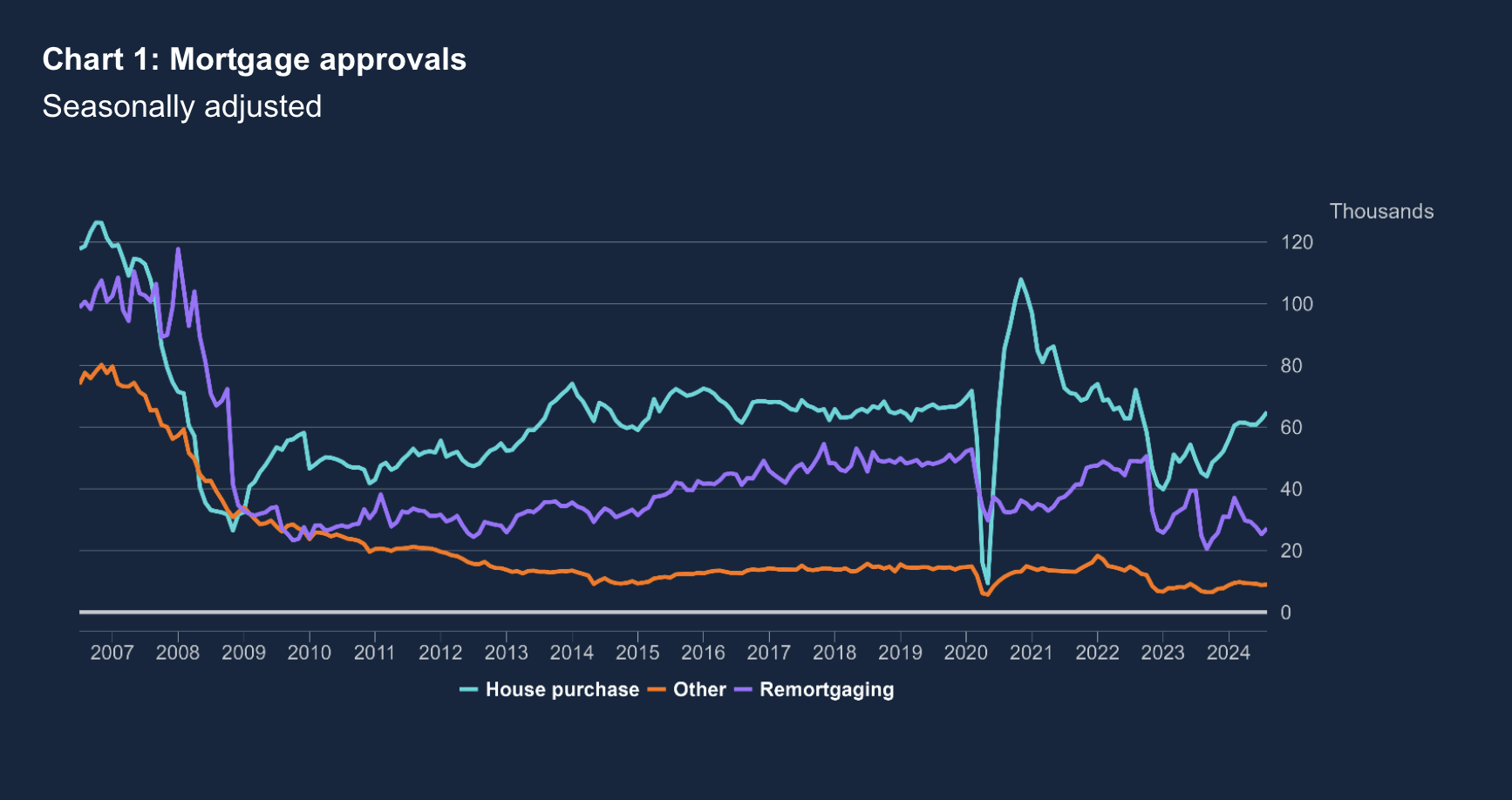

Source: Bank of England

Source: Bank of England