The number of mortgages available to borrowers with smaller deposits has reached its highest level in 17 years, according to the latest Moneyfacts UK Mortgage Trends Treasury Report.

Products at 90% and 95% loan-to-value (LTV) now account for 19% of the residential mortgage market, up from 17% a year ago.

In total, there are 1,360 deals available at these tiers, the most since March 2008.

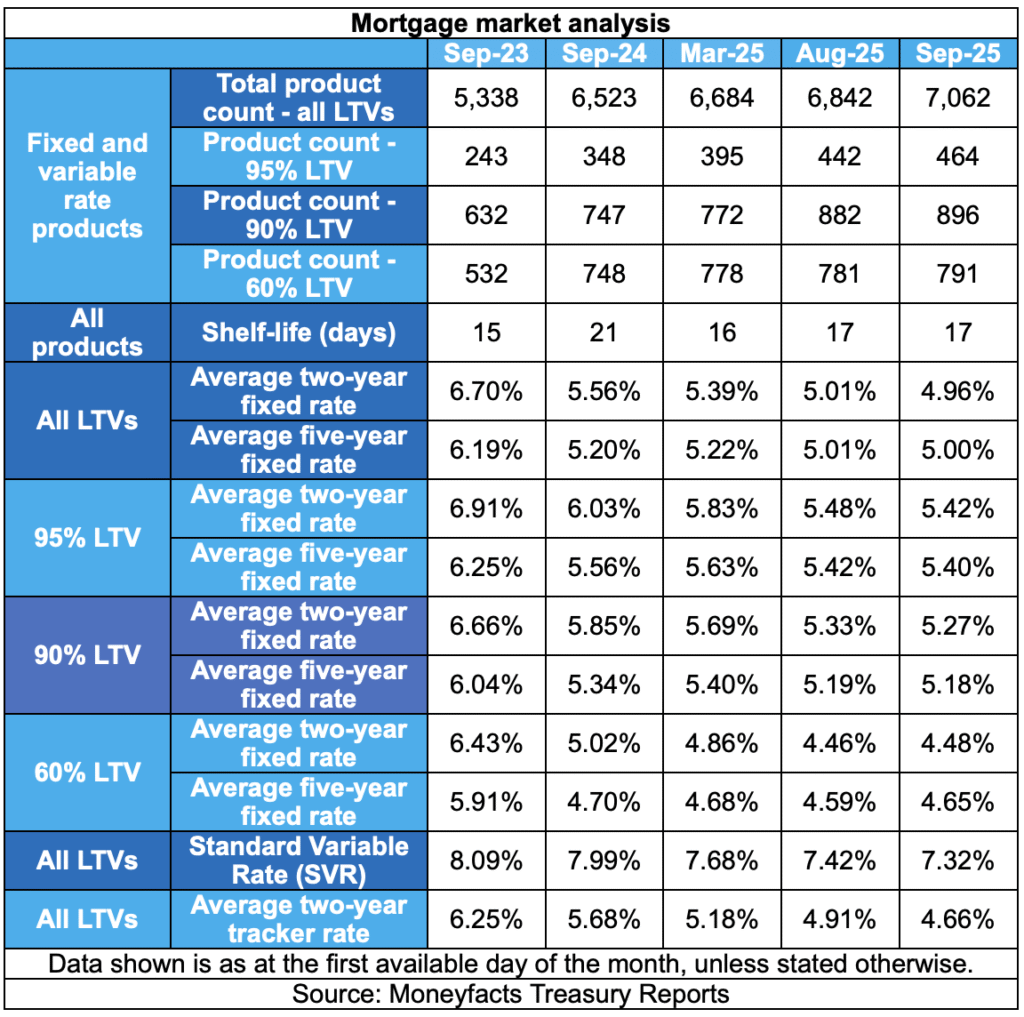

Availability at 95% LTV rose to 464 products, while 90% LTV deals climbed to 896. Overall product choice also increased, with 7,062 mortgages now on the market – the highest number since October 2007.

LOWEST SINCE 2022

Rates continue to edge down, though at a slower pace than in recent months. The average 2-year fixed rate fell by 0.05 percentage points to 4.96%, while the average five-year fixed slipped by 0.01 points to 5.00%. Both are at their lowest levels since 2022. The average 2-year rate has declined by 0.60 percentage points since September 2024, compared with a fall of just 0.20 points for the 5-year equivalent.

The Moneyfacts Average Mortgage Rate now stands at 5.00%, its lowest since September 2022, and well below the 6.41% recorded a year ago.

Tracker rates also eased to 4.66%, while the typical revert-to standard variable rate dropped to 7.32%, down from a peak of 8.19% late last year.

FIRST-TIME BUYER HURDLE

Rachel Springall, finance expert at Moneyfacts, says that while the rise in choice at higher LTVs was encouraging, affordability remains a “critical hurdle” for first-time buyers.

She adds that “longer-term fixed rates are not seeing significant shifts” and warns that rate volatility could continue to affect pricing.

The government has pressed lenders to do more to stimulate growth, with mortgage availability seen as a key driver for the housing market.

However, with cost-of-living pressures persisting, many potential first-time buyers may still find the prospect of securing a loan out of reach.

AFFORDABILITY BATTLE CONTINUES

Mary-Lou Press, President of NAEA Propertymark (National Association of Estate Agents), says: “While it’s positive that property transactions remain buoyant and many buyers, especially those entering the market for the first time with lower deposits, are able to access mortgages to get them onto the property ladder, it’s evident that affordability and raised house prices are a continuous battle.

“Now that stamp duty has risen across England and Northern Ireland, this is likely making it even more difficult to access better mortgage products due to further financial constraints. It also has the potential to distort the housing market, often stopping people from moving when they want to.”