Londoners continue to pay the steepest premiums in the UK to live close to rail and underground stations although the uplift has narrowed since 2021, according to new research from Nationwide.

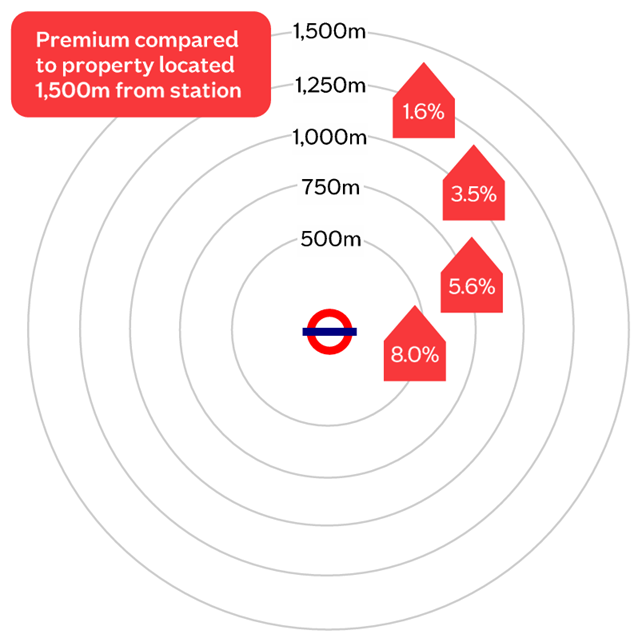

The lender found that a property located within 500 metres of a station in the capital attracts an 8% premium – equivalent to about £42,700 – compared with an otherwise identical home 1,500 metres away.

While still significant, the figure is down from 9.7% in 2021 and broadly in line with pre-pandemic levels.

In Greater Manchester, the premium stands at 4.9%, or about £10,900, compared with 6.1% four years ago. In Glasgow, the figure has slipped to 4.6%, or around £8,800, down from 7.2% in 2021.

IMPORTANT FACTOR

Andrew Harvey, Nationwide’s senior economist, says transport links remained a key factor for buyers and renters.

He adds: “Over 80% of Londoners told us being near a station was either ‘fairly important’ or ‘very important’ when choosing to buy or rent their current property. In Glasgow and Manchester, around 60% felt the same.”

The research, based on transactions between July 2024 and June 2025, highlights the continuing importance of connectivity in major cities, even as affordability pressures push many households further from central locations.

More than half of London respondents said they had been forced to buy or rent near a station outside the city centre because of price constraints.

FASTER TRAVEL

Nationwide’s survey found that 85% of people in London, Manchester and Glasgow live within a 30-minute walk of a station. Among these, the most common reasons cited were faster travel within the city and easier commutes, with 10% saying they did not have – or did not want – a car.

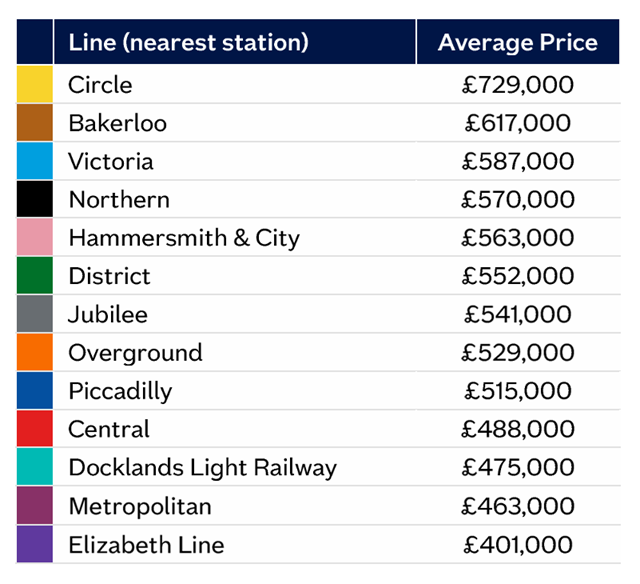

London’s Circle line remains associated with the highest average property prices, at about £729,000.

By contrast, homes near Elizabeth line stations average £401,000, reflecting their more suburban locations, though the route proved one of the most popular among respondents.

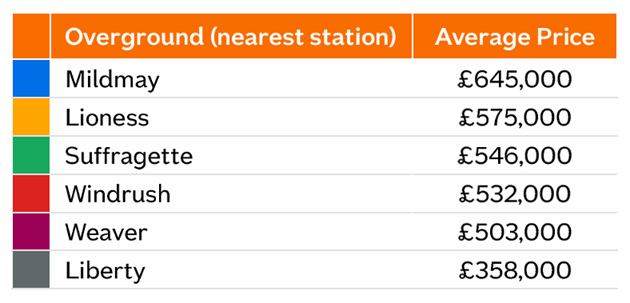

The London Overground was the most widely used service in the capital, with nearly three in 10 saying it was their nearest line.

Prices vary widely, from £358,000 near stations on the Liberty line to £645,000 on the Mildmay line.

In Glasgow, which has the UK’s largest suburban rail network outside London, two thirds of residents live within 20 minutes of a station. In Manchester, the expansion of the Metrolink has broadened access but buyers remain willing to pay only modestly more for proximity.

TREND IS REVERSING

Jeremy Leaf, north London estate agent and a former RICS Residential Chairman, says: “The pandemic accelerated trends which were starting to happen anyway and the increase in working from home certainly made a difference to where people chose to buy and rent for quite a long time.

“However, that trend is slowly starting to reverse as people return to work – not quite to the levels before Covid but certainly approaching. These figures reflect that trend to some extent although of course the cost of property and transport are other factors.

“In larger cities buyers and tenants have to travel quite a way to find value for money which has a knock-on effect on their distance and convenience to place of work. However, with car driving proving to be more restrictive in built-up urban areas, good public transport links remain a must.”

CHANGING WORKING HABITS

Mary-Lou Press, President of NAEA Propertymark (National Association of Estate Agents), adds: “Good schools, access to better transport links and ideal local social environments are key for many people when looking to move.

“Changing work habits, particularly the rise of remote and hybrid working, have made relocating a much more realistic option for many people. These flexible models enable individuals to move to more affordable areas or places offering a better quality of life, all while keeping their current jobs.

“For instance, the average property price in inner and outer London was approximately £640,000 last month. By comparison, someone commuting to London from a city like Manchester could save around £260,000 on the average home.”