Scotland’s commercial property investment market posted a modest recovery in Q2 2025 but headline figures mask underlying fragility, according to the latest quarterly review from Lismore Real Estate Advisors.

Total transaction volumes for the quarter reached £296 million, up 9% on Q2 2024.

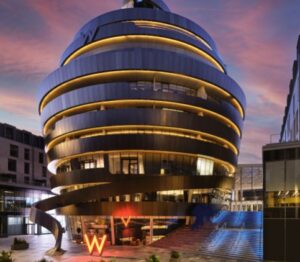

However, nearly half of that value stemmed from just two major deals: Nuveen’s £100 million sale of the W Hotel at Edinburgh’s St James Quarter to Schroders, and Sovereign Centros’ £54.44 million disposal of Glasgow’s St Enoch Shopping Centre to Praxis (main picture).

When these outliers are excluded, volumes fall below 2024 levels and sit 21% under the five-year quarterly average and highlighting what Lismore describes as “another muted quarter” for the market.

INVESTOR APPETITE

Despite the overall softness, key sub-sectors are showing resilience. Edinburgh’s hotel market continues to outperform, driven by robust tourism and business travel.

Chrissie Clancy, Investment Surveyor at Lismore, says: “The city’s high occupancy (85%) and double-digit RevPAR growth are driving investor appetite for increasingly scarce redevelopment opportunities.”

Retail, too, is showing signs of recovery, with investor interest gradually moving beyond Buchanan and George Street to include targeted sites on Princes and Argyle Street. This renewed focus is being supported by constrained supply and signs of rental growth.

Glasgow’s office market is beginning to stir as well, with Lismore reporting several deals under offer. Clancy also pointed to ongoing interest from French SCPI buyers, who are now looking beyond the Central Belt to Aberdeen in search of well-let, high-yielding assets.

She adds: “In a landscape defined by economic uncertainty and shifting investor sentiment, consistency has become a prized commodity.”

Scotland’s logistics sector has also emerged as a rare stronghold, underpinned by resilient demand, limited supply and increasing investor confidence.

According to Lismore’s investor sentiment survey, 56% of respondents expect to be net buyers of Scottish logistics assets in the second half of the year, while only 10% anticipate being net sellers. Institutional funds showed the strongest intent, with 71% projecting a net buying position.

Stabilising yield expectations are another positive signal. More than half of respondents (53%) forecast prime logistics yields to hold steady, while 38% expect yields to harden, encouraged by the potential for interest rate cuts later in 2025.

Key drivers of logistics investment include occupational demand (29%) and rental growth (26%), highlighting continued focus on income security. Investors also cited liquidity, low void risk and the potential for yield compression as important considerations.

“The biggest issue now is the lack of investable opportunities.”

Valentine Beresford and Hugh Chivers of LondonMetric Plc say: “Logistics continues to be our preferred sector, driven by strong demand and chronic supply constraints.

“While rising debt costs and limited stock present challenges, they’re market-wide, not sector-specific.

“The biggest issue now is the lack of investable opportunities, with strong competition when assets do come to market.”

CAUTIOUS OPTIMISM

Clancy adds: “The UK macroeconomic outlook offers cautious optimism; with inflation softening and interest rate cuts likely in the second half, investor sentiment may begin to turn a corner. With a number of significant deals expected to conclude in the months ahead, we anticipate a meaningful uplift in activity during H2 2025.”