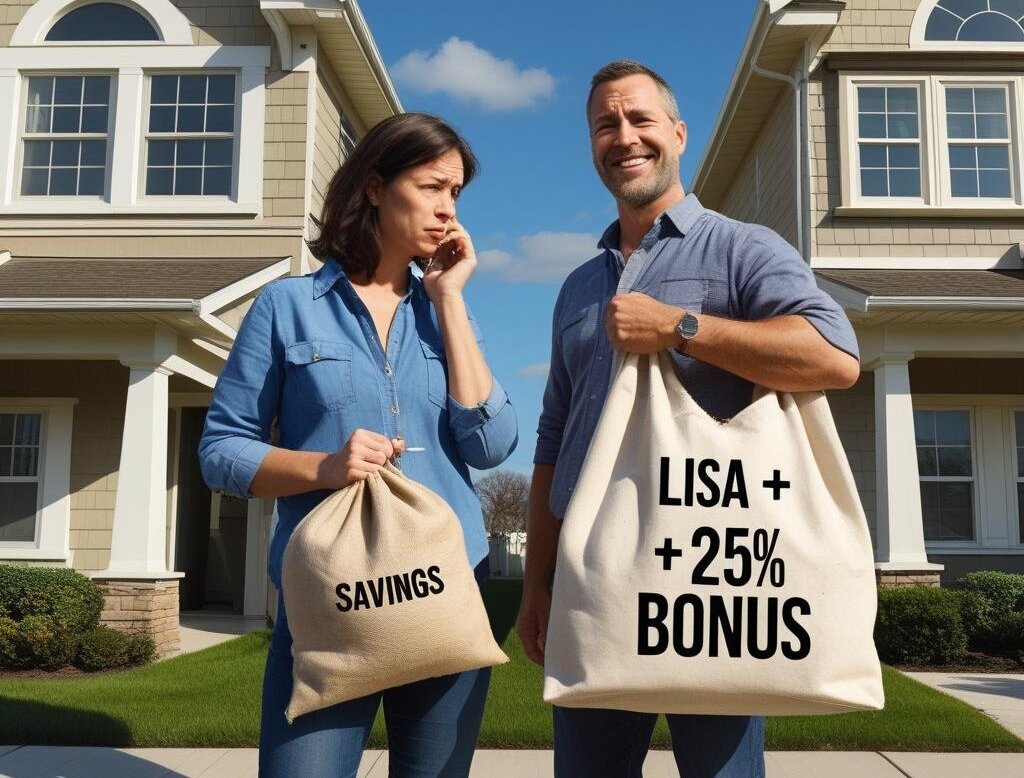

New research from Atom bank has revealed that 98% of Lifetime ISA (LISA) holders are reliant on the government’s 25% annual bonus to realise their homeownership ambitions.

The findings come as nearly half (46%) of those planning to use a LISA to buy a home said they were “very reliant” on the bonus to make their purchase viable.

At present, savers can contribute up to £4,000 per year into a LISA, with the government adding a 25% top-up – up to £1,000 annually – towards the cost of a first home or retirement.

But with rising property prices and ongoing cost-of-living pressures, many savers feel the current limit falls short.

INCREASE THE CAP

Almost half (47%) of respondents said the £4,000 cap should be increased, while a majority (59%) called for the 25% early withdrawal penalty to be lowered or eliminated altogether. Currently, any withdrawal not related to home purchase or retirement incurs a 25% penalty, effectively removing not just the bonus but part of the saver’s original contribution.

Despite its popularity among aspiring homeowners, the LISA remains a minority product in the broader savings landscape. Atom’s research found that just 20% of respondents held a LISA, compared to 80% with a standard Cash ISA and 34% with a Stocks & Shares ISA.

The research comes amid wider debate around the future of ISA allowances. In recent weeks, speculation that the government might reduce the overall £20,000 annual ISA limit – under which LISA contributions are included – has sparked criticism from providers and savers alike. For now, any such changes appear to have been shelved.

REFORMS OVERDUE

Chris Storey, Chief Commercial Officer at Atom bank, says: “Reforms of the Lifetime ISA are long overdue. With rising house prices and ongoing affordability issues, the Lifetime ISA risks being left behind, which is particularly troubling given the number of savers who are reliant on it to build a sufficient deposit.

“At a time when many are struggling to save and get on the property ladder, we should be developing products that make it easier for people to grow their hard-earned savings and buy homes. This is a key part of encouraging economic growth and prosperity.

“The fact that some first-time buyers could be penalised for accessing their Lifetime ISA has been well documented, so hopefully areas like the £450,000 limit are addressed as part of the broader conversation on ISA reforms in the coming months.”