A leading letting agency has warned landlords to ensure full legal compliance after a string of senior Labour politicians were found to have breached property letting and tax rules.

The call from Leaders, one of the UK’s largest lettings and estate agency networks, follows a week of damaging headlines for the Government over landlord conduct.

Chancellor Rachel Reeves admitted she had rented out her south London home without the required selective licence from Southwark Council. Earlier this year, Rushanara Ali, then Minister for Homelessness, resigned after reportedly re-letting her property at a higher rent shortly after informing tenants their lease would not be renewed.

And former Deputy Prime Minister and Housing Secretary Angela Rayner stepped down following an investigation into underpaid stamp duty on a flat in Hove.

BREACHES CAN LEAD TO FINES

Together, the incidents have highlighted how even policymakers closely involved in housing reform can fall foul of the complex legal framework governing private lettings. Industry experts warn that breaches – whether unlicensed lettings, missing safety documentation or unregistered deposits – can lead to fines, rent repayment orders and criminal penalties.

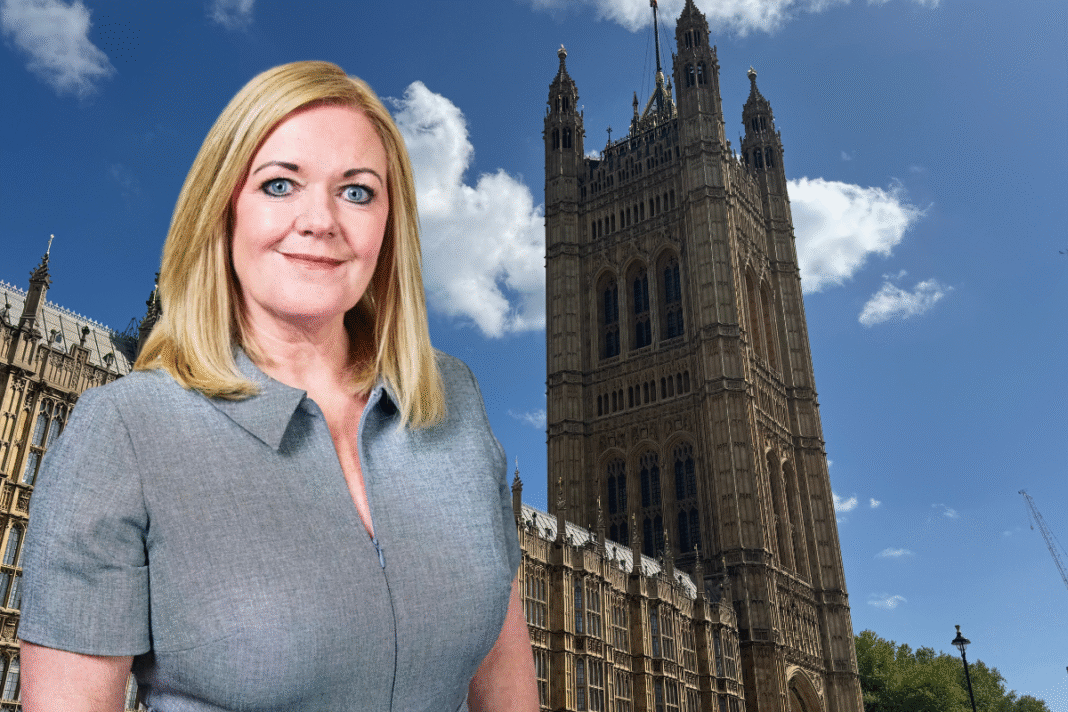

Allison Thompson (main picture, inset), National Lettings Managing Director at Leaders, says: “This situation underlines the importance of understanding your legal responsibilities as a landlord. Compliance isn’t just about avoiding fines – it’s about maintaining trust and ensuring tenants live in safe, well-managed homes.

“Our advice is to check your property licences, keep your safety certificates current, and review your documentation regularly. The cost of getting it wrong is far greater than the effort it takes to get it right – knowledge isn’t optional anymore, it’s risk management.”

RENTERS’ RIGHTS HEALTH CHECK

Thompson adds: “To support landlords, we’re offering free Renters’ Rights Health Checks through our local branches, helping identify any gaps in compliance before they become costly mistakes.

“I can’t recommend strongly enough that landlords work with a good quality letting agent who understands the legislation and keeps compliance front and centre.”

Thompson says that the recent controversies showed how “even experienced owners and senior politicians can overlook critical requirements such as valid licensing, accurate tax or tenure documentation, and fair leasing behaviour.”

“This reinforces our message,” she says. “Attention to the fundamentals matters.”

LEGAL REQUIREMENTS EVERY LANDLORD MUST MEET

- Check local licensing requirements: Confirm whether the property requires a mandatory, additional or selective licence from the local authority.

- Obtain consent to let: If the property is mortgaged, leasehold or subject to insurer conditions, secure written permission to let.

- Provide a valid Energy Performance Certificate (EPC): Properties must meet a minimum rating of E and tenants must be given a copy before moving in.

- Ensure safety compliance: Provide a valid Gas Safety Certificate each year, an Electrical Installation Condition Report every five years, and install smoke alarms on every floor and carbon monoxide alarms where applicable.

- Protect the tenant’s deposit: Register deposits in a government-approved scheme within 30 days and serve prescribed information to the tenant.

- Conduct Right to Rent checks: Verify and record the immigration status of all adult occupiers.

- Provide correct documentation: Supply the tenancy agreement, the Government’s “How to Rent” guide, the gas and EPC certificates, and the deposit information at the start of the tenancy.

- Follow the Tenant Fees Act 2019: Only charge permitted fees, such as rent, refundable deposits, and agreed early termination costs.

- Maintain and repair the property: Under Section 11 of the Landlord and Tenant Act 1985, landlords are legally responsible for the property’s structure, exterior, plumbing, heating and sanitation.

- Use valid notices for eviction: Ensure all legal and safety obligations are met before issuing a Section 21 or Section 8 notice; non-compliance can invalidate it.

- Declare rental income correctly: Ensure taxes are reported accurately, and where required, use Making Tax Digital-compatible systems.