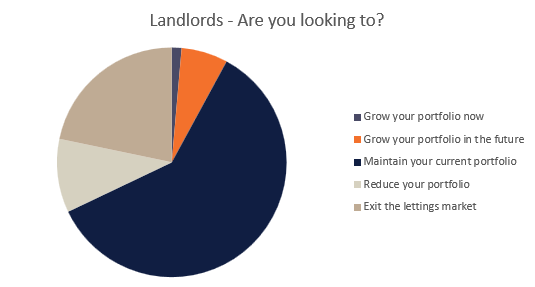

Britain’s landlords are showing resilience in the face of mounting pressures, with most choosing to hold or consolidate their portfolios rather than quit the private rented sector, new research suggests.

The latest Lettings Report from Leaders Romans Group (LRG) reveals that 60% of landlords intend to maintain their current holdings, signalling stability in a market buffeted by higher costs, regulatory change and shifting tenant expectations.

Only 22% are considering an exit, largely due to operating costs rather than falling demand. Of those looking to sell, 12% plan to reinvest in more modern, energy-efficient or lower-maintenance properties. Just 7% intend to expand, reflecting a shift toward consolidation and long-term planning.

The findings echo wider national sentiment. The DPS Private Rented Sector Review reported earlier this year that while 52% of landlords are weighing up sales, only a quarter are contemplating a full exit, with the majority seeking to rebalance portfolios.

INVESTMENT OPPORTUNITY

HMRC and Ipsos research in 2024 found that 60% of landlords entered the market as investors, with the remainder either inheriting or purchasing property to live in, underlining the sector’s diversity of motivations.

Older homes are proving the toughest to manage, cited as problematic by 54% of landlords, followed by leasehold flats (29%) and larger family homes (11%).

This reflects growing concern over regulatory complexity, energy upgrade obligations and the costs of managing leasehold stock. CBRE’s May 2025 analysis similarly identified a move away from energy-inefficient and leasehold assets as landlords seek to de-risk portfolios.

PORTFOLIO STRATEGY

Policy remains the critical factor shaping investment decisions. Regulatory changes (27%), tax policy (26%) and mortgage rates (11%) were identified as the main influences on portfolio strategy.

Asked what would encourage future growth, landlords prioritised tax reform (59%), regulatory clarity (17%), faster court processes (14%) and support for energy efficiency upgrades (10%).

Yet demand from tenants remains robust. The National Residential Landlords Association (NRLA) reports that 71% of landlords continue to see high demand, despite only 2% expressing confidence in the current policy direction.

LONG-TERM THINKING

Allison Thompson, National Lettings Managing Director at LRG, says: “Landlords are not walking away from the sector. They are responding to a more complex environment with caution, clarity and long-term thinking.

“The story here is one of measured transition. This is still a market with committed landlords who want to provide good homes and make sound investments, but they need the right framework in place to do that with confidence.

“In a sector shaped by regulation, reform and demand-side pressure, landlords are not standing still, they are stepping forward with strategy.”