Landlords bought 85,000 fewer properties in the past year as uncertainty over the government’s Renters’ Rights Bill and higher borrowing costs weighed on investment decisions, according to research by Dwelly, the lettings acquisition and strategy firm.

An estimated 170,520 landlords purchased properties in the 12 months to June, down from 255,780 a year earlier, Dwelly said.

The figure equates to just 6% of the UK’s 2.84 million landlords, compared with 9% in early 2024.

The East of England saw the largest number of landlord purchases at 23,360, followed by the East Midlands (21,720) and the South East (18,760). At the other end of the scale, Wales recorded just 2,180 landlord acquisitions.

MOST ACTIVE

The North East remained the most active market relative to landlord numbers, with 17% of the region’s estimated 67,000 landlords making a purchase last year, although this was down from 22% in 2023.

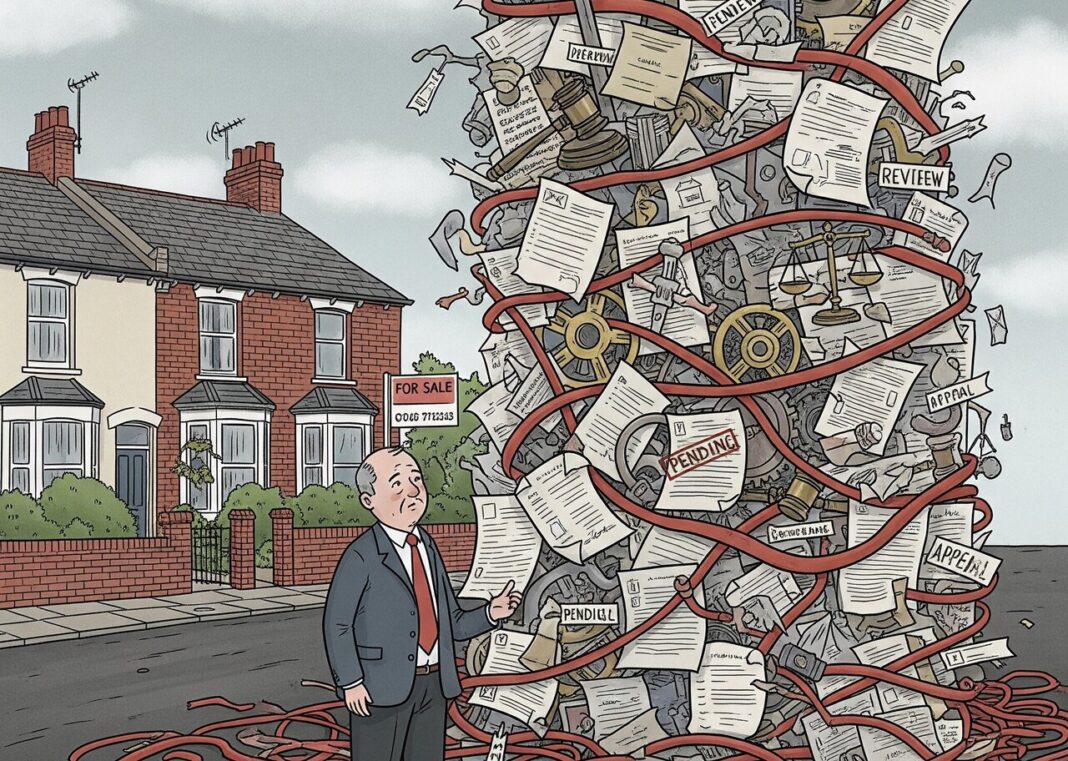

Dwelly said many landlords were waiting to see the final form of the Renters’ Rights Bill – which is set to overhaul tenancy rules, eviction processes and compliance obligations – before committing further capital.

CONFIDENCE DENTED

Sam Humphreys, head of M&A at Dwelly, says: “An 85,000 drop in annual landlord purchases is a clear signal that confidence has been dented by regulatory uncertainty, higher borrowing costs and slower house price growth.

“But this is not a mass withdrawal from the market, landlords are simply taking stock and who can blame them with the Renters’ Rights Bill set to bring substantial changes to the sector.

“Despite this uncertainty, the fundamentals of the rental sector remain strong, and once the Renters’ Rights Bill is finalised we expect many will return to buying, particularly in those regions where rental properties continue to bring strong returns on investment.”