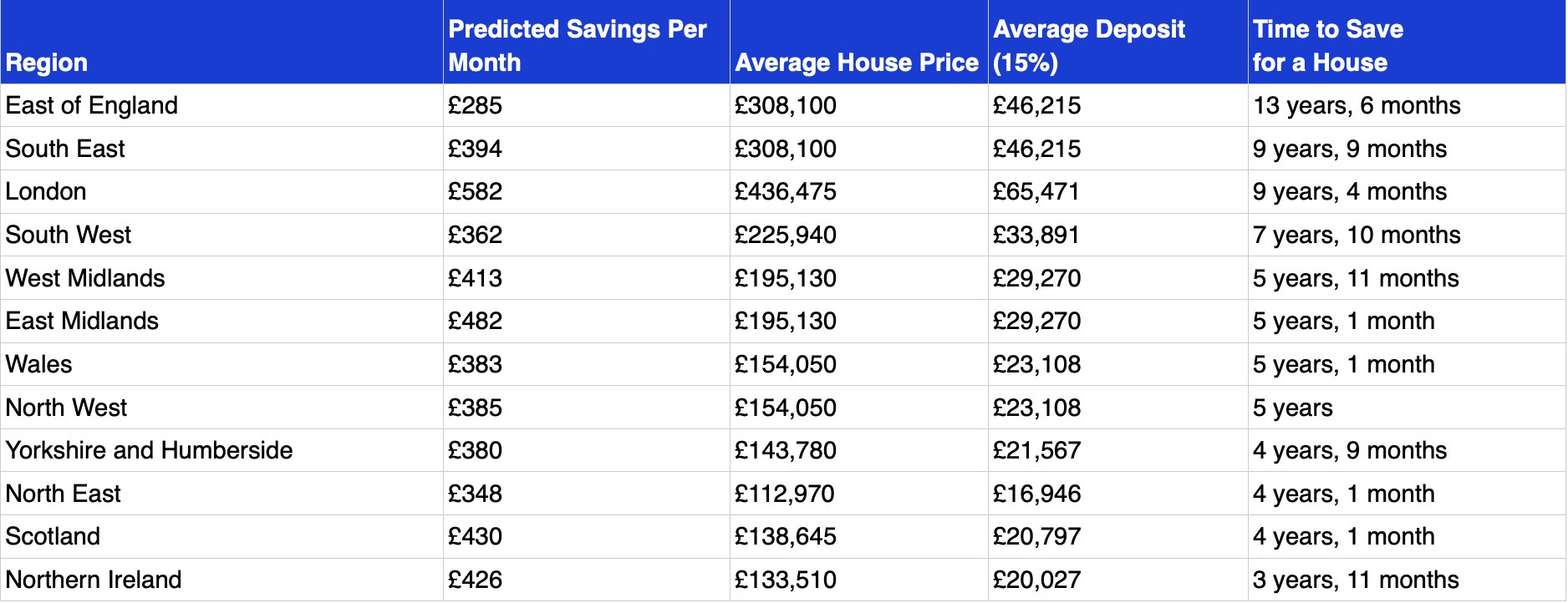

It’s taking solo first-time buyers a whopping seven years and three months to save for a deposit but a new report from broker Mojo Mortgages also reveals striking regional differences in the time it takes.

Perhaps unsurprisingly Northern Ireland leads with the shortest saving period of three years and 11 months with the East of England taking the longest time at 13 years and six months.

London buyers face high property prices but benefit from higher salaries, resulting in a nine-year, four-month saving period.

But with the average renter having outgoings of £1,748 per month in some areas of the UK (East of England), renters can only afford to set aside £285 per month towards a deposit.

SOLO HOMEBUYERS

The research comes after Mojo Mortgages witnessed a significant uptick in the number of solo homebuyers, with a 60% increase in the last year.

REGION-BY-REGION: HOW MUCH RENTING COSTS

London remains the most expensive region for renters, with total monthly costs averaging £2,073, driven by high demand and limited supply.

The average room rent in London stands at £995, nearly double that of the cheapest region, the North East, where room rent averages just £550.

With other household bills and expected outgoings, the average person in the North East spends £1,638 per month, making it one of the cheapest regions in the UK for renters.

However, those in Northern Ireland have the lowest outgoings per month, with average living costs of around £1,621 per month—approximately 27% cheaper than in London.

HOW LONG IT TAKES SOLO FIRST-TIME BUYERS TO SAVE FOR A DEPOSIT

Solo first-time buyers can join the property ladder quickest in Northern Ireland. With an average house price of £133,510, buyers can save for their deposit in just three years and 11 months by setting aside £426 each month.

Scotland follows closely behind; those looking to buy an average-priced property can expect to save in about four years and one month, putting away approximately £430 monthly.

SIMILAR TIMELINE

The North East offers a similar timeline with an average house price of £112,970, allowing renters to save for a deposit in 4 years and 1 month with monthly savings of about £348.

At the other end of the scale are the southern regions. In the East of England, renters face the longest saving period of 13 years and six months if they set aside £285 each month for an average house price of £308,100.

Similarly, those in the South East may need about nine years and nine months, saving £394 monthly for the same average house price. London presents its own challenges; despite higher salaries, first-time buyers face an average property cost of £436,475, requiring savings of £582 per month over approximately nine years and four months.

Read Mojo Mortgages full report HERE.