Ireland’s commercial property market has shifted decisively from recovery to a new phase of sustained growth, according to the latest JLL Irish Property Index, which recorded a 9% rise in annual overall returns for Q3 2025 and a sixth consecutive quarter of positive performance.

The index, which has tracked institutional property performance since 1969, measures returns from a portfolio valued at €615 million comprising offices (51%), retail (19%), industrial (16%) and residential assets (14%).

Quarterly returns rose 2.4%, reinforcing what JLL described as a clear, broad-based upswing across all monitored sectors.

Capital values increased 2.6% year-on-year, with retail and industrial assets continuing to lead the market. Retail capital values rose 6.2% annually, supported in particular by strong demand for retail parks, while industrial values grew 7.8%.

PERIOD OF ADJUSTMENT

Office values stabilised after a prolonged period of adjustment, rising 0.5% quarter-on-quarter and edging up 0.1% over the year.

Rental values also strengthened, increasing 4.8% annually across the portfolio. Retail again stood out, with estimated rental values up 10% over the year.

JLL says that this headline gain masks a diverging picture within the sector: retail parks have been the main engine of growth, while unit shop rents have remained largely flat.

The Income Index dipped 3% in the quarter but remains up 1.9% over the year. JLL attributed the quarterly fall to the timing of lease events rather than any underlying deterioration, pointing to a broadly stable income environment consistent with rising rents.

FUNDAMENTAL-DRIVEN MARKET

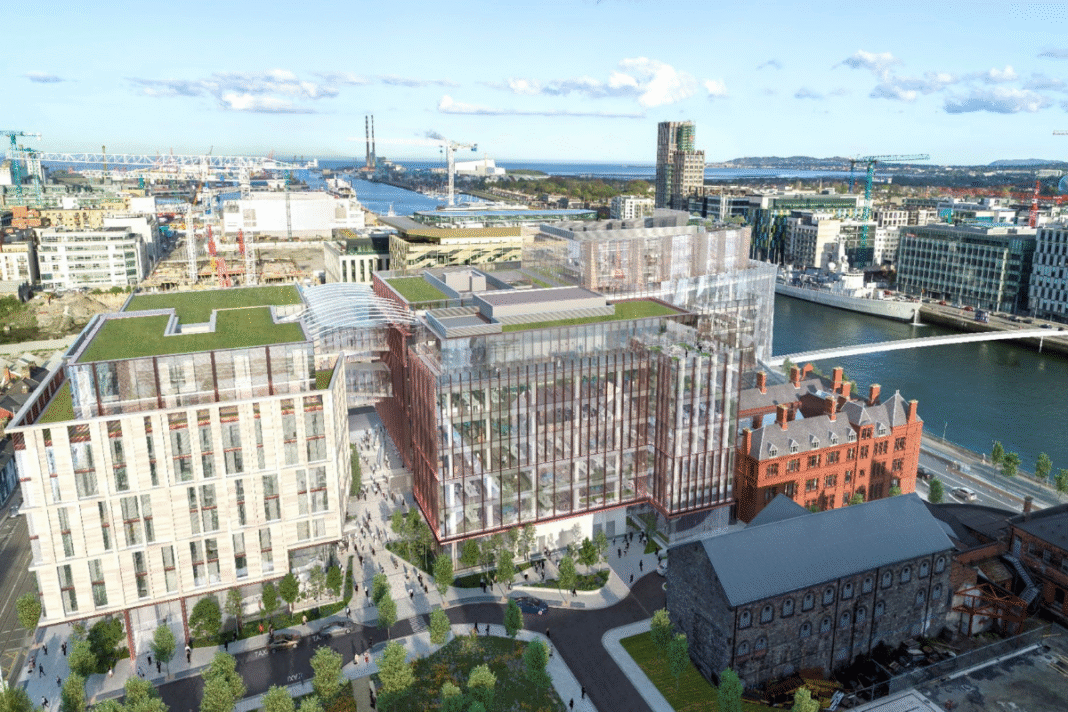

Kevin Mahony, Chief Financial Officer at Fine Grain Property – the Irish investor backed by Grosvenor and a group of European and Singaporean family offices – reckons the data signals an increasingly stable and fundamentals-driven market.

He says: “JLL’s Q3 2025 Irish Property Index highlights clear signs of stabilisation in the office sector. After two years of recalibration, capital values have begun to level, and rental growth is returning as occupiers focus on high-quality, energy-efficient workplaces.

“At Fine Grain Property, we see the same trend across our portfolio. Demand remains strongest for modern, sustainable business park and office locations where tenants can access flexible, high-amenity space supported by reliable operations.”

IMPROVING LIQUIDITY

And he adds: “The latest data point to an Irish market that is maturing, transparent, and increasingly driven by fundamentals. Liquidity is improving and the environment is well suited to long-term, income-focused strategies.

“As the sector continues on this stabilising path, we remain committed to sustainability-led asset management and careful capital allocation that support tenants, enhance performance, and deliver resilient returns for investors.”

The findings suggest that Ireland’s commercial real estate market – one of Europe’s more volatile since the pandemic – is now showing consistent signs of renewed investor confidence, underpinned by stabilising offices, robust logistics demand and strengthening retail sub-sectors.