Britain is in the grip of an estate agency boom, with thousands of new firms launching as social media-savvy entrepreneurs seize on booming online visibility and low barriers to entry.

New figures show a sharp rise in start-ups across the property sector, even as industry leaders warn that potential tax changes in this week’s Autumn Budget could stall momentum.

Cynergy Bank’s latest Business Births and Deaths Index – drawing on ONS and Companies House data – reveals that 3,230 new real estate businesses were created between July and September, comfortably outpacing the 2,000 closures during the same period. Real estate posted the strongest Cynergy Bank Health Score of any major sector at 1.62.

The sector has now expanded every quarter since 2017, accumulating a net gain of 27,865 firms in eight years.

INSTAGRAM SHOP FRONTS

Much of the growth is being driven by estate agents themselves. Companies House data shows 1,624 new estate agency firms opened in Q3 alone – almost as many as the number of new bars and pubs – marking a 48% rise on the same period in 2017.

Last year the UK had 25,155 estate agency businesses, a 24% increase compared with 2017.

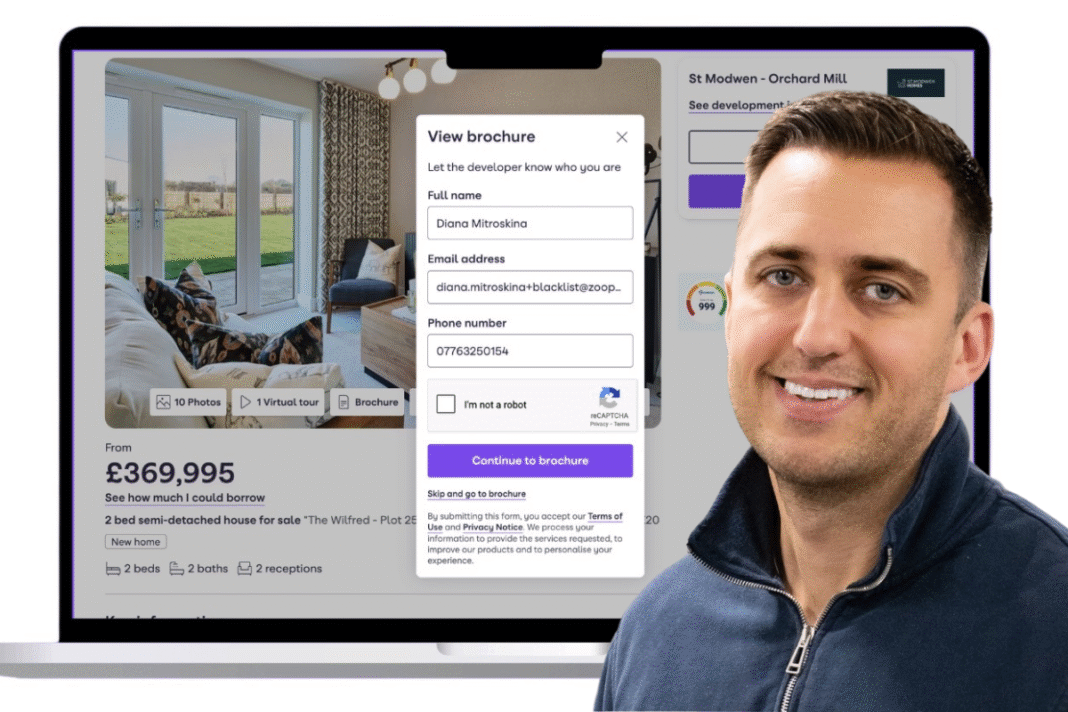

Behind the surge is the rise of Instagram as a low-cost, high-impact shopfront. A survey by NAEA Propertymark found that 79% of UK agents now rely on social media to market property, allowing new entrants inspired by shows such as Selling Sunset to operate with minimal overheads and rapidly build client bases.

BOOMING NUMBERS

Nick Fahy, Chief Executive of Cynergy Bank, says: “Estate agent numbers are booming, led by a new generation of independent firms using social media to attract clients and make their mark. This digital shift is energising the sector and opening up new opportunities.

“But as we look ahead to the Autumn Budget, there are real concerns about possible property tax rises, especially the proposed Mansion Tax and changes to Capital Gains, which could take the shine off the market for buyers and sellers alike.

“Any significant tax changes would risk stalling activity at the top end and could have a knock-on effect across the broader housing sector.”

NEW ROUTES TO MARKET

Nathan Emerson (main picture, inset), Chief Executive of Propertymark, says: “It’s encouraging to see strong entrepreneurial growth across the estate agency sector, with more professionals recognising the value of providing trusted, local expertise to buyers and sellers.

“The rise of digital and social media has undoubtedly opened new routes to the market, but ultimately, success in agency still comes down to professionalism, qualifications, and delivering for clients.”

STABILITY AND SUPPORT

But he adds: “As the sector expands, it’s vital that new entrants uphold high standards and operate within a framework that protects consumers. Propertymark continues to campaign for better regulation and mandatory qualifications across the industry to ensure consistency and trust.

“While the current momentum is positive, the UK Government has a strong opportunity to help ensure housing market confidence isn’t undermined by sudden or disproportionate tax changes in the Autumn Budget.

“Stability and support for both agents and consumers is key to sustaining a healthy property market in the long term.”

Across the wider economy, start-ups also outnumbered closures in Q3, with 73,450 new businesses launching compared with 63,205 shutting their doors. But the data points to growing pressure on larger firms: those that closed employed an average of three people – the highest level in years – and posted the second-highest turnover on record at £309,000.