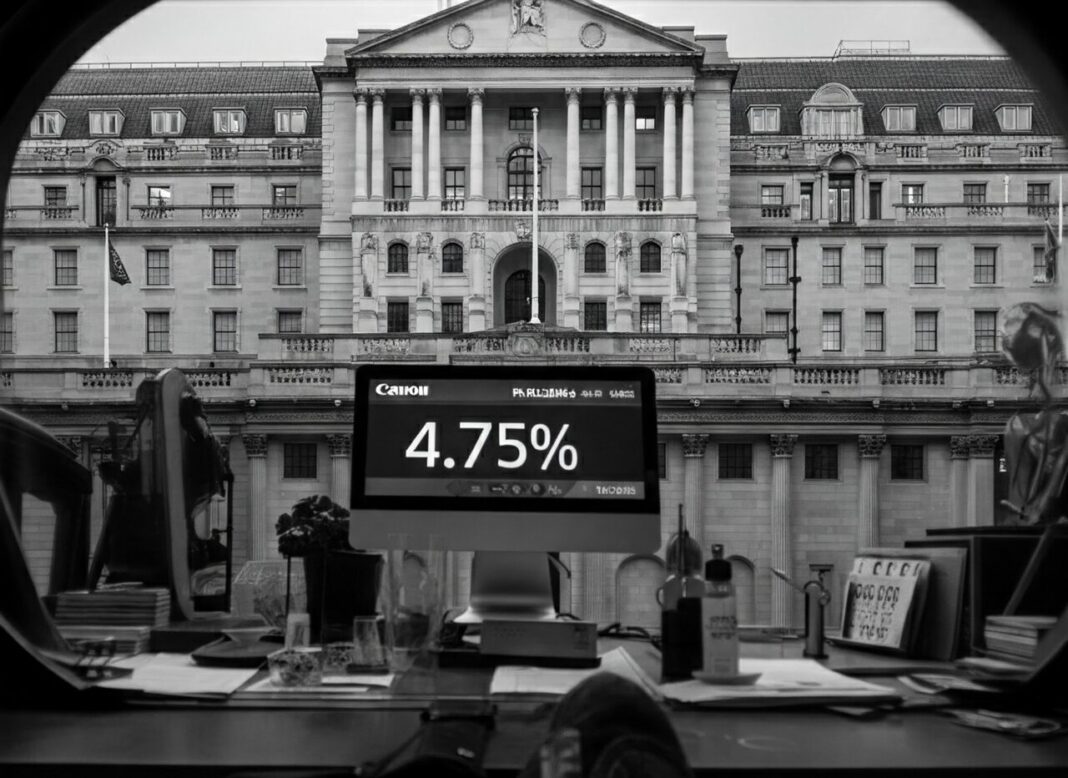

The Bank of England hit the pause button on interest rates yesterday keeping them steady at 4.75% after last month’s cut from 5%.

With inflation climbing to 2.6%, above the 2% target, the Monetary Policy Committee (MPC) made its widely expected move to hold firm.

In a tight 6–3 vote, the MPC chose stability. While the majority opted to maintain rates, three members pushed for a 0.25% cut to 4.5%, hinting at a doveish undercurrent.

The next decision is on February 6th. In its bulletin, the Bank struck a cautious tone, warning that “most indicators of UK near-term activity have declined,” and GDP growth likely slowed further than predicted in November.

INDUSTRY REACTION

Industry reaction was generally brace for more economic turbulence as the New Year unfolds.

Jeremy Batstone-Carr, European Strategist, Raymond James Investment Services, says: “Despite the UK economy’s weak performance over the autumn, senior Bank officials have judged that price and wage pressures remain too strong for comfort.

“Confirmation on Wednesday that consumer prices have moved even further away from the target 2% level followed on from stronger than expected wage growth, which the Bank of England also failed fully to predict.

“The Bank has also underlined its concerns around both domestic and international economic weakness.

“The Bank of England has judged that the domestic economy is not sufficiently vulnerable so as to require immediate policy action, as is the case in the Euro Area.

“It has however suggested that subdued activity might be a necessary prerequisite for ensuring that inflationary pressures do not become too entrenched. On this basis, the Bank continues to tread cautiously, maintaining its gradual approach to future rate cuts.”

NO SURPRISE

And Simon Webb, managing director of capital markets and finance at LiveMore, adds: “No third time lucky this month for borrowers on SVRs, trackers or first-time-buyers hoping for a reduction in the Bank Rate again.

“After the increased borrowing announced in the Autumn Budget that set markets in a flurry, and November’s repeated rise in inflation, it’s no surprise that the MPC voted against a base rate drop – for now at least.”

CAUTIOUS PATH

Nathan Emerson, Chief Executive of Propertymark, says: “With many national and international factors continuing to shape the global economy, the Bank of England is understandably taking a cautious path until they can be confident that they are able to safely reduce interest rates back.

“It has been encouraging to see interest rates reduced across recent months, but the base rate can only be reduced if all factors allow.

“High interest rates can of course affect borrowing for many people, especially those stepping onto the housing ladder, but it’s important there is sensible balance to keep the overall economy secure and workable for all.”

TOUGH DECISION

Iain McKenzie, CEO of The Guild of Property Professionals, says: “While many would have hoped for a cut with inflation edging up slightly, the Bank of England had a tough decision to make.

“It is not the Christmas present many would have wanted but is does point to a more stable market as we head into 2025.

“This year started with CPI inflation at 4% and the interest rate at 5.25%. Since January inflation has come down towards the target and we have seen the rate cut twice, which has helped boost sentiment in the market.

“While we will have to wait a bit longer to see the rate cut again, we are starting 2025 in a better place and are cautiously optimistic about 2025.”

ROLLERCOASTER YEAR

Matt Smith, Rightmove’s Mortgage Expert says: “In a rollercoaster year for the mortgage market, we end the year with a hold in the Bank Rate at 4.75%.

“While not the early Christmas present that many would have wanted, it was widely anticipated and must be considered against a backdrop of inflation being at the top end of forecasts, and wages have increased at a higher rate than expected.

“We don’t expect any reductions in mortgage rates over the next few weeks, but as we progress into 2025, lenders are likely to look at ways to take advantage of increased demand as the busier home-buying season starts.”

He adds: “Next year, three Bank Rate cuts are currently planned rather than the four anticipated just a few weeks ago, highlighting how quickly things can change in the market. We predict average mortgage rates could trickle slowly down towards around 4.0% next year, though this is dependant on the impact of a wide variety of unpredictable factors, including geo-political tensions and inflation.”

CREEPING INFLATION

Robin Rathore, Chief Executive of Bamboo Auctions, says: “Whilst most of the property market had been hoping for a further rate reduction, with inflation creeping up there is a need to maintain stability in the market.

“In reality, banks have already priced today’s interest rate decision into their mortgage products and so I would be surprised to see any dramatic shifts in mortgage rates in the next month or so.

“The malaise following the Government’s October budget appears to be wearing off and we expect buyers and sellers to return with more confidence to the market in the new year, especially with a view to beating the SDLT changes in April. We would encourage sellers to be realistic about their pricing expectations, especially if they are looking to sell early in the new year.”

NOT EXACTLY A CRACKER

Marc von Grundherr, Director of Benham and Reeves, says: “It’s not the Christmas cracker that many homebuyers were hoping for.

But it’s not quite a lump of coal either.

“The decision to hold on the base rate will do little to impact the current trajectory of the property market – particularly given the stamp duty deadline in place.”

WELCOME STABILITY

Amy Reynolds, head of sales at Richmond estate agency Antony Roberts, says: “The Bank of England was widely expected to hold interest rates steady this month.

“While stability in rates is welcome after months of sharp increases, borrowing costs remain high compared to the pre-2022 norm, which continues to challenge affordability for many buyers.

“For the property market, this ‘higher for longer’ rate environment means a slower pace of transactions and a greater emphasis on realistic pricing.”

LACK OF MOVEMENT

Jeremy Leaf, north London estate agent and a former RICS residential chairman, says: “The lack of movement in base rate is not surprising given recent increases in inflation and wages as the Bank of England wants to see some stability before taking what it thinks is risks with the economy.

“However, as far as the property market is concerned, even a small cut in base rate would be welcome not just for those on fixed-rate mortgages who are facing considerable increases in their loans when they come to remortgage but also first-time buyers who are the engine of the market, wanting to escape from high rental levels and take advantage of reduction in stamp duty before 1st April.

“A reduction in mortgage rates is always helpful as it improves activity, which is good not just for those contemplating moving but for the wider economy.”

DISAPPOINTING

Kevin Shaw, National Sales Managing Director, at Leaders Romans Group, says: “It is disappointing that that Bank of England has decided not to reduce interest rates further considering that the UK’s interest rate (at 4.75%) is out of sync with the ECB (at 3%) and other comparative economies globally.

“My view is that the Bank was too slow to increase rates back in 2023 and now runs the risk of being too slow to reduce them. The Bank needs to release the handbrake on the economy as soon as possible.

“A variety of economic indicators – from business confidence and employment rates to consumer spending – suggest that a December drop would have brought some much welcome seasonal cheer.

“However, I am now hopeful of an interest rate reduction on 6 February. In the meantime, however, the start of the year is likely to provide some momentum – whether from those keen to initiate a move as part of their New Year’s resolutions, or in a rush to avoid the Stamp Duty hike in April.”

WAIT AND SEE

And Nicky Stevenson, Managing Director of Fine & Country, adds: “While it didn’t happen the support of a further cut by some of the committee is positive.

“There has been a lot of uncertainty during 2024, which has had some buyers adopting a wait-and-see approach, however, overall, this year has been a lot more positive than many anticipated and 2025 looks to be a more stable market.

“While there are still hurdles to face, we believe that with a more stable market and the economic environment improving we will see the number of transactions increase next year, particularly in the first quarter as buyers rush to get their sale over the line before the Stamp Duty changes.”

BIGGER PICTURE

Paresh Raja, Chief Exzecutive of Market Financial Solutions, says: “The Bank of England has long urged against lowering interest rates too quickly, so following November’s decision to cut the base rate, it was always highly unlikely that the MPC would do the same. But that should not be seen as a negative.

“Instead, we have to see the bigger picture and reflect on the progress we have seen across the property and lending markets in 2024.

“This week’s data from the ONS underlined that house prices and rents are rising, while interest rates have started to fall and are expected to come down further next year.

“Meanwhile, although new policies are creating challenges for landlords in the private rental sector, the fact that 2024 has brought in a new government with a sizeable parliamentary majority does bring a greater degree of political stability after several years of turbulence.

“Put simply, the market is in a stronger position today than it was 12 months ago, and this lays the foundations for some exciting opportunities for lenders, brokers and property investors alike in 2025.”

EXPERIENCE WILL SHINE

And Ross Turrell, Commercial Director at CHL Mortgages, adds: “The news might trigger some negative responses, particularly among property buyers holding out hope for lower mortgage rates.

“However, Governor Bailey has strongly indicated that the base rate could be cut by 1% across the next 12 months, which will likely result in a significant surge in buyer demand and market activity in the new year.

“That is a promising outlook, and we must be ready as lenders to respond by engaging with brokers and their clients.

“The ability to navigate what remains a complex investment landscape will be crucial as the market continues to evolve in 2025, making access to the right expertise and support just as important as the right products and rates.

“This is an opportunity for experience to shine through, so it’s essential that lenders go above and beyond to meet the needs of individual brokers and borrowers, in turn providing the foundations for the property market to flourish next year.”