The UK housing market lost momentum in July as buyer demand and agreed sales slipped back into negative territory, according to the latest Royal Institution of Chartered Surveyors (RICS) Residential Survey.

After tentative signs of recovery earlier in the summer, July’s net balance for new buyer enquiries fell to -6%, down from +4% in June, signalling a modest drop in demand.

The slowdown was most pronounced in East Anglia, the South East and the South West, although some areas, including the North West, reported pockets of resilience.

Agreed sales also retreated, with a net balance of -16% compared with -4% the previous month.

FLATTENED SALES OUTLOOK

The near-term sales outlook has flattened, with a net balance of just +1% expecting any increase in transactions, down from +7% in June.

On a 12-month horizon, sentiment is more positive, with +8% of surveyors forecasting growth.

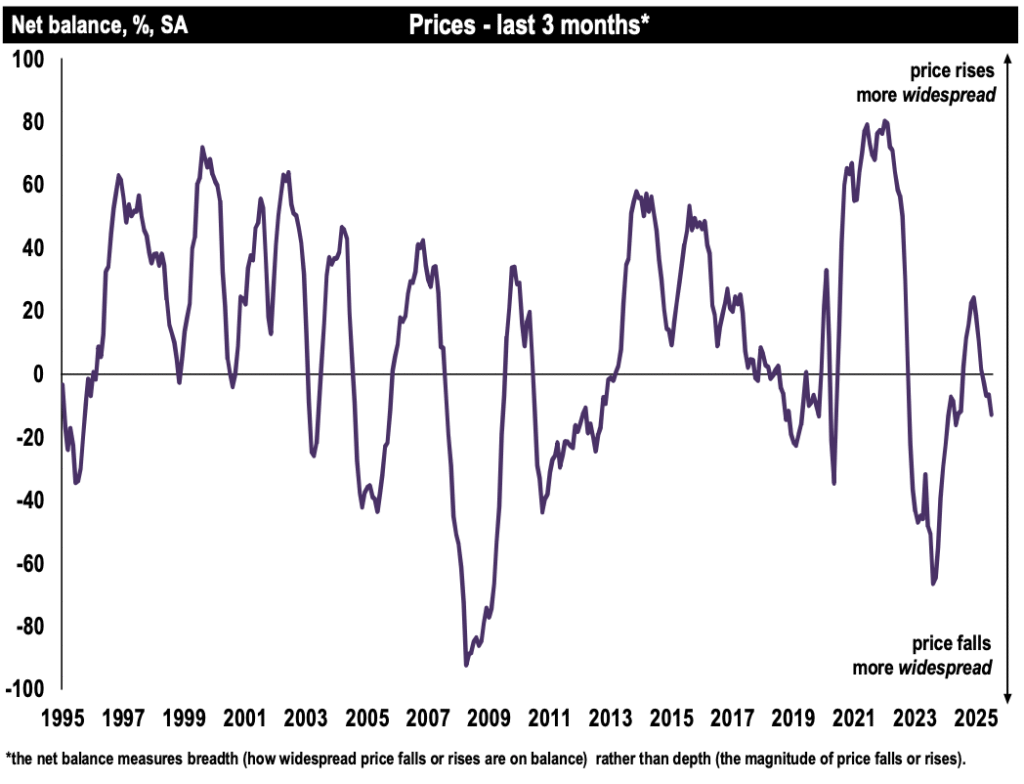

Supply edged up marginally, with +9% reporting an increase in new listings. However, house prices fell at a national level, with a net balance of -13% – the weakest reading since early spring – although prices continued to rise in Northern Ireland, Scotland and the North West. East Anglia recorded the sharpest declines.

RENTAL MARKET

In the rental market, tenant demand eased slightly to +4%, down from +14% in the previous quarter. Landlord instructions fell sharply, with a net balance of -31% and the weakest figure since April 2020.

The shortage of available rental homes is expected to push rents higher over the next three months, with +25% of respondents predicting increases.

ONGOING CHALLENGES

Simon Rubinsohn, RICS Chief Economist, said: “The somewhat flatter tone to the feedback to the July RICS Residential Survey highlights ongoing challenges facing the housing market.

“Although interest rates were lowered at the latest Bank of England meeting, the split vote has raised doubts about both the timing and extent of further reductions.

“Meanwhile, uncertainty about the potential contents of the Chancellor’s autumn budget is also raising some concerns.

“Against this backdrop, respondents continue to report that the market remains particularly price sensitive at the present time.”

INDUSTRY REACTION

Jeremy Leaf, north London estate agent and a former RICS Chairman, says: “Only some vendors are recognising the need for realistic pricing in order to attract attention in view of stock overload, with much of it overpriced, particularly smaller one- and two-bed flats and larger houses.

“Agreed sales are mostly holding supported by falling mortgage rates and a stable employment environment.

“We noticed that [lettings] demand has dropped over the past month or so especially for two-bed flats in older buildings, with more interest in modern, lower maintenance properties.

“Landlord rent expectations are often elevated although they are starting to become more flexible on pricing even though we are finding that fewer are wanting to sell.”

GUESS THE TAX RISE

Tom Bill, head of UK residential research at Knight Frank, said: “The housing market is hitting a series of hurdles this year.

“April’s stamp duty cliff edge was the first and now buyers and sellers are increasingly unsettled by a re-run of last year’s game of ‘guess the autumn tax rise’.

“We had an interest rate cut this month but it was priced in and the wider economic mood remains fragile. Supply still notably outstrips demand, which is also keeping a lid on prices.”

“[As to rentals] supply is shrinking as more landlords explore a sale due to tax and regulatory changes in the lettings sector.

“It is one unintended consequence of the forthcoming Renters Rights Bill, which could make it more onerous to regain possession of a property and raises the risk of void periods.

“As a result, we have seen renewed upwards pressure on rental values in recent months, which will be unwelcome news for tenants.”

FICKLE MARKET

Andrew Oulsnam, Director at West Midlands-based Robert Oulsnam & Company, says: “The market held up suprisingly well in August with very good levels of gross instructions and sales.

“However this was impacted by higher levels of withdrawal and fall throughs than would normally be expected, the public seem very fickle and prone to change their minds on a whim.”

RATE CUTS NEEDED

Tomer Aboody, director of specialist lender MT Finance, said: “Lower mortgage rates have helped fuel confidence among those looking to take a step onto, or move up, the housing ladder.

“However, further rate cuts are needed to encourage further activity.

“Transaction numbers are lower than in previous years as a result of higher stamp duty and taxes imposed by the Chancellor in her last budget.

“Sales numbers need to improve as this will benefit the wider economy, not just the housing market.

“Some encouragement is required via a reform in stamp duty to encourage those moving up the ladder, as well as those downsizing, to take the plunge.”