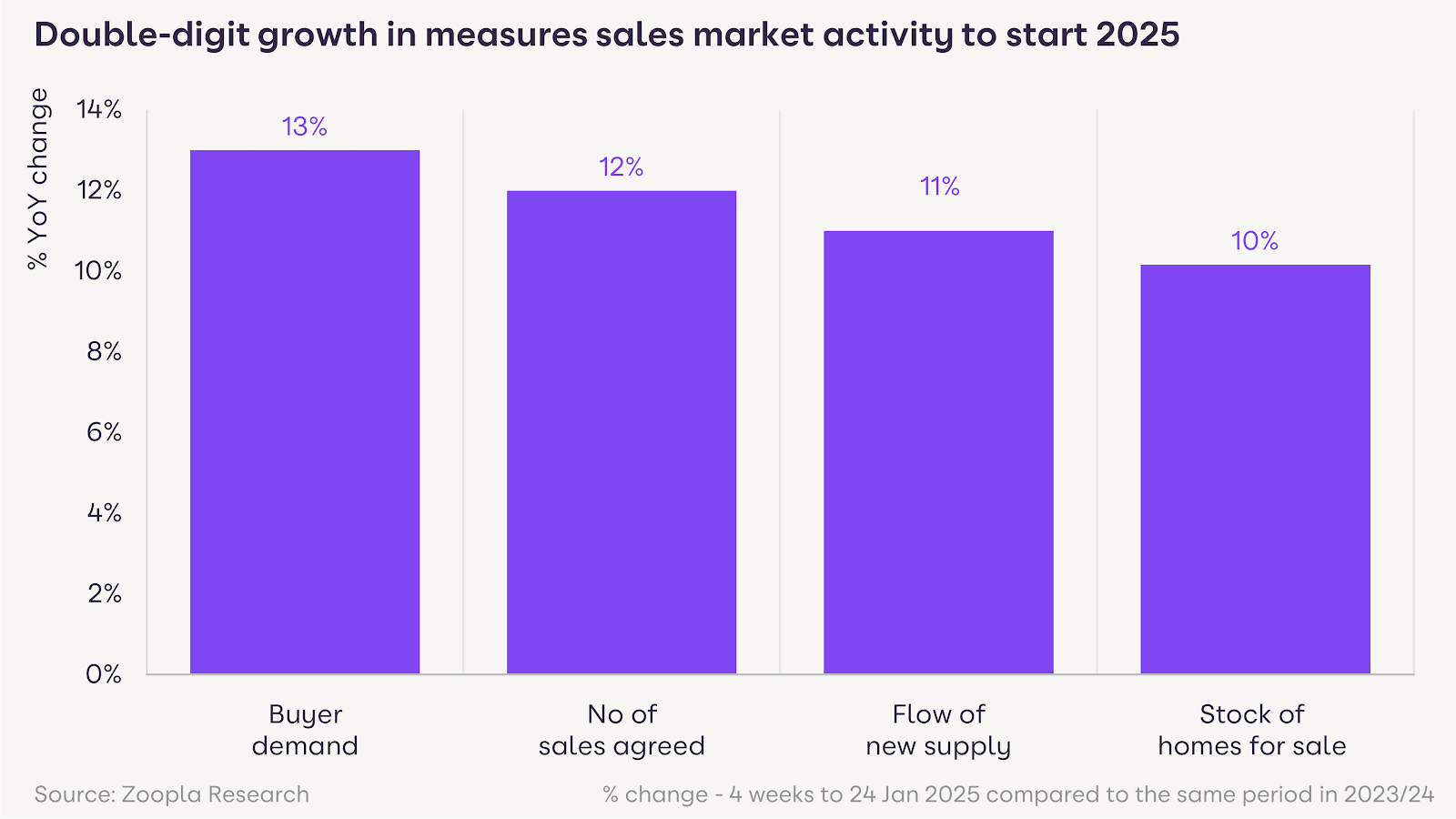

The 2025 sales market has got off to a stronger start than in 2024 or 2023 with buyer demand up 13% and 10% more homes for sale, Zoopla’s latest House Price Index reveals.

The portal says that trhe momentum in sales market activity that built up over 2024 has run into 2025, despite concerns over mortgage rates drifting higher and a softening in UK consumer confidence.

The number of homes for sale is also 10% higher than a year ago – the highest number of homes for sale (31) per estate agency branch for seven years. And more sellers mean more buyers, with demand for homes 13% higher than the same time last year.

The annual rate of UK house price inflation is running at 2%, up from -0.9% a year ago, with sales growth supporting modest price gains. This is the highest level of house price growth since April 2023. The average UK house price is £267,700, an increase of £5,200 over 2024 following a £2,400 decline over 2023.

House prices have returned to growth across the UK on rising sales. Prices are rising most quickly in more affordable areas with above-average growth in the number of jobs.

The fastest growth in average house prices is in Northern Ireland (7.7%), where prices are rebounding off a low base, followed by North West England (3.2%).

Data from the ONS shows that the North West region of England, Scotland and Northern Ireland have recorded faster growth in jobs over the last two years compared to regions in southern England. Locally, prices are rising fastest in Wigan (5.6%) and Motherwell in Scotland (4.9%).

House prices are rising more slowly in southern England where prices are above average and it is taking longer for rising incomes to help reset housing affordability. House prices have risen by less than 1.5% in London, the South West, South East and Eastern regions of England over the last 12 months.

There are signs that the recent upturn in prices is starting to level out as mortgage rates drift higher and buyers have plenty of homes to choose from. This will keep price inflation in check over 2025 but the current north-south divide in home price inflation is expected to continue over the year ahead.

HIGHER STAMP DUTY FROM APRIL BOOSTS DEMAND

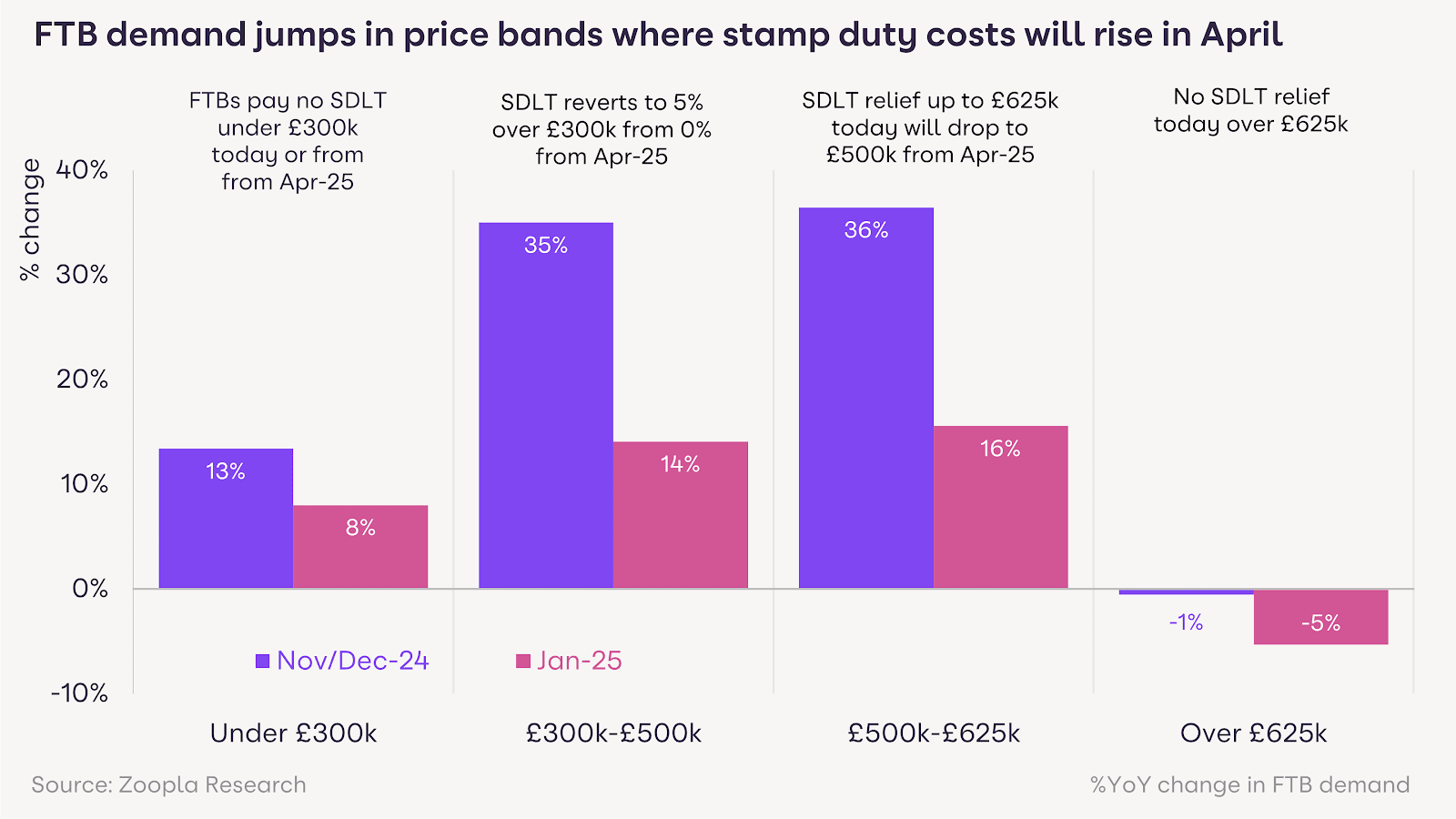

The Autumn Budget confirmed that temporary reliefs from stamp duty will end in April 2025 in England and Northern Ireland. As a result, first-time buyer demand jumped by over a third in November and December 2024 in the price bands where stamp duty for first-time buyers will increase the most from April 2025, between £300,000 and £625,000. The greatest savings are to be had by FTBs looking to buy in London and higher value areas of South East England.

First-time buyer demand increased more slowly below £300,000, where first-time buyers will continue to pay no stamp duty, and over £625,000 where there remains no tax relief from stamp duty for first-time buyers.

It is now too late for first-time buyers to agree and complete property purchases before the end of March 2025 and pay lower stamp duty. However, it is a positive sign that first-time buyer demand remains higher year-on-year, in line with the wider market. Concerns over a possible cliff edge in home buyer demand after April are overdone.

Homeowner demand also increased in response to the stamp duty changes albeit to a lesser degree. The extra stamp duty payable by homeowners from April (up to £2,500 per purchase) is less than the additional cost for first-time buyers buying homes in the £350,000 to £625,000 price range which will be £2,500 or higher.

Buying a first home in London for the average first-time buyer price of £420,000 will result in stamp duty increasing from £0 to £6,000 from April. For the typical FTB property in South East England (£332,500) the increase will be from £0 to £1625.

MORE LOOKING TO BUY

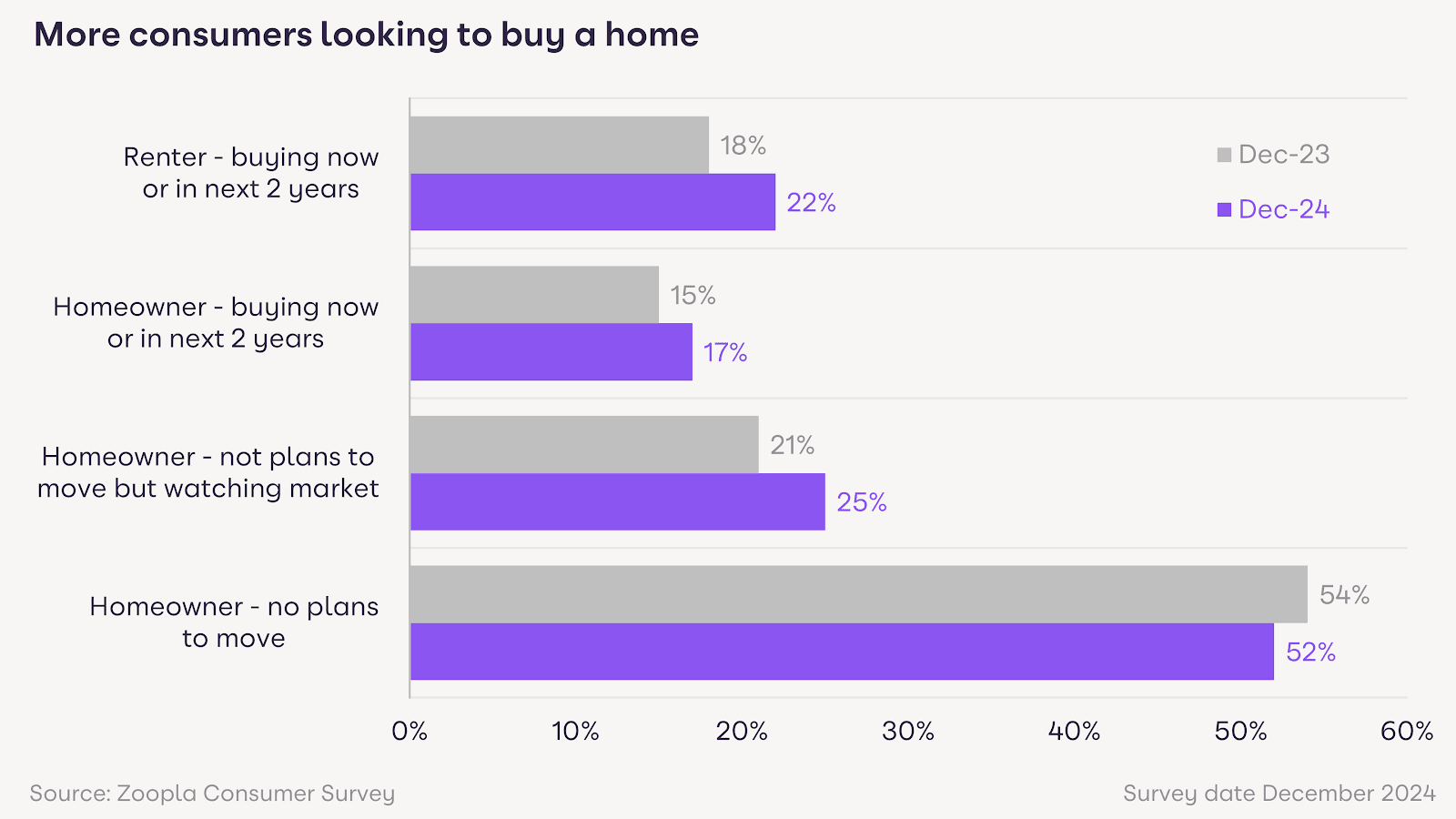

While the ending of stamp duty relief has provided a boost to market activity in recent months, there remains an increased appetite amongst UK households to move home in the next two years.

Zoopla’s Monthly Consumer Tracker shows there has been an increase in the proportion of households looking to buy amongst renters and existing homeowners compared to a year ago. This is due to households delaying decisions in the face of higher mortgage rates in recent years, expectations that base rates will be cut in 2025 and rising incomes will further improve affordability.

Over a fifth of renters want to buy a home having seen the cost of renting rise rapidly over the last two years. Renters buying homes are the driving force for the first-time buyer market which will be the largest buyer group once again in 2025.

Just under a fifth of homeowners want to move in the next two years while a quarter have no immediate plans to move and are keeping a close watch on the market should circumstances change.

CLEAR INDICATION

Richard Donnell, Executive Director at Zoopla, says: “The first few weeks of each year tend to provide a clear indication of how the rest of the year is likely to unfold. 2025 has started well, better than 2024 and 2023 which bodes well for market activity over the rest of the year, supported by evidence of more people looking to move.

“It is important not to read too much into the increase in stamp duty for more buyers from April as three in five first-time buyers will still pay nothing from April. The extra costs to homeowners remain manageable and unlikely to reduce sales but they will keep price rises in check.

“The healthy stock of homes for sale will keep price rises in check and we are forecasting average UK house prices will rise by 2.5% in 2025 with five per cent more sales than last year at 1.15m. Rising incomes and base rate cuts will improve affordability and support consumer sentiment.”

POSITIVE OUTLOOK

Malcolm Prescott, Managing Director of Webbers Estate Agents, adds: “Fundamentally the UK property market thrives on confidence and positive sentiment and whilst we have had to endure negative press for a while we are now seeing customers positively embracing property hearing that prices are set to rise, albeit marginally (4/6%) and affordability seems to be back given the more consistent mortgage interest rates.

“January has started very positively here in the South West, with an abundance of new listings and sales to match. In particular, we have seen keen interest in our new homes developments in North Devon and Cornwall, with green credentials, outside space and “choice” still high on the agenda from our broad range of buyers.”

RATE CUTS WILL BOOST CONFIDENCE

Gareth Samples, Chief Executive of The Property Franchise Group, says: “The year has started with an increase in market activity, with property transactions expected to be much healthier this January compared to last year.

“This is driven by factors such as marginally lower mortgage rates, a robust sales pipeline, and more favourable market conditions.

“Many prospective buyers who were waiting for mortgage rates to drop, have also been spurred on by the upcoming stamp duty changes and are hoping to get their transaction over the line before April. While some may have preferred to wait longer for mortgage rates to ease further, the looming deadline has motivated them to accelerate their plans.

“The increased demand, coupled with an improving economic outlook, is helping to sustain house prices. While we may see demand moderate somewhat after the stamp duty changes, factors like the anticipated interest rate cuts are expected to bolster market confidence.”

DEMAND FEELS ARTIFICIAL

Tom Bill, head of UK residential research at Knight Frank, says: “Demand in the UK housing market feels artificially high.

“As well as the prospect of higher stamp duty from April, a number of borrowers are sitting on sub-4% mortgage offers that pre-date the Budget, which will support prices and transaction volumes in the first quarter of this year.

“As the impact of higher mortgage costs kicks, we expect a period of downwards pressure on house prices that will only be alleviated once rate cut expectations rise.”

MORE BUYERS

Toby Leek, President of NAEA Propertymark, says: “With the average house price higher than what was achieved last year, coupled with the fact that more buyers are looking to move home, now is a great time to consider putting your house on the market.

“Propertymark member agents reported that the number of new buyers registered per branch has on average increased year on year by 44%.

“The stamp duty changes due to commence in England and Northern Ireland from April are having the expected effect of high activity due to many people wanting to save themselves potentially thousands on their next home move.”