As the UK economy shows signs of stabilising, the housing market is emerging as a beacon of resilience.

Propertymark’s latest Housing Insight Report reveals a surprisingly robust November 2024, with the average number of sales per member branch hitting nine – the strongest performance for the month in over three years in many regions.

And fuelling optimism, the number of new prospective buyers registered per member branch climbed to an average of 108 – a two-year high.

This surge in demand highlights renewed consumer confidence, bolstered by improving affordability and a steadying economic backdrop.

MIXED PICTURE

Regional trends show a mixed picture – areas such as the North West, West Midlands, and Scotland have experienced notable house price growth, while parts of London and the South East have seen a slowdown in demand compared to 2023 levels.

But in a promising sign for sellers, the proportion of properties achieving their asking price nearly doubled from 6% in October 2024 to 11% in November. This marks a significant shift, signalling a more competitive market and heightened buyer urgency.

LENGTHY PROCESS

Despite the positive data, the report highlights a persistent issue: the house-buying process remains a slow and often frustrating experience. Over a third (38%) of member agents report an average timeline of 17 weeks or more to progress from offer acceptance to exchange, a figure that continues to rise.

This bottleneck could dampen market momentum, especially as remortgage activity and first-time buyer interest are expected to surge in 2025.

Industry leaders stress the need for streamlining processes to sustain the market’s recovery and prevent delays from discouraging buyers and sellers.

RESILIENCE

While regional disparities in house price growth and extended transaction times highlight the challenges ahead, the latest data paints an overall picture of resilience.

As the economy stabilises and consumer confidence builds, the housing market seems poised for steady, if cautious, growth in the coming year.

Nathan Emerson (main picture), Chief Executive at Propertymark, says: “As we kick the year off, the housing market stands in a strong position for growth.

“However, as always, there are many variables that interact with the housing market and influence consumer affordability and confidence, and regionally, the strength of the housing market can vary due to fluctuations in supply and demand.”

MORE STABLE

He adds: “Across the entire UK, the economy stands at a more stable position than it did twelve months ago, with both inflation and the base rate sitting at more encouraging levels. While there is hope we may see a series of controlled cuts to interest rates over the coming months, the Bank of England will be keen to ensure long-term stability and the impact of Government policy will have a bearing on this.

“Across the first quarter of the year, many people across England and Northern Ireland will be mindful of the increases in Stamp Duty commencing from 1 April and we are likely to see an eagerness to complete on a property on the run-up to that date.

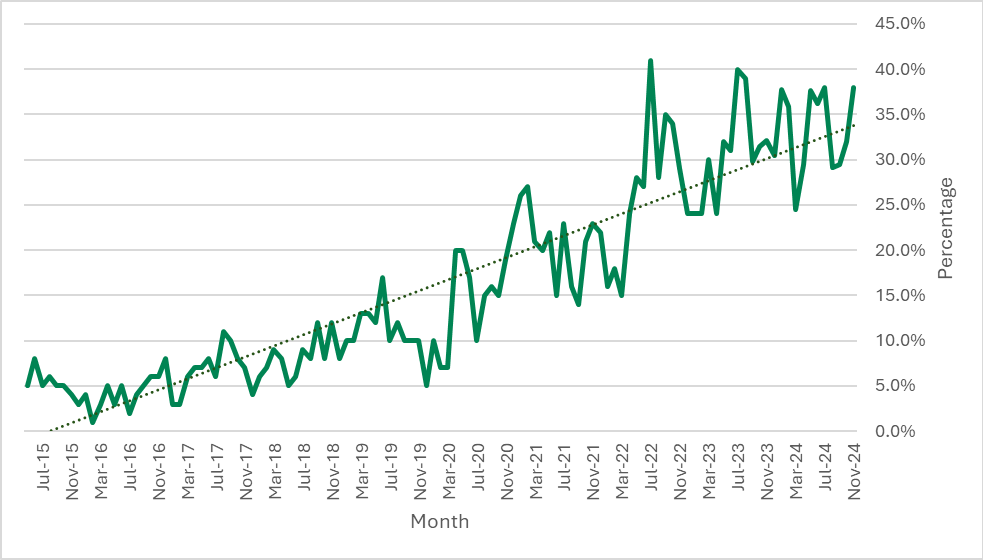

“We have continued to see house price growth over the last twelve months in many regions, and we expect this momentum to continue as we head further into 2025. The housing market is always a strong indicator of wider economic health and while there may be challenges ahead, we are optimistic the market will continue to operate positively.”