Housing affordability remains stretched by historic standards despite recent earnings growth marginally outpacing house price growth and a slight reduction in average borrowing costs, latest research from Nationwide reveals.

The Society’s Housing Affordability Report shows a prospective buyer earning the average UK income and buying a typical first-time buyer property with a 20% deposit would have a monthly mortgage payment equivalent to 36% of their take-home pay – well above the long-run average of 30%.

Those in London and South of England are the most stretched with the North of England and Scotland the most affordable places to purchase a property.

House prices also remain high relative to average earnings, with the first-time buyer (FTB) house price to earnings ratio (HPER) standing at 5.0 at the end of 2024, still far above the long run average of 3.9.

HIGH DEPOSIT HURDLES

Andrew Harvey, Senior Economist at Nationwide, says: “Consequently, the deposit hurdle remains high. This is a challenge that has been made worse by the record increase in rents in recent years, which, together with the cost-of-living crisis more generally, has hampered the ability of many in the private rented sector to save.”

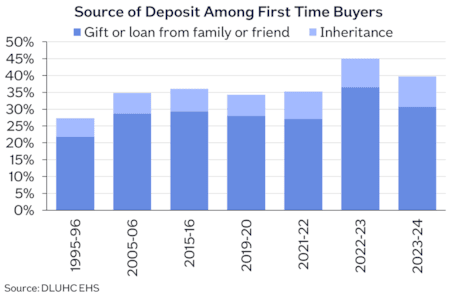

And he adds: “It’s not surprising that a significant proportion of first-time buyers have to draw on help from friends and family to raise a deposit.”

In 2023/24, around 40% of first-time buyers had some assistance raising a deposit, either in the form of a gift or loan from family or friends or through an inheritance.

Despite these affordability challenges, the society says mortgage market activity and house prices proved surprisingly resilient in 2024.

Harvey adds: “Annual house price growth ended the year at 4.7%, a marked improvement from the small declines seen at the start of 2024.

“The number of mortgage approvals returned to 2019 levels, despite typical mortgage rates being around three times higher.

“Perhaps even more remarkably, first-time buyers’ share of house purchase mortgages was actually higher in 2024 (54%) than it was pre-pandemic (51%).

“Looking ahead, providing the economy recovers steadily, as we expect, the underlying pace of housing market activity is likely to continue to strengthen gradually as affordability constraints ease through a combination of modestly lower interest rates and earnings outpacing house price growth.”

RIGHT DIRECTION

Iain McKenzie, CEO of The Guild of Property Professionals, says: “Buyer’s back pockets continue to be stretched, however, affordability is moving in the right direction with marginal improvements.

“Despite the challenges that the market faced during 2024, it outperformed predictions and weathered elements such as political uncertainty and mortgage rates that remained elevated for longer than many anticipated.

“While both rental increases and the cost of living has made it challenging for many to save for a deposit and get on the first rung of the ladder, there was a year-on-year increase in mortgage approvals towards the end of 2024. Confidence in the market and new buyer demand also improved.

“Looking ahead, provided inflation is kept under thumb, we should see interest rates come down in 2025. This will have a knock-on effect on mortgages, both improving affordability further and jabbing the market in the arm. Hopefully we will continue to see sustained and steady economic recovery, easing affordability constraints and underpinning housing market activity.”

LONDON DEMAND

Matt Thompson, head of sales at Chestertons, says: “As one of the world capitals and leading financial hubs, London sees steady demand from domestic and corporate buyers, property investors and international students.

“This level of demand often outweighs the number of homes for sale which contributes to the majority of properties in the capital either holding their value or seeing a price increase.

“If interest rates go down further this year, London’s property market will likely see additional buyers starting their search which will inevitably fuel a more competitive market compared to last year.”

DRIVING FACTORS

Marc von Grundherr, Director of Benham and Reeves, says: “What you do for a career and where you choose to do it remain the driving factors behind your property purchasing potential, but whilst housing affordability certainly remains an obstacle, it’s far from a deterrent, with over a million homebuyers making their move over the last year alone.

“This is despite the fact that today’s buyers are contending with far higher mortgage rates than they’ve become accustomed to in recent years and, with hopes that the cost of borrowing will ease in 2025, we expect homeownership to remain very much the focus of the nation.”

FIRST-TIME BUYER STRUGGLE

Verona Frankish, Chief Executive of Yopa, adds: “Housing market affordability remains a significant issue for many and whilst we may be seeing more existing buyers make their move, the number of first-time buyer transactions taking place across England has fallen by 43% on an annual basis, as they struggle to overcome the high cost of getting that first foot on the property ladder.

“Whilst there are a number of schemes aimed at helping first-time buyers onto the ladder, we need to see the government deliver on its promises of building more homes if any meaningful progress is to be made with respect to addressing housing affordability across the nation.”

SUSTAINABLE HOUSING NEEDED

Toby Leek, NAEA Propertymark President, adds: “Northern parts of the UK such as across Scotland and the North of England are becoming increasingly desired locations due to their increased levels of affordability. However, this is having an impact on prices across other regions as a result.

“The UK’s latest House Price Index found that the North East was the English region with the highest house price growth in the 12 months to November 2024 at 5.9 per cent. Also, the figures demonstrate that the average house price in Scotland in November 2024 was £195,000 and £306,000 in England.

“This situation is unlikely to sustain itself, which is why we look forward to working with governments across all nations to help support the concept of delivering a new generation of sustainable housing to ensure housing supply keeps pace with intense current demand.”