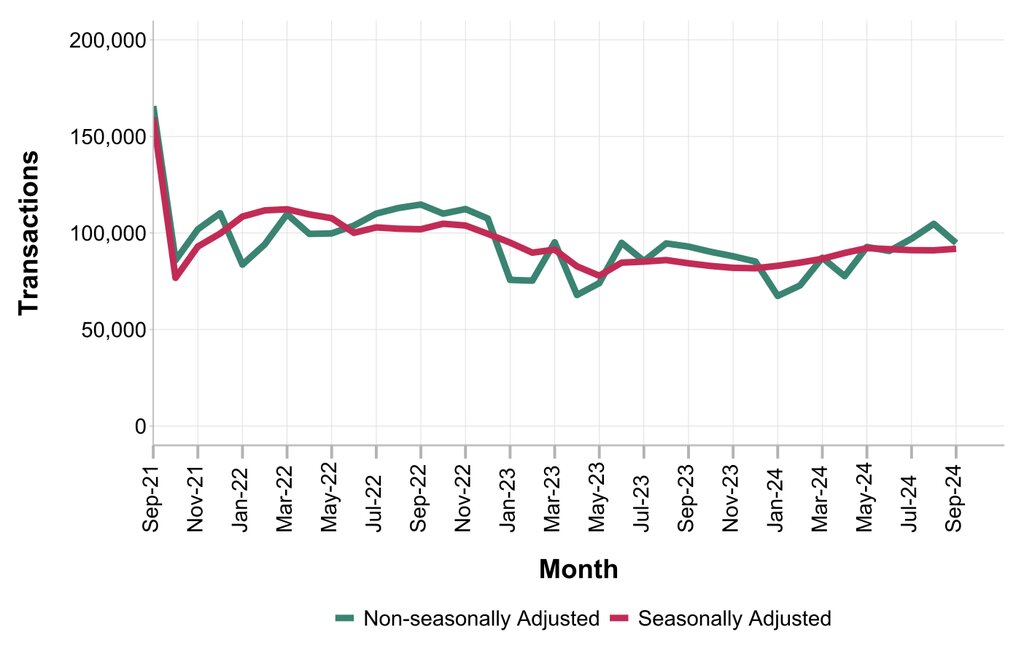

The number of UK seasonally adjusted residential transactions in September 2024 sat at 91,820, 9% higher than September 2023 and marginally higher (less than 1%) than August 2024, latest data from HMRC reveals.

The non-seasonally adjusted estimate of the number of UK residential transactions in September 2024 was 94,800, 2% higher than September 2023 and 9% lower than August 2024.

And Nathan Emerson, Chief Executive of Propertymark, reckons that there are potential positives still to come.

UPBEAT

He says: “As we move towards the end of the year, it remains upbeat to witness a real transformation within the housing sector with an overall trend of growth.

“There are also potential positives hopefully still to come, with strong hints we may see a further dip regarding the base rates next week.

“However, there are some aspects contained within yesterday’s budget which are extremely disappointing, with first time buyers feeling the brunt, as the current stamp duty threshold is lowered back to £300,000 from next April being an example.

“Typically, this would mean an additional tax liability of £6,250 for those hoping to get on the housing ladder on a home priced at £425,000.”

BUYER INTEREST INCREASING

Matt Thompson, head of sales at Chestertons, says: “In September, sub-4% mortgage products as well as lower interest rates motivated house hunters to start or finalise their property search.

“This uplift in buyer interest enticed sellers to put their property up for sale sooner rather than later which provided buyers with a larger pool of properties to choose from.

“We currently have 17% more properties under offer than in 2020 and still register new house hunters entering the market. We expect this level of buyer activity to continue over the coming weeks, especially if the Bank of England announces another rate cut next week.”

BUYERS AND SELLERS UNFAZED

Jeremy Leaf, north London estate agent and a former RICS residential chairman, adds: “Completed sales are a better gauge of market strength than more changeable house prices, not least because they include cash as well as mortgaged transactions.

Jeremy Leaf, north London estate agent and a former RICS residential chairman, adds: “Completed sales are a better gauge of market strength than more changeable house prices, not least because they include cash as well as mortgaged transactions.

“Although reflecting activity from a few months ago, the figures do show buyers and sellers were not fazed by the economic and political uncertainty prevailing at that time, which bodes well.

“We do not believe the Budget will have a significant impact although properties which investors decide not to purchase due to higher stamp duty could be snapped up by first-time buyers as they also look to take advantage before they have to pay more stamp duty after the spring.”

DEMAND REMAINS

And Amy Reynolds, head of sales at Richmond estate agency Antony Roberts, says: “With the Budget not as dramatic as feared from a property perspective, the ‘wait and see’ approach we have seen from some buyers, who have been more cautious than usual given the economic backdrop, will hopefully now ease.

“That uncertainty has resulted in an increase in properties coming back on the market after fall-throughs. These fall-throughs are often due to buyer nervousness, which in many cases is unrelated to the property itself and rather a reflection of economic uncertainty and tightening financial conditions.

“For now, demand remains and most properties are successfully re-agreed and sold after returning to the market. Demand for prime London locations is historically resilient; buyers may pause to reassess financial implications, but high-demand areas are likely to retain interest.”

BROKER REACTION

Mark Harris, chief executive of mortgage broker SPF Private Clients, says: “Lower mortgage rates have boosted activity in the market.

“With one interest rate cut behind us and hopefully another coming next week, bringing base rate down to 4.75 per cent, buyers will be more confident about committing to a property purchase.

“However, Swap market volatility continues, with five-year Swaps edging up over 4 per cent in reaction to the Budget. Some lenders are repricing upwards while others hold their ground for now at least, in a bid to attract new business.

“Borrowers should plan ahead and seek advice from a whole-of-market broker to find the best mortgage for their circumstances.”

LENDER REACTION

Gareth Lewis, managing director of specialist lender MT Finance, says: “It is good to see a small increase in transactions in September. The small increase on the previous month may be partly down to the fact that August was relatively buoyant and busier than usual as people got their holidays out of the way early.

“The housing market is moving in the right direction but we will wait to se what happens in response to the Budget and whether some purchases fall by the wayside as a result of the surprise increase in stamp duty on buy-to-let and second homes.

“If Swaps don’t soften in coming days, mortgage rates will start to edge up as the market reprices.

“While we appreciate there is a financial hole to plug, the government does need property transactions as they are good driver of growth for the economy.”