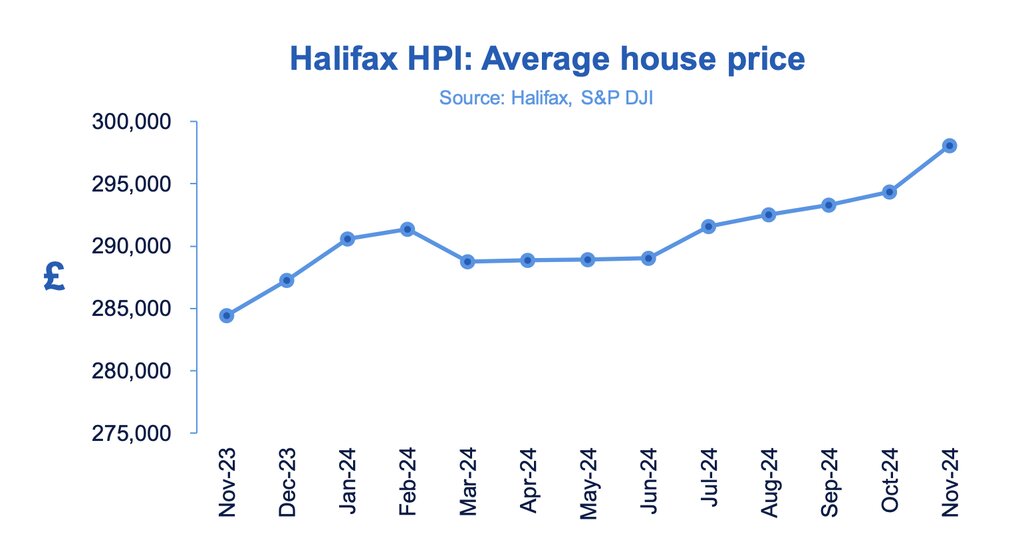

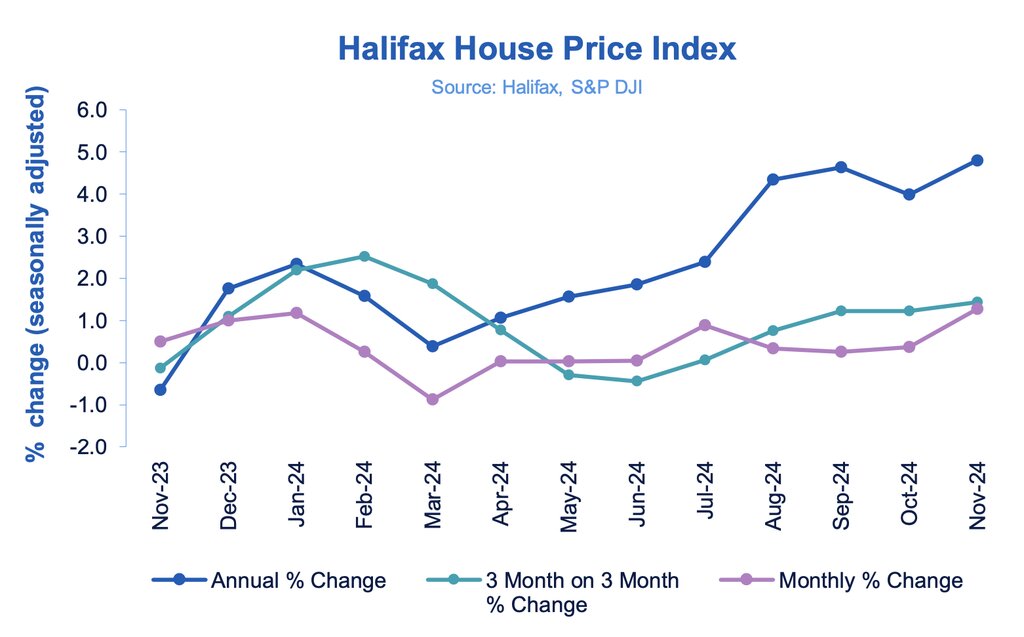

UK house prices have surged yet again, with a 1.3% increase in November marking the fifth consecutive month of growth.

This rise pushed the average price of a home to an all-time high of £300,000, surpassing the previous record set in October.

According to the Halifax House Price Index, annual growth has also accelerated, reaching 4.8%. The figures suggest the housing market remains resilient, unaffected by concerns surrounding measures introduced in Chancellor Rachel Reeves’ debut Budget.

Northern Ireland leads the charge with the highest annual growth of any UK nation or region. House prices here jumped by an impressive 6.8%, with the average property now costing £203,131.

STRONG GROWTH

Wales saw strong growth as well, with prices rising by 4.1% over the year to an average of £225,084.

In England, the North West experienced the most significant price increases, climbing 5.9% annually to an average of £237,045.

The West Midlands followed closely with a 5.5% annual rise, bringing the average house price to £257,982.

Scotland, however, recorded a more modest annual increase of 2.8%, with average prices reaching £208,957—still one of the more affordable regions in the UK.

Meanwhile, London remains the priciest region, with the average property costing £545,439. Prices in the capital rose by 3.5% over the year, maintaining its position at the top of the UK property market.

Amanda Bryden, Head of Mortgages, Halifax, says: “UK house prices rose for the fifth month in a row in November, up by +1.3% in the month – the biggest increase so far this year.

“This pushed the annual growth rate up to +4.8%, its strongest level since November 2022. As a result, the record average house price we saw in October edged higher still, with a typical property now costing £298,083.”

And she adds: “Latest figures continue to show improving levels of demand for mortgages, as an easing in mortgage rates boost buyer confidence. However, despite these positive trends, many potential buyers and movers still face significant affordability challenges and buyer confidence may be tested against a changeable economic backdrop.

“As we move towards the end of the year and into 2025, positive employment figures and anticipated decreases in interest rates are expected to continue supporting demand. This should underpin further house price growth, albeit at a modest pace as borrowing costs remain above the average of a few years ago.”

HESITATION HAS TURNED TO HURRY

Jonathan Hopper, Chief Executive of Garrington Property Finders, says: “Hesitation has turned to hurry in some parts of the market, especially among first-time buyers racing to complete their purchases before the Stamp Duty thresholds change at the end of March.

“This sense of urgency is prompting some buyers to view in haste and offer high in order to secure a home now and complete their purchase before the tax changes take effect.

“This will be music to the ears of sellers, many of whom have been forced to hold down their asking prices and accept lower offers for much of this year as the supply of homes for sale outstripped demand.

“But this buoyancy – which is pumping up average prices and could easily turn into another ‘Stamp Duty stampede’ as the deadline approaches – is far from universal.

“It’s a different story at the higher end of the market, where wealthy buyers who have rerun the numbers in the wake of a largely unfavourable Budget remain highly price sensitive.

“The supply of good quality prime homes for sale is strong, and buyers at this end of the market often find themselves spoilt for choice and able to negotiate hard on the price they pay – and this is keeping prime price rises much more modest.”

FULL SPEED AHEAD

Marc von Grundherr, Director of Benham and Reeves, says: “It’s full speed ahead following the Autumn Budget, with the monthly rate of house price growth in November the largest seen so far this year.

“It’s amazing what a little urgency can do and with stamp duty costs now set to increase from April next year, buyers are acting with a far greater degree of intent which is driving the market forward at pace.

“Of course, affordability remains an issue and many buyers are continuing to struggle with the high cost of securing a mortgage. However, what we are seeing is a measured return to health, driven by increasing buyer demand, which is very good news for sellers and the wider property market.”

ACT SOONER RATHER THAN LATER

Verona Frankish, Chief Executive if Yopa, adds: “We’ve seen an immediate reaction from buyers following the Autumn Budget and this uplift in market activity is driving current house price performance, however, those who are keen to complete before stamp duty costs increase really need to be acting sooner rather than later.

“There is still time to get a sale over the line before April next year but the property purchasing process can be a complex one riddled with delays.

“Those who are currently house hunting need to be aware that they could well miss the deadline and so they need to factor in the potential increase in costs that this would bring.

“Stretching your budget to its maximum in order to secure a property at speed and ahead of other buyers may well work in the short term, but it could prove problematic if you are required to pay more in stamp duty having completed beyond 31st March next year.”

ENCOURAGING TRANSFORMATION

Nathan Emerson, Chief Execcutive of Propertymark, says: “We have seen an encouraging transformation across the year in terms of a resilient trend of house price growth.

“Affordability and overall confidence in the sector have also seen a boost throughout the year so far, and with interest rates now easing, many buyers will have increased confidence to approach the housing market.

“We are, however, likely to see a spike in homes for sale and those looking to move home, especially across England and Northern Ireland trying to complete before the rises to Stamp Duty commence from April 2025.”

AFFORDABILITY CHALLENGES

Amy Reynolds, Head of Sales at Richmond estate agency Antony Roberts, says: “The continued increase in average house prices is surprising in light of the affordability challenges and reduced demand in some parts of the country.

“Those areas where there is limited stock to tempt buyers are seeing prices hold firm and indeed rising in some cases. Homes that are well priced and well presented continue to sell relatively quickly.

“Buyers may pause to assess the financial implications of a purchase but high-demand areas are likely to retain interest into the new year and beyond.”

GENERAL UPLIFT

Nigel Bishop of buying agency Recoco Property Search, says: “There has been a general uplift in buyer demand in November which impacted on property values and enabled some sellers to achieve their asking price.

“In some parts of the country, however, homeowners are experiencing seller fatigue after failing to sell earlier this year and are more open to lowering their asking price.

“We therefore advise house hunters to conduct careful research of their chosen area’s property market as it could be very different from the national picture and give them the upper hand during price negotiations.”

DOWNWARDS PRESSURE

Tom Bill, head of UK residential research at Knight Frank, says: “The impact of Labour’s Budget is still in the post for the UK housing market. An increase in borrowing costs and the disappearance of sub-4% mortgages in recent weeks means we expect downwards pressure on house prices to intensify next year.

“This sense of temporary strength is reinforced by the fact many buyers are acting ahead of a stamp duty increase next April. The risk that inflation and mortgage rates stay higher for longer means we recently revised down our UK house price forecasts for the next three years.

“Growth will feel more sustainable once the economy is heading decisively in the right direction.”

HIGHER BUYING COSTS

Jeremy Leaf, north London estate agent and a former RICS Residential Chairman, says: “The market is showing its teeth, despite the extra Budget taxes in particular reducing the likelihood of early cuts in mortgage cuts and prospect of slower wage growth.

“Demand continues to be strong, particularly for competitively-priced homes in lower-value areas.

“However, investors hit by higher buying costs are proving unwilling or unable to take on typically smaller one- and two-bedroom homes. On the other hand, confirmation that the stamp duty concession will not be extended has given an opportunity to first-time buyers, especially of such properties, to take advantage.

“That has also given a lift to the rest of the market by releasing second-steppers and connecting chains. However, buyers are taking their time before committing as affordability concerns remain.”