Zoopla’s latest House Price index shows a housing market steadily recovering from the impacts of higher mortgage rates with prices rising slowly. However record levels of supply mean caution is needed among sellers when it comes to pricing their home.

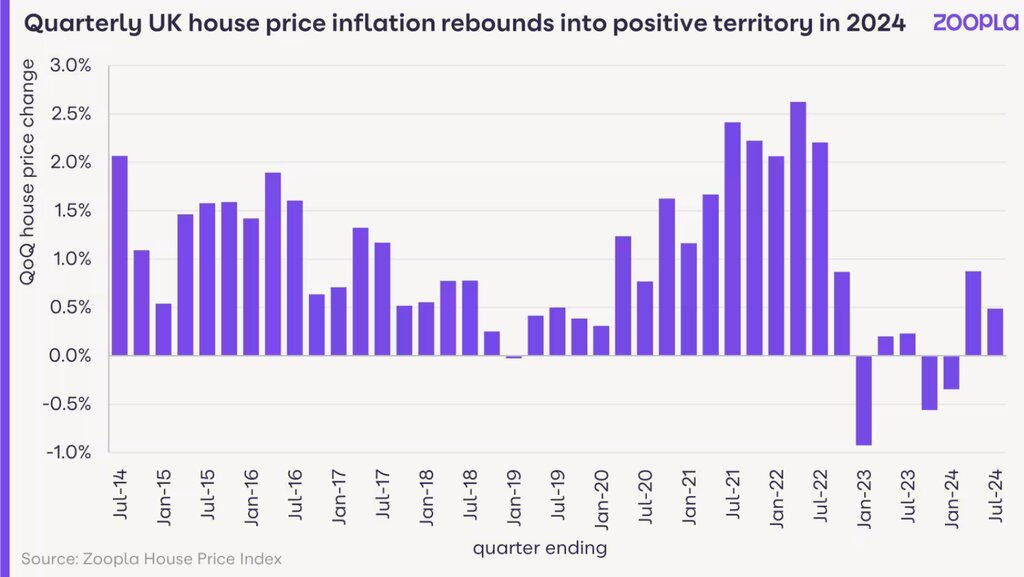

Over the last decade, house price falls have only fallen in three quarters- Q4 2022 and again in Q3 and Q4 2023, both times in response to a spike in mortgage rates. 2024 has seen a return to low rates of price growth with rising demand and more sales agreed.

Average UK house prices have risen by 1.4% in the seven months to July 2024. They are on track to be 2.5% higher over 2024. The annual (12-month) rate of growth is lower at +0.5% as it includes price falls over the latter part of 2023.

The improvement in house prices over the year to date is being felt across most areas of the country.

Annual house price inflation ranges from -0.9% in the East of England to +5.1% in Northern Ireland. Price inflation has turned positive in London (+0.2%), while prices are posting small falls in the South East (-0.7%), South West (-0.6%) and East Midlands (-0.1%).

The average estate agent listing homes for sale on Zoopla has 33 homes for sale unsold, the highest level since 2017 and a seven year high. Many of these sellers are also buyers which is why sales agreed are up 23% year-on-year.

LOCAL MARKETS ADJUSTING

House prices are still adjusting to the impact of higher borrowing costs in some local areas. House prices continue to register small falls on both a quarterly and annual basis in postal areas including Taunton (TA, -2.0%), Dartford (DT, -1.3%), Enfield (EN, -1.1%) and Harrogate (HG, -1%) – year on year price changes.

House prices are rising faster than the national average in lower value and more affordable housing markets, often in proximity to larger cities in England including Wolverhampton (WV, 3%), Oldham (OL, 2.8%), and Wakefield (WF, 2.7%).

House prices are rising even faster across the Scottish Borders from Dumfries and Galloway (DG, 4.4%) to Galashiels (TD, 3.1%) as well as in Falkirk (FK, 3.1%) to the north and east of Glasgow.

While measures of market activity are higher and price inflation positive, it’s important that sellers remain realistic on pricing, especially if they are serious about moving home.

Buyers remain price sensitive as their purchasing power has been eroded by higher mortgage rates.

This is slowly being offset by faster incomes growth but there is further to go to fully repair affordability. This explains why 1 in 5 homes had the asking price reduced by 5% or more in August to attract greater buyer interest.

GREATER CHOICE

Richard Donnell, ZooplaRichard Donnell, Executive Director at Zoopla, says: “Momentum in the sales market continues to build as mortgage rates drift lower and more and more sellers gain the confidence to list their home for sale.

Richard Donnell, ZooplaRichard Donnell, Executive Director at Zoopla, says: “Momentum in the sales market continues to build as mortgage rates drift lower and more and more sellers gain the confidence to list their home for sale.

“Buyers have much greater choice which will support sales numbers, but this will keep prices rises in check.

“Buyers have less purchasing power than 2-3 years ago and remain price sensitive meaning sellers can’t afford to get ahead of themselves on where to set the right price for their home.

“If you need to cut the asking price by 5% or more then your home will take twice as long to sell or may not sell at all.”