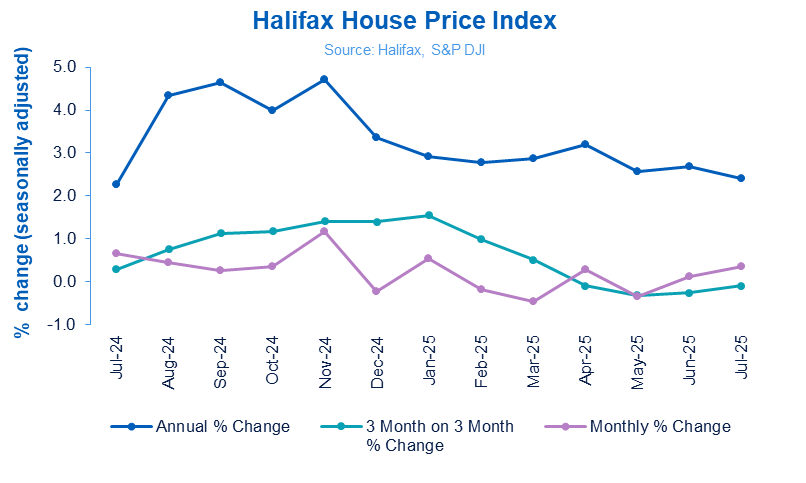

UK house prices rose by 0.4% in July, the strongest monthly gain since January and lifting the average property value to £298,237, according to the latest Halifax House Price Index.

The £1,080 rise nudged annual price growth to 2.4%, slightly down from 2.7% in June, but still pointing to a housing market showing signs of resilience despite ongoing pressure on household finances.

Regionally, Northern Ireland remained the UK’s strongest performing market, with prices up 9.3% year-on-year to an average of £214,832.

Scotland saw annual growth of 4.7%, with the average property now priced at £215,238. In Wales, values rose 2.7% to £227,928.

FASTEST GROWTH

In England, the North West and Yorkshire & the Humber posted the fastest annual growth at 4.0%. London, by contrast, saw just 0.5% annual growth, with average prices now at £539,914 – still the most expensive in the UK.

However, headline figures for the capital mask deeper weaknesses beneath the surface.

Professor Joe Nellis, economic adviser at MHA and co-creator of the Halifax House Price Index, says: “Many properties in London, particularly inner London, are actually losing value. Families looking to invest in their first owned property are being forced out of the city by high property prices and the seemingly ever-increasing cost of living.”

Nellis adds that demand in the capital has softened further following the withdrawal of stamp duty relief for first-time buyers in April. He predicts that UK-wide house price growth is likely to remain below 3% for 2025, though regions such as Northern Ireland and the North West were expected to outperform.

AFFORDABILITY CHALLENGES

Amanda Bryden, head of mortgages at Halifax, says activity levels are holding up well in the face of affordability challenges.

“While the national average remains close to a record high, it’s worth remembering that prices vary widely across the country depending on a number of factors, not least location and property type,” she adds.

Bryden says affordability is “gradually improving” thanks to easing mortgage rates and rising wages, though she acknowledges continued challenges for those trying to move up or onto the housing ladder.

“More flexible affordability assessments are helping to underpin market activity,” she says, predicting a path of “modest gains” for house prices through the remainder of the year.

MORTGAGE CHANGES

The figures come ahead of a wave of fixed-rate mortgage expiries due in the second half of 2025 – particularly among households who borrowed at ultra-low rates during the pandemic.

Bryden says most 5-year fix customers would face higher monthly repayments but adds that some borrowers on 2-year deals struck in the wake of the 2022 mini-budget may actually see lower costs. While the impact on house prices may be muted, the shift could delay moving plans for some households.

INDUSTRY REACTION

Nathan Emerson, Chief Executive of Propertymark, says: “This is a glimmer of good news for consumers considering it has been reported that there are economic headwinds ahead of us soon, and this news proves that house prices are adapting to recent stamp dduty changes despite other reports suggesting that housing activity has slowed due to these tax increases.

“Lenders are adapting to market trends by offering more competitive products, however, with the average deposit needed to purchase a home now exceeding £60,000, more support is needed to make homeownership a realistic aspiration for more people.

“The UK Government and the devolved administrations must prioritise housebuilding to void the gap between supply and demand, which ultimately will help bring down house prices in the long-term, as well as the Bank of England reducing interest rates as soon as possible to further improve affordability.”

PRICES IN CHECK

Tom Bill, head of UK residential research at Knight Frank, says: “The UK housing market is getting back on its feet following the disruption of April’s stamp duty cliff edge, but high levels of supply are keeping prices in check.

“We expect low single-digit annual growth by the end of the year but that depends on the content of the autumn Budget.

“Some parts of the economy are already adopting the brace position and buyers could begin to hesitate after the summer if speculation over tax rises persists.

“The conundrum for the housing market is that the government needs to increase its financial headroom to keep borrowing costs in check but without sentiment-sapping tax hikes.”

WINDOW OF OPPORTUNITY

Matt Thompson, Head of Sales at Chestertons, says: “Many house hunters feel that the property market now provides a window of opportunity as more properties are up for sale.

“Last month, some of our branches registered an evident uplift in the number of vendors wanting to sell which has motivated more buyers to resume their search and make an offer.

“With the Bank of England likely to cut interest rates today, we expect more buyers to proceed with their property search over the coming weeks.”

STEADY NORMALISATION

Iain McKenzie, Chief Executive of The Guild of Property Professionals, says: “This modest but welcome 0.4% rise is another brick in the wall of a steadily recovering market. The engine room of this recovery is undoubtedly improved affordability.

“With mortgage payments for first-time buyers returning towards their long-term average and lenders offering more competitive rates, buyer confidence is being rebuilt on solid foundations.

“This is translating directly into action, with agreed sales and mortgage approvals both showing healthy year-on-year growth.

“However, this is a story of steady normalisation, not a return to a runaway market. Buyers remain highly price-sensitive, and an increase in available properties is keeping a lid on any dramatic price hikes.

“For the remainder of the year, we expect this pattern of moderate, sustainable growth to continue. All eyes are now on the Bank of England’s decision this afternoon, which will be a critical signpost for the market’s direction in the months ahead.”

WAIT AND SEE

Amy Reynolds, Head of Sales at Richmond estate agency Antony Roberts, says: “While in our offices we experienced a brief lull in activity at the start of the school holidays, it has picked up significantly since then. Serious buyers are committing and keen to move before the end of the year.

“However, there’s a definite sense that everyone – buyers, sellers, and estate agents – is waiting to see what happens with interest rates.

“The possibility of a reduction in mortgage costs is a frequent topic of conversation.

“For any vendor waiting until the end of the holidays and the children go back to school before launching their property onto the market, it makes sense to do so as soon as you are ready.

“A sudden influx of properties could upset the current balance. Right now, we have a healthy equilibrium between supply and demand, and a steady flow of new instructions is key to maintaining that momentum.”

CONFIDENCE BOOST

Jason Tebb, President of OnTheMarket, says: “The housing market continues to demonstrate remarkable resilience, shaking off external economic concerns amid evidence of plenty of activity.

“While the average house price is close to a record high, this is only part of the picture as behind the headline figure are considerable regional variations and differences according to property type.

“Recent base rate cuts have been fundamental in boosting confidence and activity. Further rate reductions from the Bank of England will provide much-needed stimulus for the market and boost buyer and seller confidence as we head towards autumn. Further relaxing of criteria by lenders will also help with this.”

BUYERS RULE THE ROOST

Jeremy Leaf, north London estate agent and a former RICS residential chairman, says: “Buyers and sellers are heartened by cuts in mortgage rates, and are overcoming worries about broader economic prospects, such as the almost-inevitable autumn tax hikes.

“The overwhelming majority of agreed sales are proceeding but buyers are still ruling the roost and negotiating hard.

“The continuing excess of supply over demand is putting a stop to any strong price rebound and keeping values in check for the foreseeable future, reflected in the modest uplift of these latest figures.”