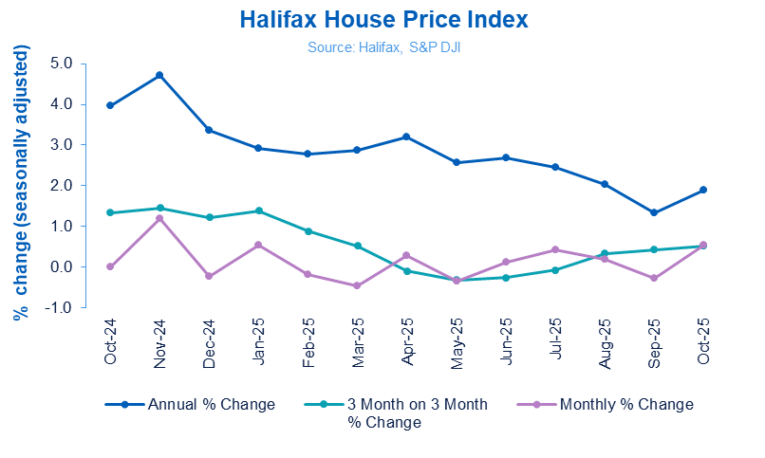

UK house prices rose at their fastest pace since January with the average property price climbing to a new record high of £299,862 in October, according to the latest Halifax House Price Index.

Values increased by 0.6% over the month, reversing September’s 0.3% decline and marking the fourth rise in the past five months.

Over the quarter, prices were up 0.5%, while the annual rate of growth accelerated to 1.9% from 1.3% in September – signalling that the housing market remains more resilient than expected amid economic uncertainty.

The increase comes as mortgage approvals reached their highest level of the year, suggesting that demand from homebuyers has held firm despite affordability pressures and relatively high borrowing costs.

CAUTIOUS OPTIMISM

Average mortgage rates remain around 4% but easing inflation and expectations of future rate cuts have provided cautious optimism for both buyers and lenders.

While house prices have now risen for most of 2025, affordability continues to weigh on sentiment.

The average UK home has gained £1,647 in value since September, and with prices now near £300,000, many households are finding it increasingly difficult to move up the ladder.

However, incomes have grown faster than property values for almost three years, slowly improving the underlying affordability picture.

HIGHEST ON RECORD

Amanda Bryden, Head of Mortgages at Halifax, said: “October saw the biggest monthly rise in UK house prices since January this year, with the value of the average UK home increasing by £1,647.

“That brings the typical property price up to £299,862 – the highest on record – while annual growth also increased to 1.9%.

“Demand from buyers has held up well coming into autumn, despite a degree of uncertainty in the market, with the number of new mortgages being approved recently hitting its highest level so far this year.”

AFFORDABILITY CHALLENGE

But she added: “Even so, affordability remains a challenge for many, with property prices at record levels and rising living costs continuing to squeeze disposable incomes.”

Regionally, Northern Ireland remains the strongest performing market, with annual price growth of 8% taking the average home to £219,646. Scotland also saw a solid 4.4% rise to £216,051, while prices in Wales were up 2% to £229,558.

In England, the North East led growth with a 4.1% annual increase to £180,924. London and the South East were the only regions to record price falls, slipping by 0.3% and 0.1% respectively. The capital remains the most expensive part of the UK, with an average property price of £542,273.

Tom Bill, head of UK residential research at Knight Frank, says: “Stable mortgage rates have supported demand in recent months and the bank rate is now on a downward path.

But a tax-raising Budget will curb buying power and weigh on sentiment, keeping a lid on housing market activity next year.”

GROWING CONFIDENCE

Nathan Emerson, Chief Executive of Propertymark, adds: “Any rise in house prices is a welcome sign of growing confidence in the UK housing market.

“It suggests that demand remains strong and that recent economic adjustments are beginning to bear fruit.

This optimism also arrives at a time when the UK Government’s ambition to deliver 1.5 million new homes in England edges closer to becoming law, a potentially transformative milestone for supply.

“However, with stamp duty across England and Northern Ireland becoming a political flashpoint ahead of the Autumn Budget and a flurry of possible housing policy leaks, the drawn-out uncertainty risks unsettling both buyers and sellers.

“Housing is the heartbeat of the UK economy, so policymakers should be focused on delivering stability and reforms that encourage movement, investment, and growth, not hesitation.”

INDUSTRY REACTION

Guy Gittins, Chief Executive of Foxtons, says: “The latest Halifax figures show that, despite a degree of buyer hesitation in the lead-up to the Autumn Budget, the housing market continues to move forward, with prices recording another month of positive growth.

“This resilience reflects the depth of underlying demand, as well some confidence from buyers following a period of greater stability in mortgage rates.

“With inflation holding firm, there is a very real prospect of a base rate cut before Christmas, which would further bolster affordability and positive sentiment amongst buyers.

“Regardless of what the Bank of England decides next month, we expect the UK property market to finish the year on a strong footing, as many buyers and sellers still push to complete before the end of 2025, or wish to head into 2026 with a renewed focus on their property goals.”

CONFIDENCE BOOST

Jason Tebb, President of OnTheMarket, says:“The housing market continues to demonstrate its resilience, shaking off external economic concerns and holding up remarkably well even as speculation continues as to what the Budget might hold in store later this month.

“Confidence among buyers and sellers has undoubtedly been boosted by five base rate cuts over the past 14 months. Yesterday’s hold in rates for the second consecutive month, while not delivering the further reduction borrowers would have wanted, does suggest a stability in the market which is encouraging.

“With the vote extremely close, and further reductions expected, this should help improve affordability, stimulate the market and encourage activity into the new year.”

CHRISTMAS RUSH

Verona Frankish, Chief Executive of Yopa, says: “Despite the economic headwinds and political noise ahead of the Autumn Budget, it seems as though the rush to complete before Christmas is well and truly on.

“A late seasonal surge in market activity has not only helped the monthly rate of house price growth to rebound, but we’ve also seen the annual rate of increase strengthen as well.

“This is the real evidence of improving market health and, all in all, we’re set to finish the year on a very strong footing, all things considered.”

STEADY RESILIENCE

Marc von Grundherr, Director of Benham and Reeves, says: “The property market continues to display remarkable consistency given the wider economic backdrop, with the latest Halifax figures showing that the monthly rate of growth has bounced back following a marginal decline in September.

“Buyers remain active, mortgage approvals are robust and, even with the Autumn Budget looming, many are pressing ahead to complete before Christmas.

“The underlying message is one of steady resilience rather than dramatic recovery, and that’s no bad thing.”

FALL THROUGH RISK

Shepherd Ncube, Founder and Chief Executive of Springbok Properties, says: “While the latest data shows small but positive steps for the market, the reality on the ground remains far more testing for sellers.

“Market hesitation is rife and whilst sellers are securing a fair price, it’s taking many months before they find a buyer willing to commit.

“Those with ambitions of moving Christmas may well find themselves disappointed, even if they already have a buyer, as the overarching air of market instability is also leading to a greater propensity for sales to fall through at the final hour.”

CAUTIOUS CONFIDENCE

Iain McKenzie, Chief Executive of The Guild of Property Professionals, says: “October’s data from Halifax paints a picture of cautious resilience in the UK housing market.

“A +0.6% monthly rise, the strongest since January, and annual growth of +1.9% underscore that demand remains solid.

“While the upcoming Autumn Budget and the prospect of possible tax changes are creating a degree of hesitation, particularly at the top end of the market, the fundamentals remain steady.

“Mortgage approvals and transaction levels are both up year-on-year, reflecting the presence of serious, needs-based buyers who continue to move despite wider uncertainty.

“A 7% increase in the number of homes for sale compared with last year is helping to balance the market, giving buyers more choice and tempering the pace of price growth.

“We expect affordability to gradually improve as wage growth continues.”

“Looking ahead, we expect affordability to gradually improve as wage growth continues and borrowing costs ease once the Bank of England begins to lower rates again.

“Overall, the market is showing cautious confidence, steady, not spectacular, but underpinned by genuine activity and improving fundamentals. This stability should give both buyers and sellers reassurance as we move towards the end of the year.”

SPLIT SENTIMENT

Jeremy Leaf, north London estate agent and a former RICS residential chairman, says: “Once again, the market is baring its teeth. Although sentiment is split between upsizers who believe prospects will improve and downsizers who think it may deteriorate as a result of Budget measures, fortunately enough buyers and sellers have confidence in longer-term prospects.

“The Chancellor may have confirmed taxes will be rising but encouragement can be taken from the Bank of England’s comments that inflation has peaked and that direction of travel for interest rates is certainly downward in the coming months.”

BUDGET NERVES

Matthew Thompson, Head of Sales at Chestertons, says: “October’s property market was noticeably calmer as many buyers have paused to see what the Budget might bring.

“Some buyers remained active and were able to secure good opportunities, particularly where sellers were willing to negotiate.

“Once there is more clarity from the Chancellor’s announcements, we expect buyer activity to pick up as those waiting on the sidelines re-enter the market.”

MUTED GROWTH

Daniel Austin, Chief Executive and Co-founder at ASK Partners, says: “Today’s modest uptick in UK house prices offers a flicker of optimism, but growth remains muted as elevated borrowing costs continue to weigh on affordability.

“The Bank of England’s decision to hold rates at 4% provides little immediate relief, with stubbornly high fixed mortgage rates keeping pressure on homeowners and first-time buyers alike.

“With global volatility elevated and domestic policy direction uncertain ahead of the Autumn Statement, policymakers are holding back pending greater fiscal clarity.

“Inflation is unlikely to return to target this year, maintaining mortgage strain and dampening household confidence. As a result, the property market remains cautious, buyers are pausing, and developers are delaying projects amid uncertainty over taxation, build costs, and planning timelines.

“Proposed reductions in affordable housing requirements and efforts to streamline planning could boost scheme viability, yet high financing costs and tight margins continue to constrain delivery.

“Even so, resilient sectors such as co-living, build-to-rent, and storage remain attractive to investors, supported by robust fundamentals and a persistent supply-demand imbalance.

“For those seeking stability amid geopolitical risk and wider market volatility, UK real estate debt continues to stand out, offering capital preservation, steady income, and a degree of insulation from equity market swings.”