UK house prices were up 1.5% in June compared to a year ago but are still unaffordable for most typical buyers, the UK’s largest building society warned this morning.

Nationwide said that while earnings growth has been much stronger than house price growth in recent years it simply hadn’t been enough to offset the impact of higher mortgage rates.

For example, the interest rate on a 5-year fixed rate mortgage for a borrower with a 25% deposit was 1.3% in late 2021, but in recent months this has been nearer to 4.7%.

Robert Gardner, Nationwide’s Chief Economist, says: “Housing affordability is still stretched. “Today, a borrower earning the average UK income buying a typical first-time buyer property with a 20% deposit would have a monthly mortgage payment equivalent to 37% of take-home pay – well above the long run average of 30%.”

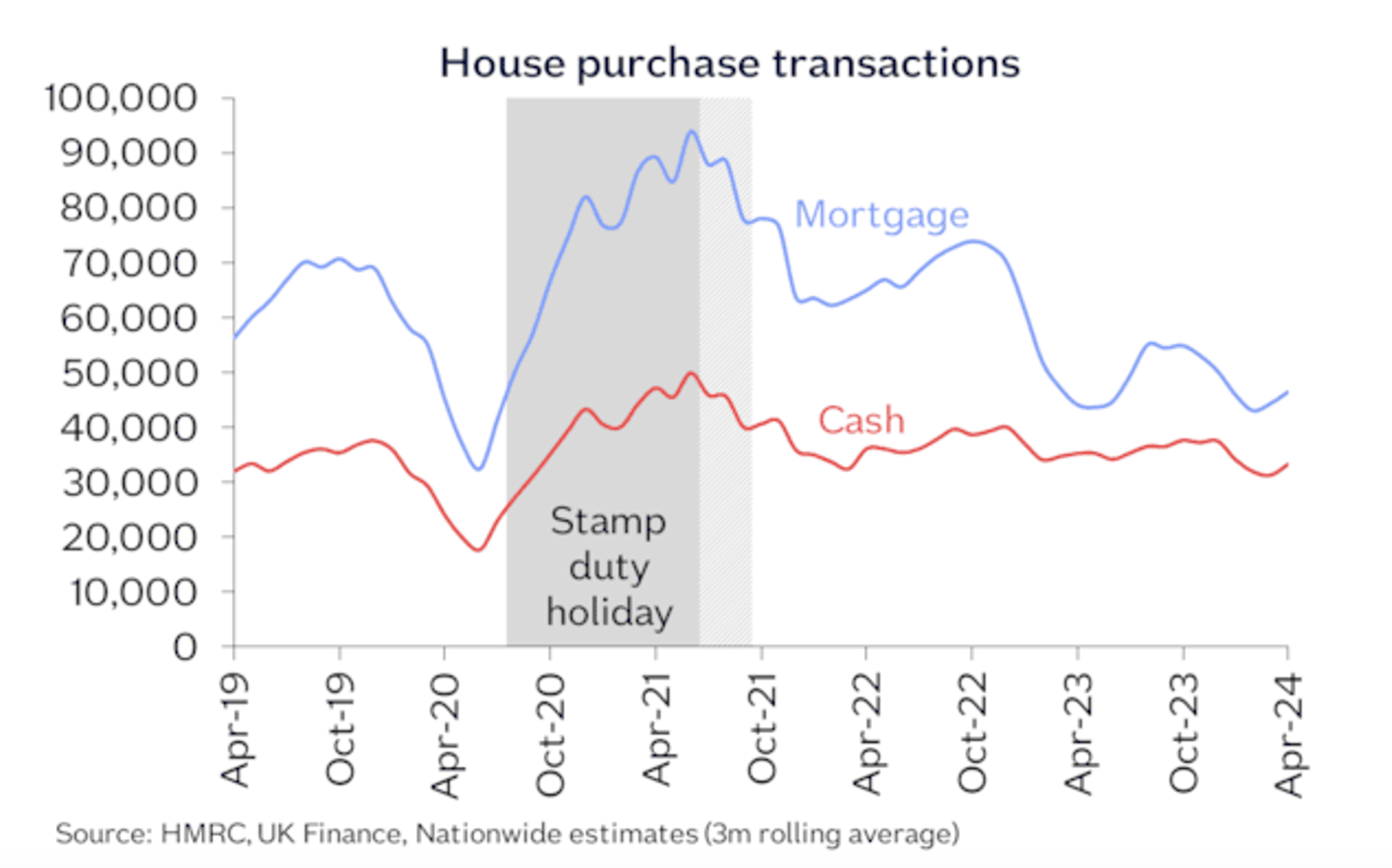

And he adds: “Housing market activity has been broadly flat over the last year, with the total number of transactions down by around 15% compared with 2019 levels. Transactions involving a mortgage are down even more (nearly 25%), reflecting the impact of higher borrowing costs. By contrast, the volume of cash transactions is actually around 5% above pre-pandemic levels.”

|

Headlines |

Jun-24 |

May-24 |

|

Monthly Index* |

524.8 |

523.8 |

|

Monthly Change* |

0.2% |

0.4% |

|

Annual Change |

1.5% |

1.3% |

|

Average Price (not seasonally adjusted) |

£266,064 |

£264,249 |

Iain Mckenzie, The Guild of Property ProfessionalsIain McKenzie, CEO of The Guild of Property Professionals, says: “This is the last litmus test on the state of the property market prior to the General Election and it is fair to say that while challenges remain, stability has returned to house prices in recent months.

Iain Mckenzie, The Guild of Property ProfessionalsIain McKenzie, CEO of The Guild of Property Professionals, says: “This is the last litmus test on the state of the property market prior to the General Election and it is fair to say that while challenges remain, stability has returned to house prices in recent months.

“A modest rise in June follows the trend of steady price growth that we have seen since the start of the year.

“While some may argue prices are stagnating, affordability concerns still loom for many Brits and there is a delicate balance to appease both buyers and sellers alike.

“The regional picture is more mixed and we are seeing a greater adjustment in house prices happening in the South, where prices in many areas have been inflated for years.

“Meanwhile, regions in the North of England have seen higher levels of demand which have created a market that favours sellers.

“We would like to see first-time buyers being prioritised in the coming months, regardless of which party forms the next government. While house price growth is welcome news for sellers, it undeniably makes it harder for those still saving for a deposit to get on the property ladder.

“A renewed push to ramp up the rate of homebuilding would be a good place to start, particularly for properties that are considered more affordable.

Guy Gittens, Foxtons“There is also the possibility that we may see a new help-to-buy scheme rolled out in the near future, which would go a long way towards encouraging potential buyers to get saving.”

Guy Gittens, Foxtons“There is also the possibility that we may see a new help-to-buy scheme rolled out in the near future, which would go a long way towards encouraging potential buyers to get saving.”

Foxtons Chief Executive Guy Gittins adds: “The election may be looming but this has done little to deter the uplift in market activity seen in recent months, with UK house prices continuing to show positive signs of upward growth.

It’s clear that homeownership remains high on the agenda and so far this year we’ve seen a notable increase both in terms of buyer enquiry levels and the number of sales being agreed.

We expect that the market will remain resilient regardless of which political party comes out on top this Thursday and, with the addition of a base rate cut on the horizon, we anticipate a very busy end to the year for the UK housing market.”

Ruth Beeton, Home Sale PackRuth Beeton, Co-Founder of Home Sale Pack, says: “Market activity remains somewhat subdued and this is largely down to the fact that mortgage rates remain substantially higher than they have been in previous years.

Ruth Beeton, Home Sale PackRuth Beeton, Co-Founder of Home Sale Pack, says: “Market activity remains somewhat subdued and this is largely down to the fact that mortgage rates remain substantially higher than they have been in previous years.

“However, there’s no doubt that momentum is starting to build and not only are house prices up on an annual basis, but this rate of positive growth is starting to accelerate.

“We expect this positive house price growth performance will only strengthen as the year progresses, particularly now that it’s a matter of when, not if, interest rates are cut.”

Marc von Grundherr, Benham and ReevesMarc von Grundherr, Director of Benham and Reeves, says: “The latest house price figures provide concrete evidence that the market is very much heading in the right direction and although it remains a case of not running before we can walk, we look set for a far more prosperous year both with respect to house price growth and overall market activity levels.

Marc von Grundherr, Benham and ReevesMarc von Grundherr, Director of Benham and Reeves, says: “The latest house price figures provide concrete evidence that the market is very much heading in the right direction and although it remains a case of not running before we can walk, we look set for a far more prosperous year both with respect to house price growth and overall market activity levels.

“While this week’s general election is unlikely to slow this momentum, there’s a good chance it could add to it, depending on who comes out on top and what housing market initiatives they introduce.”

Verona Frankish, Yopa Chief Executive, adds: “It’s clear that while higher mortgage rates continue to restrict market activity to an extent, a hold on the base rate since last September has provided the stability needed to steady the ship and provide a strong foundation for market growth.

“With a cut to interest rates looking highly likely in the coming months, the expectation is a further boost to buyer activity and this is likely to increase the speed at which house prices are rising.”

Verona Frankish, Yopa

Verona Frankish, Yopa