Buying a home is becoming more affordable relative to income as house price increases ease and wage growth remains strong, latest research from Halifax reveals.

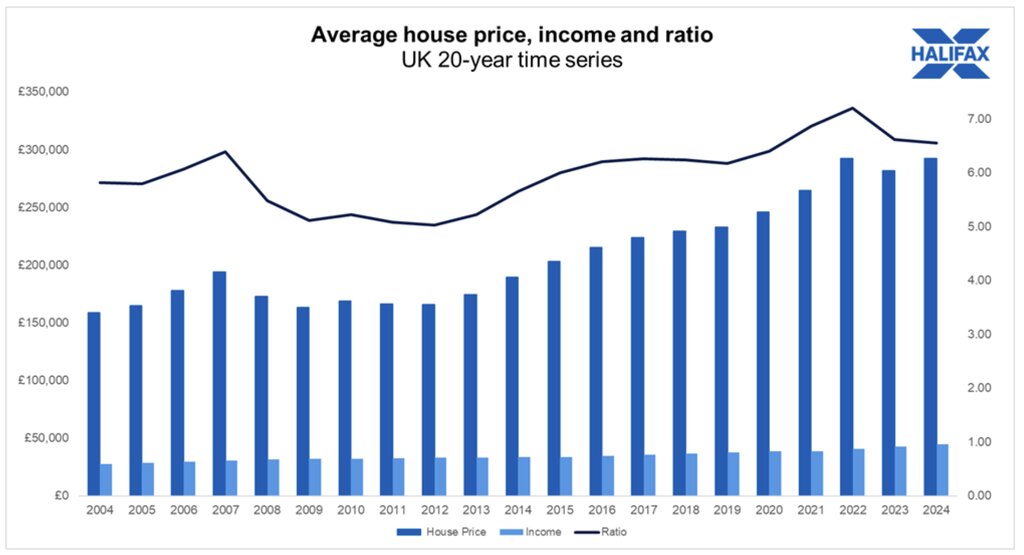

House prices have increased by +3.8% compared to a year ago, reaching an average of £292,508.

Meanwhile, annual earnings for full-time workers climbed by +5% to an average of £44,667, over the same period.

This means wage growth outpaced house price inflation, putting the house price to income ratio at 6.55.

This is down from 6.62 last year, with the house price to earnings ratio gradually reducing since it reached a record high of 7.24 in the summer of 2022.

HIGHER INTEREST RATES

While market activity has been improving – the number of new mortgages agreed recently reached its highest level in two years – residential property purchases are down by around a third (-33%) compared to 2021, when interest rates were at a record low of 1.3% on average, compared to 4.1% in September this year.

A reduction in demand from buyers, from the highs of 2021, is one of the reasons house prices have remained flat for much of the last two years, with the average house price of £292,410 in 2022 comparing to £292,508 in 2024.

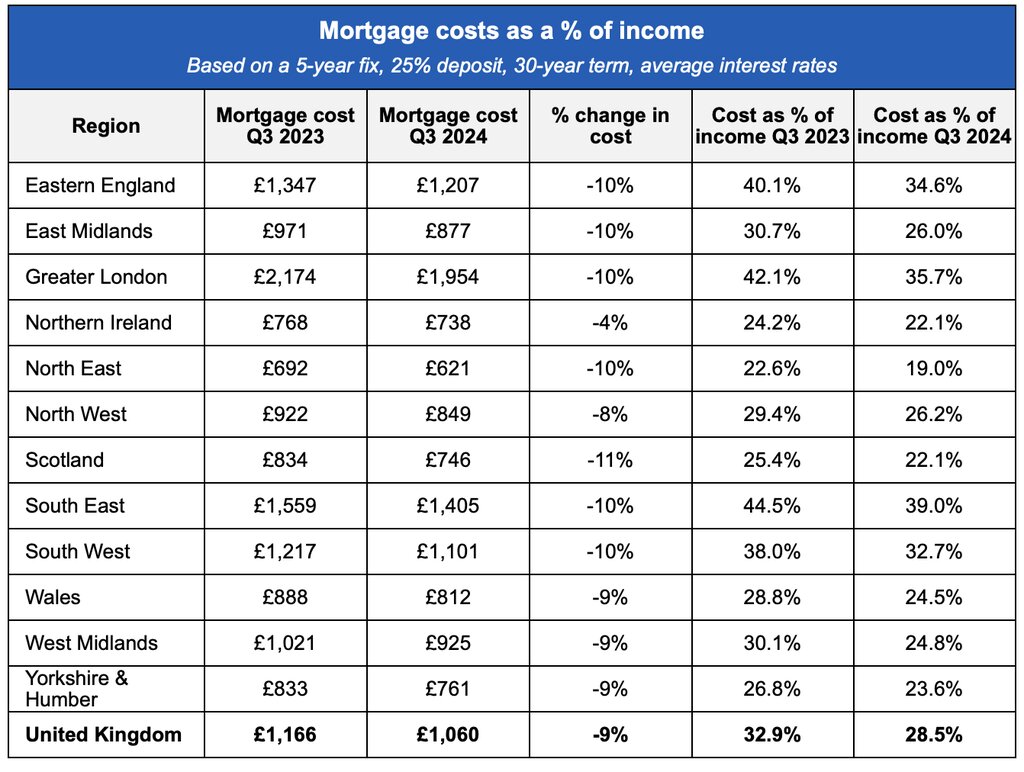

Typical monthly new mortgage costs have fallen by about 9% over the last year, from £1,116 to £1,060.

That’s based on the typical monthly cost of a 5-year fixed rate mortgage, with a 30-year term and a 25% deposit (average interest rates of 5.2% and 4.1% respectively).

Based on the average UK full-time income, that equates to mortgage costs as a percentage of income falling from 33% to 29%, its lowest level in over two years.

On the same basis, mortgage costs have fallen in each nation and region of the UK over the last year.

IMPROVED AFFORDABILITY

Amanda Bryden, Head of Halifax Mortgages, says: “Housing affordability has improved over the past year, thanks to stabilising property prices, strong wage growth, and easing interest rates.

“That’s great news for first-time buyers and existing homeowners looking to remortgage or move up the property ladder.

“However, while homes are becoming more affordable, the progress has been gradual. Buying a property remains a significant challenge for many, with prices still near record highs and interest rates likely to stay higher than we’ve been used to over the past decade.”

REGIONAL DIFFERENCES

While the national house price to earnings ratio has eased, making homes more affordable on average, there’s a mixed picture across the UK.

House prices in some parts of the UK have become less affordable, with Northern Ireland experiencing the largest increase in the house price to earnings ratio from 4.88 last year to 5.09 this year, driven by a substantial 10% rise in house prices.

“Homes have become less affordable in these areas relative to income.”

In England, the North West, South East and Yorkshire & Humberside also saw an increase in their house price to earnings ratios, meaning homes have become less affordable in these areas relative to income.

Although London still boasts the highest average house price of £539,238, its house price to earnings ratio of 8.22 is lower than the South East – which is the highest (or least affordable) of all regions at 8.96 (up slightly from 8.95 last year).

Conversely, the North East of England is the most affordable region, with a house price to earnings ratio of 4.38. This is down from 4.56 last year, meaning that homes in the area have become more affordable. This is because house prices in the North East rose by +2.4% and were outpaced by a +7% increase in average income for the area.

MOST AND LEAST AFFORDABLE

At a local level, the North of England accounts for many of the most affordable areas.

Kingston upon Hull in East Yorkshire is crowned the most affordable area of the UK, with a house price to earnings ratio of 3.15. This is followed by Burnley and Blackpool in the North West, with ratios of 3.20 and 3.34 respectively.

Elmbridge in Surrey is the least affordable local area by some distance, with a house price to earnings ratio of 17.54. St Albans in Hertfordshire is in second place with a ratio of 13.96, followed by Kensington and Chelsea in London at 13.93.

However Elmbridge also saw the biggest improvement in affordability, falling from 19.46 in 2023. The biggest deterioration in affordability was recorded in Oxford in the South East, rising from 8.37 to 10.26.

“It’s crucial to remember that the property market varies significantly at a local level.”

Bryden adds: “While national house price figures often grab the headlines, it’s crucial to remember that the property market varies significantly at a local level.

“The most sought-after areas tend to have the highest prices, and local developments, such as improved transport links or job opportunities, can all help to drive demand.”

INDUSTRY REACTION

Tom Bill, head of UK residential research at Knight Frank, says: “Affordability pressures relented this summer but have increased since the Budget as the government borrows more and inflationary risks intensify.

“We expect house price growth and transaction volumes to moderate as it again becomes impossible to agree a fixed-rate deal starting with a three.”

And Toby Leek, NAEA Propertymark President, adds: “Buyers’ affordability continues to grow, not only as property prices

start to align with wages, but also as interest rates steadily improve which has allowed more competitive mortgage products to enter the market compared to what was seen at the start of the year.

“Additionally, with Stamp Duty increases due from April 2025 in England and Northern Ireland, we expect movers to be pushing through and completing on their home purchases in order to save, in some cases, thousands of pounds as they move into the New Year.”