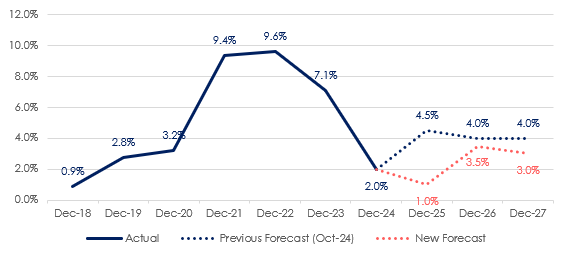

Rental growth across Great Britain is slowing more sharply than expected, prompting Hamptons to downgrade its forecast for 2025 amid a significant shift in market dynamics.

In its latest outlook, the estate agency now expects average rents to rise by just 1.0% year-on-year by December – a substantial revision from its earlier forecast of 4.5%.

The update follows confirmation that average rents on newly let properties rose just 0.4% in June compared with the same month in 2024, the weakest annual growth since August 2020.

The slowdown reflects a fundamental shift in tenant demand, much of which is now being redirected into the sales market.

FIRST-TIME BUYERS

According to Hamptons, a record 33% of all homes sold in the first half of 2025 were purchased by first-time buyers – many of whom have taken advantage of falling mortgage rates to exit the rental sector.

This exodus has had a profound impact. Nationally, tenant demand was 11% lower in H1 2025 than during the same period in 2024 and 20% lower than in H1 2019.

Source: Hamptons

At the same time, the number of homes available to rent rose 8% year-on-year – not due to new landlord investment, but because rental properties are sitting on the market for longer as demand ebbs.

SPREADING ACROSS THE COUNTRY

Aneisha Beveridge, Head of Research at Hamptons, says: “The rental market softened more quickly than we anticipated towards the end of last year.

“What initially appeared to be a London-centric slowdown has now spread across the country, with rents declining in multiple regions and growth easing elsewhere.

“A combination of falling mortgage rates and a weaker labour market has shifted the dynamics – more affluent renters are becoming first-time buyers, while the economic slowdown is limiting what others can afford.

“That said, this isn’t the end of the rental growth story. The structural shortage of rental homes remains unresolved, and upcoming regulatory changes, such as the Renters’ Rights Bill and new EPC requirements, are likely to constrain supply further and add to landlords’ costs.

“A slowdown in build-to-rent development this year is also expected to result in fewer new rental homes entering the market in the coming years. These pressures will continue to underpin rental growth over the medium term, even as the market recalibrates in the short-term.”

LONDON LEADS THE DECLINE

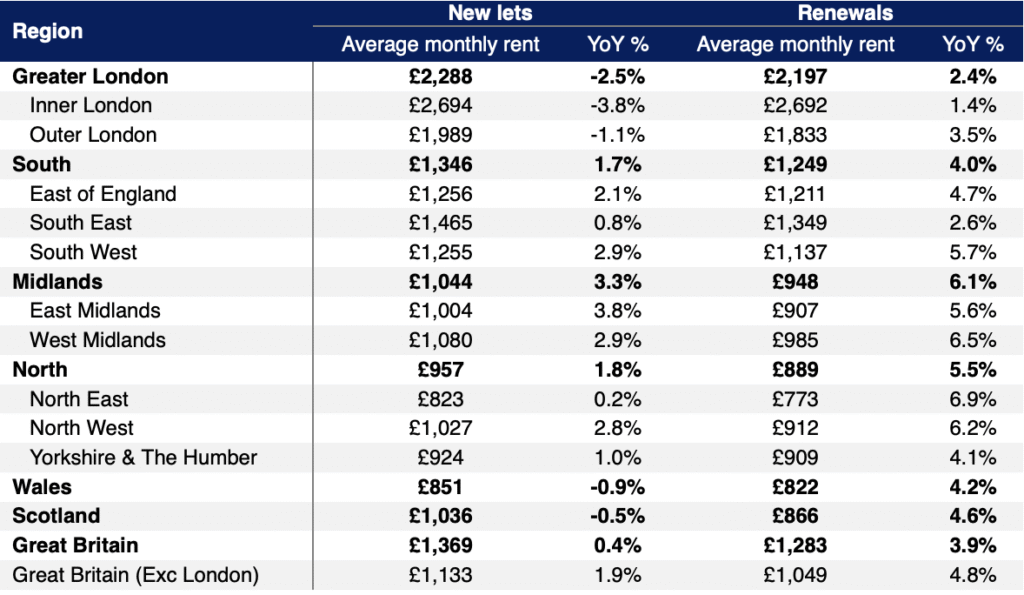

London has seen the sharpest retreat, with rents on new lets falling for the sixth consecutive month, down 2.5% year-on-year in June.

This marks the capital’s steepest annual rental drop since May 2021, bringing average new-let rents in London back to May 2023 levels.

Source: Hamptons

In Inner London, rents now stand at £2,694 per month – 3.8% lower than this time last year, and their lowest since October 2022.

The weakening trend is broadening. Rents fell 0.5% in Scotland and 0.9% in Wales in June – the first annual declines in these nations since 2019 – while even the previously buoyant North of England saw growth slow from 8.1% to 1.8%. Rental growth in the South eased to 1.7%, and the Midlands posted the strongest growth at 3.3%.

Renewed tenancies are also showing signs of softening. While still outpacing new lets, renewal rent growth halved to 3.9% in June from 7.6% a year earlier.

The gap between renewal and new-let rents has now narrowed to just 6% or £86 per month – the smallest differential since summer 2021.

MACRO PRESSURES MOUNT

Wider economic conditions are weighing heavily on tenant finances. HMRC data shows a net decline of 178,000 payroll employees over the last 12 months, with job losses concentrated in sectors like hospitality and graduate employment – traditionally renter-heavy demographics.

Unemployment is expected to rise to 5% by Q4 2026, while average wage growth has slowed to 5% in May and is forecast to dip further to 3% next year.

Given the close relationship between earnings and rent affordability, Hamptons has also revised down its rental growth forecasts for 2026 and 2027 – now expecting increases of 3.5% and 3.0%, respectively, each 0.5 percentage points lower than previously anticipated.

INFLATIONARY OUTLOOK

Despite the near-term deceleration, Hamptons projects that average rents will rise by 18% between the end of 2022 and 2027, adding £2,650 to annual tenant costs by the end of that period.

The chronic structural shortage of rental stock – exacerbated by regulatory pressures and a slowdown in build-to-rent delivery – remains unresolved. The number of homes available to rent is still 34% below 2019 levels.

For landlords, lenders and letting professionals, the message is mixed: the market is cooling faster than expected, but the long-term fundamentals remain inflationary.

The challenge now is navigating short-term softness while preparing for renewed pressures from regulatory change and constrained housing supply in the years ahead.