First-time buyers are helping to deliver the busiest year for UK housing transactions in three years, despite late-year uncertainty triggered by Budget speculation, according to Zoopla.

The property portal’s latest House Price Index shows the market is on course for around 1.2m transactions in 2025, up 9% on last year and broadly in line with the 10-year average.

More stable mortgage rates and stronger household income growth have encouraged buyers back into the market, lifting activity more than expected.

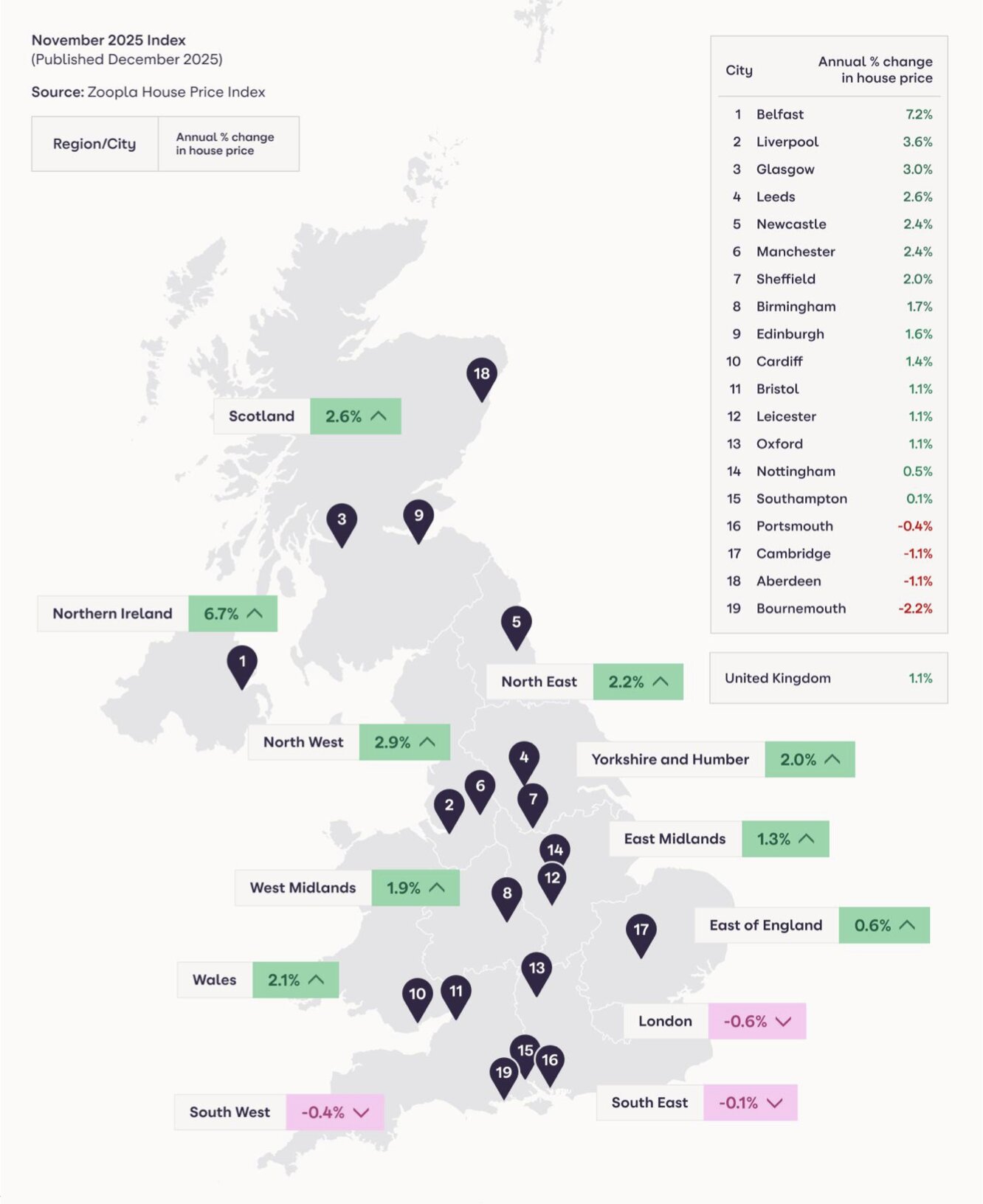

The increase in sales, however, has not translated into faster house price growth. The average UK home now costs £270,300, up 1.1% year on year in November 2025. That compares with 1.9% growth in 2024 and is well below the 10-year annual average of 3.8%.

REGIONAL VARIATIONS

Price performance continues to diverge sharply by region. The strongest growth is being recorded in more affordable parts of the country, with prices up 2.9% in the North West and 6.7% in Northern Ireland.

By contrast, values are falling across much of southern England and are down by as much as 0.6% in London, where high house prices and stamp duty costs are weighing on demand.

At a local level, the strongest price growth has been seen in the Scottish Borders, where prices are up 4.7%, followed by Oldham at 4.4%, Kirkcaldy at 4.2% and Falkirk at 4.2%. In contrast, coastal markets in the South have seen values slip, reflecting higher taxes on second homes and a shift back towards office working. Prices are down 2.4% in the Truro area, 1.9% in Torquay and 1.8% in Bournemouth.

FIRST-TIME BUYERS

First-time buyers are the main driver of increased activity. Improved mortgage availability means their numbers are on track to be 20% higher in 2025, with this group accounting for 39% of all purchases.

Existing homeowners using a mortgage make up 33% of sales, followed by cash buyers at 21% and landlords buying with a mortgage at 7%.

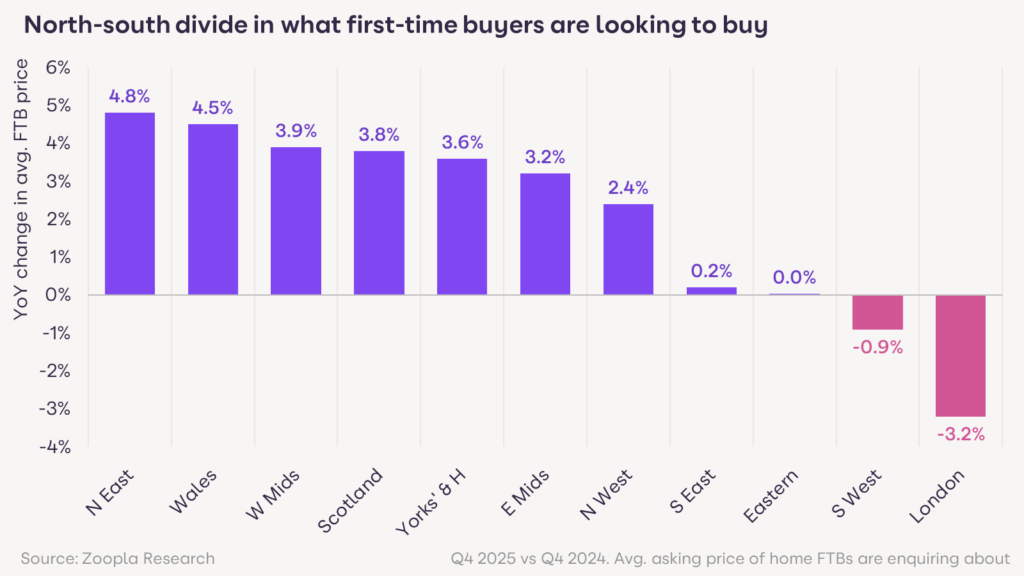

While borrowing capacity has improved, first-time buyers are not necessarily trading up. Zoopla says they are looking to spend up to 5% more in regional markets than a year ago, but in London they are targeting homes that are around 3% cheaper, reflecting higher stamp duty costs and limited price growth across the South.

STRONG START TO 2026

Looking ahead, Zoopla forecasts average UK house prices will rise by 1.5% in 2026, supported by a stronger-than-usual start to the year as pent-up demand is released following delays ahead of the Budget. Sales are expected to total around 1.18m next year.

Price growth of more than 2.5% is forecast across the Midlands, northern England, Scotland and Northern Ireland in 2026, with affordability continuing to favour these regions.

Zoopla expects the north-south divide in house price inflation to persist, with average prices rising by an annual average of 2.1% between 2027 and 2029 as affordability gradually resets.

BUYERS STARTING TO RETURN

Richard Donnell, Executive Director at Zoopla, says: “2025 has been a strong year for home moves but the Budget hit activity in the final months of the year and saw many moving decisions put on hold.

“Now the uncertainty has lifted, we expect a stronger than usual start to 2026 as buyers return to the market.

“The appetite to move home remains strong but affordability remains a constraint for those buying their first home or looking to trade-up to a larger home which will keep prices in check.”

REALISTIC PRICING

And he adds: “There remains plenty of homes for sale, which will boost buyer choice as we start the new year.

“Average UK house prices are projected to be 1.5% higher over 2026 with a continued divide between southern England and the rest of the country where affordability is better and buying costs are lower.

“It is important that sellers remain realistic on pricing to secure sales in 2026, especially across southern England. Homeowners looking to move in the year ahead should understand the value of their home and what they can afford before starting their property search.”

MARKET DRIVER

Polly Ogden Duffy, Managing Director at John D Wood & Co, says “First time buyers drive every part of the property market.

“When they kick-start activity at the entry level, it creates momentum throughout the entire system, allowing chains to form and transactions to progress across the country.

“With a continued shortage of rental homes pushing rents to record highs, buying is increasingly the more affordable option for many households – provided they can pass affordability checks and secure a mortgage.

POSITIVE STEP

She adds: “That’s why the recent easing of affordability criteria is such a positive step. In many cases, buyers can comfortably manage monthly repayments but have historically struggled to access lending.

“Greater flexibility from lenders is beginning to change that, helping more people make the leap onto the property ladder. Supporting first time buyers in this way is critical to maintaining healthy levels of market activity into 2026.”

LOWER BORROWING COSTS

Nathan Emerson, CEO of Propertymark, says: “We continue to see a housing market that is responding positively despite economic turbulence.

“Now that we have seen a further reduction in base rates down to 3.75%, this will hopefully spur first-time buyers to continue to drive the highest level of home moves as lower borrowing costs are easing monthly repayment pressures and improving affordability, particularly for those entering the market for the first time.

“The falls in rates have helped release some of the pent-up demand that built up towards the end of this year, supporting transaction levels as we move into 2026.

“However, while activity is picking up, data shows that house price growth remains modest. With a good supply of homes available and affordability still a key constraint, especially in higher-priced areas, price rises are likely to remain measured rather than accelerate rapidly.”

ZOOPLA HOUSE PRICE INDEX