The proportion of first-time buyers purchasing homes in England and Wales has fallen by more than 10% this year as affordability pressures continue to weigh heavily on the housing market.

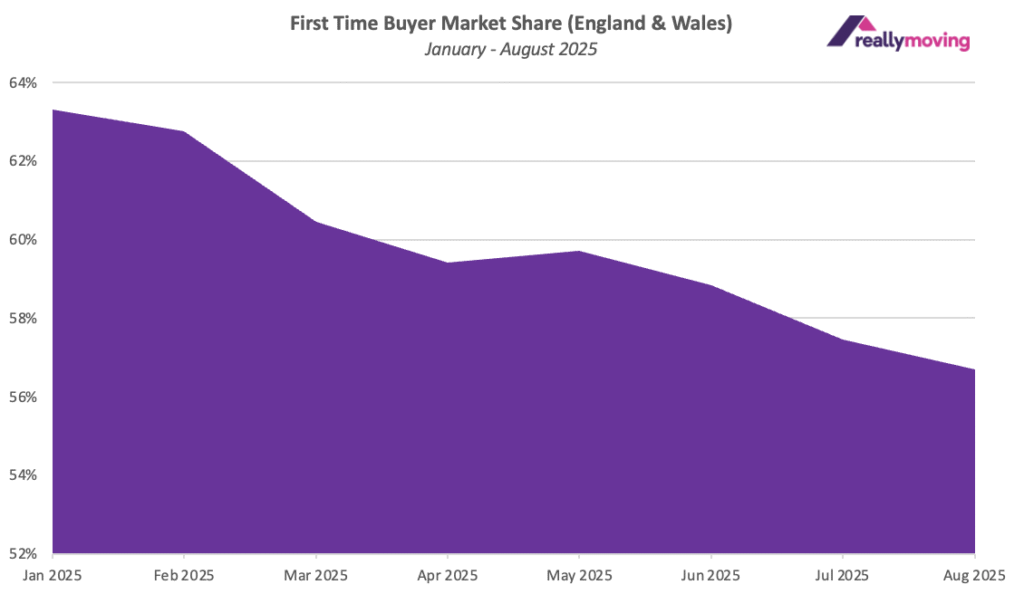

New data from home-move comparison site reallymoving shows that first-time buyers accounted for 63.3% of all home movers in January 2025, dropping to 56.7% by August – a 6.6 percentage point decline and the lowest level in almost three years.

Over the same period, the average price paid by first-time buyers fell by 3.1%, from £280,610 in January to £271,784 in August.

However, the modest drop in prices has failed to entice more buyers into the market, suggesting that high borrowing costs and rising living expenses are continuing to limit affordability.

ACROSS THE REGIONS

The decline has been recorded across every region of England and Wales. The steepest falls were seen in the South West, Yorkshire and the Humber, the East of England, and the North East – all down by more than nine percentage points.

In the North East, average prices paid by first-time buyers actually rose by 9% over the same period, underlining the extent to which affordability pressures are keeping many would-be buyers out of the market.

The smallest declines were recorded in London and the East Midlands, down 2.9 and 2.6 percentage points respectively.

Despite having the highest property prices in the country, London remains the leading market for first-time buyers, with 68% of all movers in the capital now purchasing their first home. Analysts suggest that high rents are making long-term renting unsustainable, while continued parental support from the “Bank of Mum and Dad” and a slight easing in prices may be helping to sustain demand.

The average price paid by a first-time buyer in London has fallen by £12,000 over the past year, from £454,800 in August 2024 to £442,443 in August 2025 — a decline of 2.7%.

PROPERTY TYPE

The type of homes being bought by first-time buyers is also shifting. The share of flats has fallen from 29.7% in January to 26.6% in August – a 10.5% decline – reflecting growing caution around cladding risks, ground rents, and rising service charges.

The proportion of new-build purchases has dropped even more sharply, down nearly a quarter from 12.8% to 9.7%, the lowest level since 2016.

A fall in new housing supply has compounded the issue. Government data shows that new home completions dropped by 19% year-on-year in the second quarter of 2025, reducing choice for buyers and pushing prices for existing stock higher.

At the same time, the reduction in the first-time buyer stamp duty threshold from £425,000 to £300,000 in March has encouraged some to bypass traditional “starter homes” and purchase larger properties, further reducing the number of first-time transactions.

FIRST-TIME BUYER CHALLENGE

Rob Houghton, founder and chief executive of reallymoving, says: “These figures highlight the scale of the challenge facing first-time buyers in 2025. Prices may be softening and mortgage rates inching down, but not nearly enough to offset the affordability pressures being felt in every region of the country.

“First-time buyers face trying to save for a deposit amid rising living costs and secure a mortgage at a sustainable repayment rate, with very little targeted government support to help them onto the ladder.

“Unless we start to see a dramatic increase in housebuilding and measures to boost affordability, first-time buyers are unlikely to regain their market share any time soon.”