A new UK startup is shaking up the housing and personal finance sectors with a model that allows homeowners to unlock upfront capital without taking on debt.

Moovable offers a product called Life Boost, enabling homeowners to receive a lump sum of £3,000 to £15,000 – tax-free up to £7,500 – in exchange for letting out a spare room for six to 24 months.

Unlike equity release or personal loans, the funds don’t need to be repaid. Instead, they’re covered by future rental income from a vetted lodger, with Moovable managing contracts, background checks and housemate matching where needed.

Positioning itself as a “spare room finance” platform, Moovable is targeting the millions of UK homeowners who are “house rich but cash poor”.

NEW ROUTE TO CASHFLOW

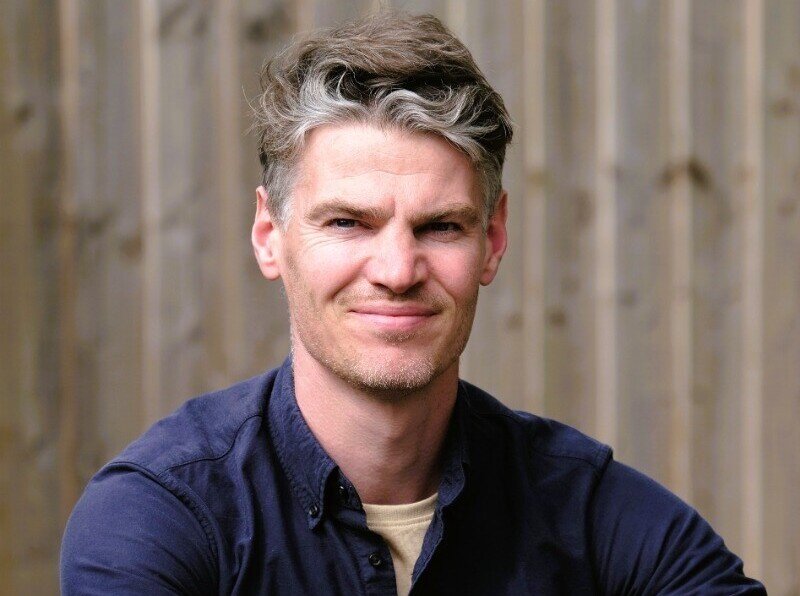

Justin Smith, founder of Moovable, says: “We’re offering homeowners a way to unlock the value of their home without giving up equity or adding to their debt burden.

“It’s a new route to cashflow – no credit checks, no monthly repayments, no interest.”

According to the company, there are over 10 million under-occupied homes across the UK, with at least two spare bedrooms, while more than 20 million adults are underserved by traditional financial providers.

Beyond the lump sum, participants also receive monthly contributions toward bills, a 5% share of the rent, and a 7.5% completion bonus – all covered by the housemate’s payments.

FULLY VERIFIED OPTIONS

Moovable’s model also appeals to renters, offering fully verified housing options and the ability to build credit scores through rent reporting – still a rarity in the private rental sector.

Early demand has been strong with 69% of prospective first-time buyers surveyed said they would consider using the platform, with 25% saying they “definitely” would.

Initially launching in London, Moovable plans a nationwide roll-out across England and Scotland.

With housing pressures mounting and consumer credit tightening, the platform says it aims to provide an alternative path to financial resilience one spare room at a time.