A leading London estate agency chief has warned that the government risks undermining the housing market if Wednesday’s Budget focuses solely on new taxes without providing investment or incentives to stimulate construction and support buyers.

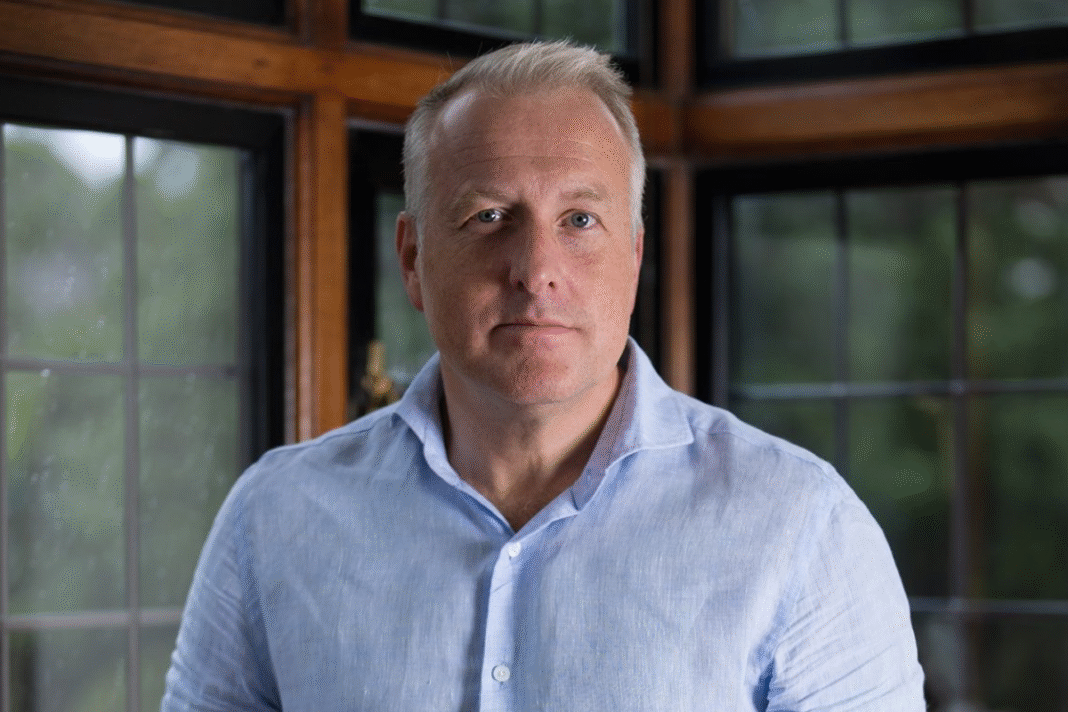

Neil Louth (main picture, inset), Chief Executive of The Acorn Group, part of LRG, says that while rumours ahead of the Budget had focused on “restrictions and taxation” there has been “no discussion of investment, no plan for stimulating construction or getting developments off the ground”.

He says: “A thriving property market requires more than taxation; it needs investment, incentives and the conditions that enable people to act with confidence.”

Louth says first-time buyers require better-targeted support than under previous schemes. “A new government scheme should offer meaningful support without requiring the prohibitively large deposits that caused issues with previous initiatives,” he says.

DEVELOPER INCENTIVES

He adds that any new support should be “transferable”, allowing buyers to pass on assistance when they sell so the market “keeps flowing rather than creating bottlenecks”.

He also called for practical incentives for developers, warning that housebuilding targets would not be met without government backing.

“Without government support for builders, construction will not happen,” he says. “This is not just about helping builders; it’s about delivering the 1.5 million homes the country needs.”

STAMP DUTY REFORM

Louth argues that stamp duty reform remains essential to improving mobility across the housing market.

“A full reversal of April’s Stamp Duty changes would stimulate the entire market, not just first-time buyers,” he says.

“Restrictions on movement – whether through transaction costs, pension constraints or other barriers – are suppressing activity.”

BALANCED TAX RISES

He cautions that tax rises must be balanced with policies that maintain market activity. “Taxation and growth must work together,” he says.

“If people are unable to transact or generate value within the market, adding more tax simply suppresses activity further.”

He says ministers must also consider the impact of any wealth-based property taxes on “asset-rich but cash-poor homeowners”, including pensioners and households with high-value homes but limited income.

“The property market drives significant economic activity,” Louth says. “Supporting it effectively means balancing taxation with the investment and incentives needed to keep the market moving and homes being built.”