The UK rental market is showing clear signs of cooling as tenant demand falls and the pipeline of first-time buyers begins to recover – a shift that could have long-term implications for landlords, investors, and the build-to-rent sector.

New data from Hamptons reveals that the number of tenants registering with lettings branches across Great Britain fell 17% year-on-year in May 2025, with demand now sitting 28% below 2019 pre-pandemic levels.

This marks the twelfth consecutive month of annual decline in tenant registrations, and the first time in at least a decade that both London and Scotland have recorded more first-time buyers than renters actively seeking a home.

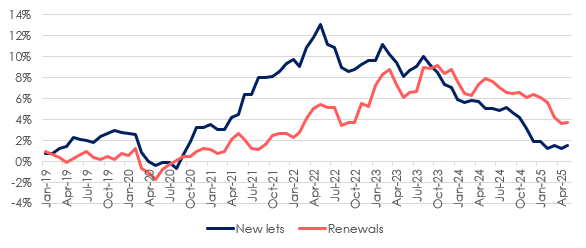

In parallel, rental growth has slowed markedly. The average rent on a newly let property rose just 1.5% over the 12 months to May – down from 5.1% a year earlier – taking the average monthly rent to £1,366. For context, that brings annual rental inflation back in line with 2013 levels, when rents grew by 1.6%.

LONGER VOID PERIODS

This cooling trend has coincided with a 5% year-on-year rise in available rental stock, driven less by new investment and more by longer void periods as homes take longer to let.

The shift is being fuelled in part by improved buyer affordability, particularly among first-time purchasers.

Hamptons reports that for buyers with at least a 10% deposit, monthly mortgage costs have now dipped below the cost of renting in many locations – reversing the affordability imbalance that dominated during the 2022–23 mortgage rate spike.

This is especially evident in more affluent areas, where tenant registrations have dropped 50% more than in less affluent postcodes.

Nationally, the ratio of new tenant to first-time buyer registrations has shrunk to 1.5 to 1 – down from nearly 6 to 1 in 2017.

Rental growth on tenancy renewals remains elevated, with rents rising 3.7% on average in May compared to new lets at 1.5%. This divergence suggests landlords are prioritising tenant retention over re-letting properties into a softer market.

FALLING PAYMENTS

Aneisha Beveridge, Head of Research at Hamptons, says: “In a similar trend to the years following the last economic downturn, falling interest rates have reduced the pace of rental growth.

“Landlords rolling off short-term fixed-rate mortgages are now seeing their monthly payments fall, reducing the need to pass on further costs to tenants.

“At the same time, lower mortgage rates are changing the arithmetic for tenants who are thinking about buying. While rates remain high relative to pre-Covid times, three years of above-inflation rental growth mean that for most, buying remains cheaper than renting.”

FIRST-TIME BUYER BOOST

And she adds: “This has boosted first-time buyer numbers and reduced demand in the rental sector.

“It has taken the best part of two years for the pace of rental growth to fall from double digits down to 1.5%. This means that rents are now rising at a rate that’s close to their long-term average, and suggests that the era of rapid rental growth is behind us for now.

Landlords are increasingly getting their heads around what the Renters’ Rights Bill will mean.

That said, rental growth is unlikely to cool much further. While falling interest rates should take the sting out of rental growth over the next few years, landlords will likely continue to price in political risk.

Source: Hamptons

Landlords are increasingly getting their heads around what the Renters’ Rights Bill will mean for them, but the way it plays out for landlords in reality will shape future investor appetite.”

RENTER RESPITE

While softening demand may offer some respite for renters, the outlook for landlords is more nuanced. Political uncertainty, evolving tax policy and the longer-term implications of the Renters’ Rights Bill could temper new investment in the sector, even as affordability improves for would-be buyers.

For developers and BTR operators, the figures may signal a turning point in market dynamics – as well as a renewed need to re-evaluate tenant expectations, lease flexibility, and long-term asset strategies in a landscape where tenants are, increasingly, becoming buyers.