First-time buyers could save thousands of pounds a year by purchasing a home rather than renting, even with a low 5% deposit, according to new analysis from Lloyds Banking Group.

Across the UK, average monthly mortgage payments for first-time buyers are now typically 17% cheaper than renting equivalent properties, the study found.

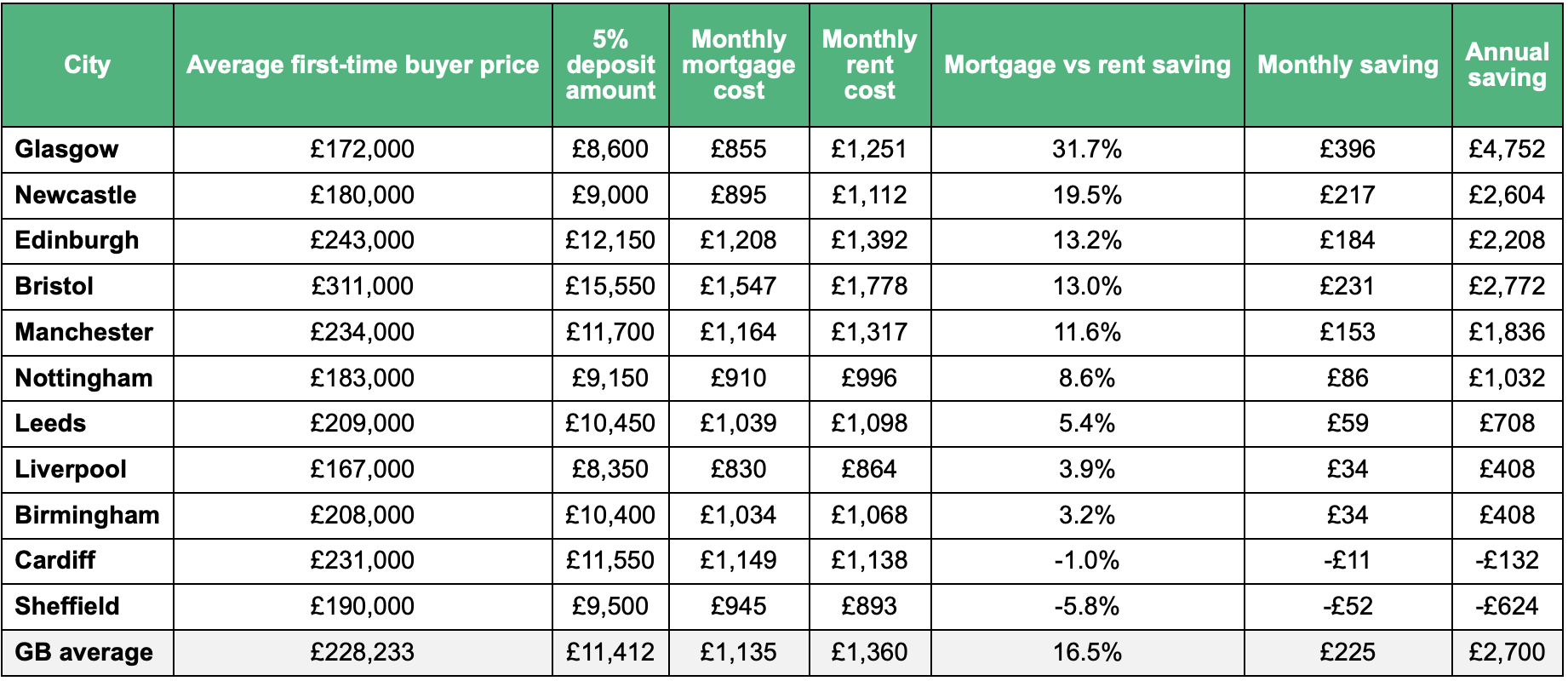

Based on an average first-time buyer home costing £228,233, a 5% deposit of £11,412 would be enough to secure a mortgage that works out around £225 less per month than the cost of renting.

In nine out of 11 major cities outside London, owning a home was found to be more cost-effective than renting.

PRICE GAPS

The biggest gap was in Glasgow, where a first-time buyer could save £396 a month – or £4,752 a year – compared to renting.

Newcastle, Edinburgh, Bristol and Manchester also ranked highly, with monthly savings of between £150 and £230.

The analysis, based on a 4.78% 5-year fixed rate and a 30-year mortgage term, shows that while deposit requirements remain a key barrier to homeownership, the long-term financial case for buying is strengthening.

For buyers in cities such as Nottingham and Leeds, mortgage costs were found to be only marginally below rental prices, while in Cardiff and Sheffield renting remains slightly cheaper on a monthly basis.

EQUITY GAINS

However, when factoring in equity gains, Lloyds found that homeowners build substantially more long-term wealth than renters.

On average, a first-time buyer putting down a 5% deposit could end up more than £20,000 better off after five years – through a combination of lower monthly payments and the equity built up in their property.

In Glasgow, that figure rises to nearly £29,000, while in Bristol a typical buyer could be £23,000 better off after five years.

Even in markets where renting remains marginally cheaper, equity growth over time was found to outweigh short-term rental savings.

LOW DEPOSIT DEALS

Amanda Bryden, Head of Mortgages at Lloyds, says: “We know that saving for a deposit is one of the biggest hurdles for first-time buyers.

“With rents having risen sharply over the last two years, many are already managing monthly payments that are higher than a typical mortgage.

“That’s why low-deposit mortgages could be the right solution for many – helping people move from renting to owning sooner than they thought possible.”

She adds that buying remains one of the strongest long-term financial decisions most people can make, as homeownership provides both cost stability and the opportunity to build wealth over time.

ADDED COSTS

Mary-Lou Press, President of NAEA Propertymark (National Association of Estate Agents), says: “While low-deposit mortgage products are helping more first-time buyers access the property market, many still face significant upfront financial hurdles.

“Recent changes to stamp duty in England and Northern Ireland mean that some first-time buyers will also now have additional tax to pay.

“Beyond the deposit and any relevant property tax, buyers must also budget for solicitor fees; mortgage arrangement charges; valuation and survey costs; local authority searches; moving expenses and insurances.

“In many cases, these additional costs can amount to several thousand pounds, making the initial outlay far higher than just the deposit alone.”

AFFORDABILITY ISSUES

But she adds: “That said, in some areas, we are seeing that monthly mortgage repayments can still be lower than local rents, especially for buyers securing competitive rates.

“But affordability must be assessed holistically.

“First-time buyers need to go in with a clear understanding of both the upfront and ongoing costs of ownership to make an informed decision.”

Where can first-time buyers save?