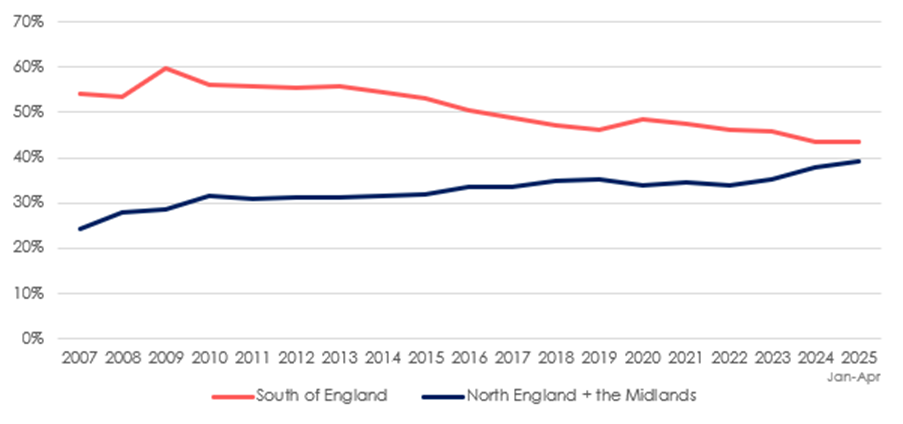

The UK’s buy-to-let market is undergoing a fundamental geographic shift, as landlords retreat from the high-cost South and pursue better returns in the North of England and the Midlands.

New data shows that 39% of investor purchases in the first four months of 2025 were located in the North or Midlands, the highest proportion on record and up from just 24% in 2007.

According to Hamptons, the trend reflects growing pressure on landlords from higher mortgage rates, regulatory changes, and an increased stamp duty surcharge on second homes.

As affordability tightens, many investors are turning their backs on the South, where rental yields are lower and entry costs significantly higher.

STILL OPPORTUNITIES

Buy-to-let investment remains well below long-term averages nationwide, but the market is not without opportunity.

Aneisha Beveridge, Head of Research at Hamptons, says: “Buy-to-let investment is gradually grinding to a halt in some markets where higher purchase and mortgage costs take their toll.”

However, she adds: “Some investors have been looking further afield for new opportunities” and that landlords are “seeking better-yielding and cheaper properties, increasingly in Northern England.”

FINANCIAL INCENTIVES

The average landlord purchasing in the North or Midlands this year paid £150,480 – nearly half the £292,240 average paid in the South. This lower purchase price equates to a stamp duty saving of £11,190 per transaction under the new 5% surcharge, introduced in late 2024. The financial incentive is clear and is helping fuel investor migration northward.

Source: Hamptons

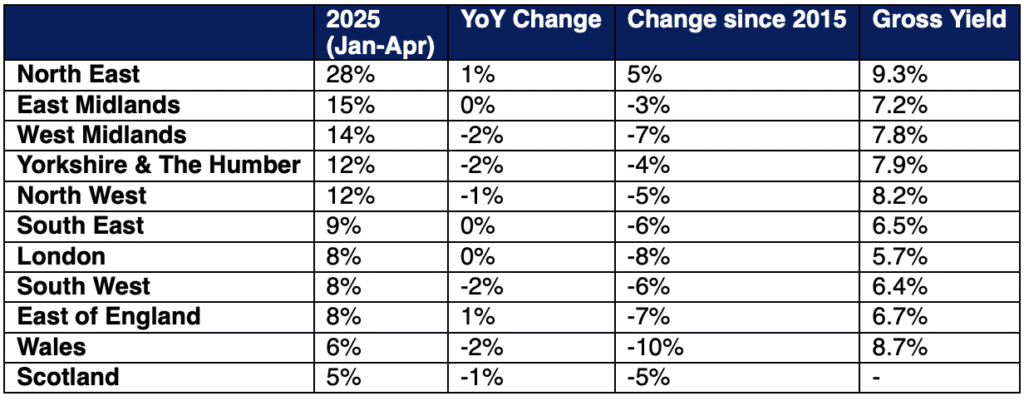

The North East remains the UK’s buy-to-let epicentre. Landlords there accounted for 28% of all sales so far this year, up from 23% in 2015. It also offers the highest gross yields in the country at 9.3%, compared to a national average of 7.1%. In contrast, London – with the lowest yields and highest prices – saw investor activity fall to just 8% of sales.

COUNTRY CLUB

Wales and Scotland have experienced similar declines. In Wales, just 6% of homes sold this year went to landlords, down from 16% a decade ago. In Scotland, where rent caps and tighter regulation have deterred new entrants, investor purchases now make up just 5% of the market.

Source: Hamptons

Despite the broader retreat, hotspots remain. Nine of the top 10 local authorities with the highest landlord activity since the surcharge hike are in the North and Midlands. In Redcar and Cleveland, 50% of all homes sold this year went to investors, with typical purchases priced at just £70,300 and yielding nearly double-digit returns.

FISCAL COST

Beveridge believes this rebalancing will only deepen and says: “Based on current trends, 2033 will mark the point at which the bulk of buy-to-let purchases are in the Midlands and North of England.”

However, she warns this may come at a fiscal cost, estimating a potential £161m annual loss to Treasury revenues due to reduced stamp duty receipts. It may also exacerbate rental pressures in the South if investor activity continues to dwindle.

Nonetheless, Beveridge points to longer-term opportunity.

“Investors will still find opportunities in the South of England, particularly if rents continue to rise and house prices pick up pace after nearly a decade of stronger capital growth further North,” she says. Lower interest rates could also help revive Southern investor interest by making buy-to-let more attractive than savings alternatives.

For now, the gravitational pull of higher yields and lower acquisition costs appears firmly rooted in the North.

But as the macroeconomic environment evolves, the outlook for regional rebalancing – and its implications for the housing market – remains fluid.