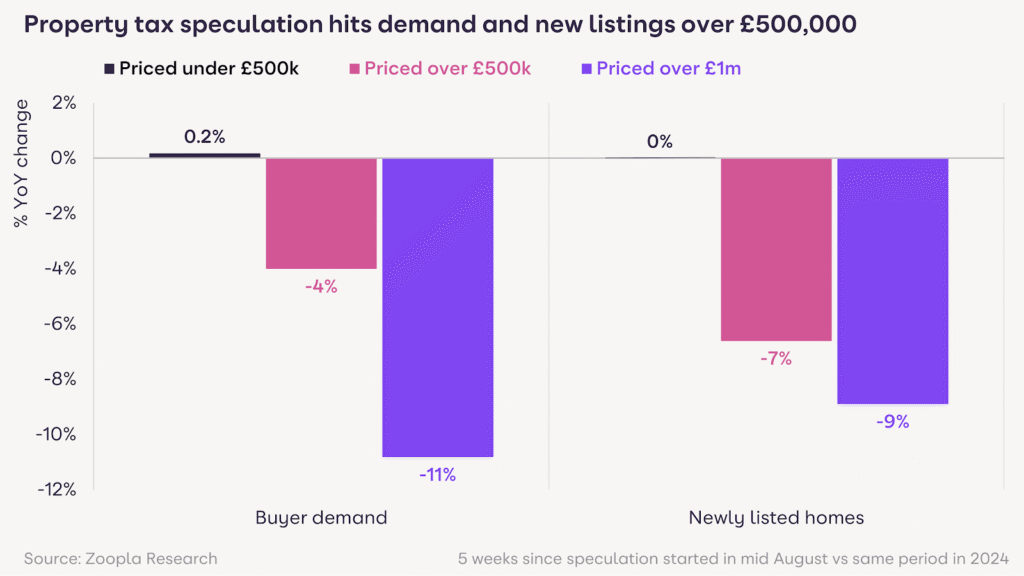

Speculation over new property taxes in the November Budget is casting a chill over the top end of the UK housing market with buyer demand and new listings for homes priced above £500,000 sliding sharply, according to Zoopla’s latest House Price Index.

Demand for £500,000-plus homes has dropped 4% compared with last year, while new listings are down 7%. At £1 million and above, the slowdown is even starker, with demand falling 11% and fresh supply down 9%.

With one in three homes currently for sale valued at more than £500,000 and 8% over £1 million, the jitters are concentrated in London and the South East.

Here, affordability constraints and hefty stamp duty bills are already dragging on activity. The prospect of further tax changes has created a holding pattern among wealthier buyers and sellers.

HOUSE PRICE GROWTH COOLING

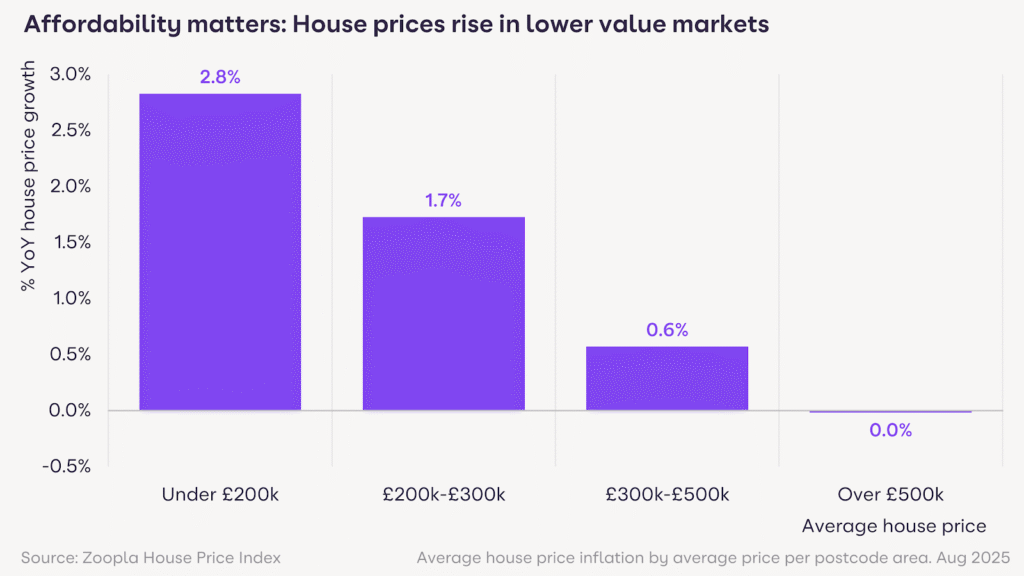

Nationally, house price growth has cooled from 1.9 % in December 2024 to 1.4% in August this year.

The average home is now worth £271,000, just £4,350 higher than a year ago. But in regions where prices are lower, growth remains robust. Northern Ireland is leading with a 7.9% rise, while the North West has recorded 3.1%.

Areas such as Kirkcaldy, Oldham, Tweeddale, Motherwell and Llandrindod Wells are all seeing increases above 4%.

By contrast, prices across southern England are down 1% year-on-year, with coastal second-home hotspots like Bournemouth, Truro, Exeter and Torquay among the hardest hit.

Parts of central London are also weakening, compounded by tougher council tax rules for second homeowners, which are pushing more stock onto the market.

MOST SALES SINCE 2022

Richard Donnell, Executive Director at Zoopla, says: “The housing market has experienced a sustained increase in market activity over the last 18 months as mortgage rates have stabilised. The market is on track for the most sales since 2022, but without rapid house price inflation.

“Pre-Budget speculation over possible tax change is a regular occurrence but this summer it has been bigger than usual which has led some buyers and sellers to delay home moving decisions for homes priced over £500,000. The wider market remains largely unaffected.

“Serious buyers should think twice before delaying as while the Budget is two months away it takes, on average, six to seven months to find a property and complete a sale.”

WELCOME BALANCE

Kevin Shaw, National Sales Managing Director at LRG, the UK’s largest estate agency group, adds: “The housing market has shifted in favour of buyers, with sellers increasingly willing to align with agents’ valuations and to negotiate on price.

“That balance is welcome for many purchasers, particularly first-time buyers who appear undeterred by April’s increase in Stamp Duty and have benefitted from lower interest rates.

“At the upper end of the market, speculation over property tax has created hesitation. The prospect of a so-called mansion tax, combined with wider fiscal uncertainty, has dented sentiment and slowed decision-making somewhat.”

FUNDAMENTALS ARE STABLE

And he adds: “Other aspects of Zoopla’s research reflect the broader political and economic picture – specifically the reversal of pandemic-driven coastal demand, together with an increase in council tax on second homes in the South West, and a reduction in the number of non-doms impacting demand for second homes in central London.

“Much of the market remains buoyant.”

“Yet price growth in more affordable regions – to which we would add the East Midlands and parts of the North West – demonstrates that much of the market remains buoyant. While tax speculation may leave 2025 relatively flat overall, the fundamentals are stable. A stronger spring market should emerge once fiscal policy is clarified and confidence returns.”

SENSE OF UNCERTAINTY

Tom Bill, Head of UK Residential Research at Knight Frank, says: “A combination of high supply and a creeping sense of uncertainty as the Budget approaches means the pressure on prices is downwards at the moment.

“Mortgage rates have been stable, which has supported demand, but we would expect a re-run of the hesitancy we saw last year as 26 November approaches and have recently downgraded our 2025 UK forecast to 1% from 3.5%.

“Supply is high as a growing number of landlords sell due to the tougher legislative environment in the lettings sector, sales that were delayed because of the general election in 2024, more financial distress in the system as rates normalise and an overhang of stock from April’s stamp duty cliff edge.

“It will mean sellers need to be particularly realistic with their asking price just to get buyers through the door for a viewing.”

CHALLENGING FOR BUYERS

Matthew Thompson, Head of Sales at Chestertons, says: “In August, buyers used the holidays to review their finances, refine their search criteria and to view homes they already shortlisted. The number of properties coming onto the market has decreased, however.

“Whilst there was a substantial increase in landlords selling up amid the Renters’ Rights Bill earlier this year, it was a momentary uplift that has now rebalanced.

“As a result, buyers will find it more challenging to secure a property within their budget and are advised to start their property search as early as possible.”

AFFORDABILITY CONCERNS PERSIST

Nathan Emerson, Chief Executive of Propertymark, says: “A slowing in house price growth will be welcome news for those serious about moving home, especially first-time buyers.

“However, there are underlying factors affecting affordability and confidence, such as economic uncertainty and inflation, making people cautious about their finances, and stagnating income and wage growth.

“Recent changes to Stamp Duty across England and Northern Ireland have also reduced buyer affordability, and rumours of further alterations are bound to create some uncertainty.”

COMPETITIVE MORTGAGE RATES

And he adds: “For some, however, especially current homeowners, a slow tapering in interest rates has allowed lenders to introduce more competitive mortgage products and has decreased the monthly cost for those with variable or tracker mortgages, allowing them to refinance to lower rates.

“We now look to the Bank of England’s next interest rate announcement in November and hope to see positive introductions through the UK Government’s Budget that will help ease affordability pressures for buyers looking to step onto or move up and down the housing ladder.”