The government risks undermining its pledge to curb inflation unless it eases pressure on retailers in the Autumn Budget, the British Retail Consortium (BRC) has warned.

A survey of 2,000 people by the BRC and pollster Opinium found that the rising cost of living remains the public’s biggest concern.

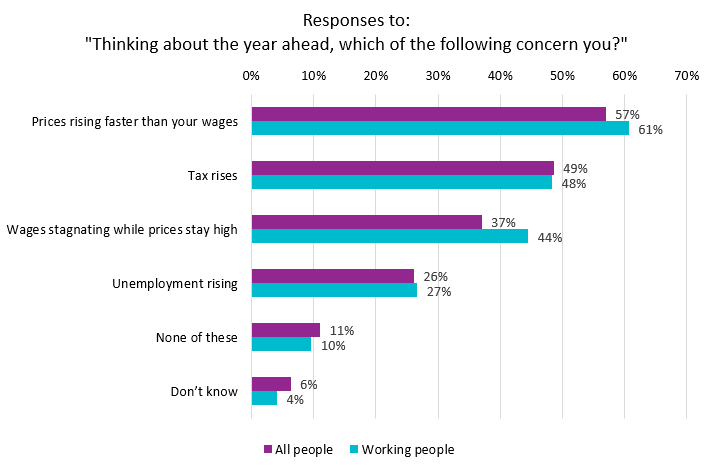

Some 57% of respondents said they were most worried about “prices rising faster than wages” – a figure rising to 61% among working households. This outweighed fears of higher taxes (49%) and unemployment (26%).

The Office for National Statistics reported headline inflation at 3.8% in August, almost double the Bank of England’s 2%. Food prices rose even faster, up 5.1% – the sharpest annual increase since the 2022–23 cost of living crisis.

WORSENING PROBLEM

Retailers argue that government policy is worsening the problem. The BRC said last year’s Budget alone added £7 billion to industry costs through higher employer National Insurance contributions, an increase in the National Living Wage, and the introduction of a packaging tax.

Minutes from the Bank of England’s Monetary Policy Committee last week pointed to “labour costs and costs associated with new packaging regulation” as drivers of food price inflation.

Helen Dickinson, Chief Executive of the BRC, says: “The Government risks losing the battle against inflation and working families are understandably worried.

“With many people barely recovering from the last cost of living crisis, the Chancellor will want to protect households and enable retailers to continue doing everything they can to hold back prices.

“The Treasury is currently finalising its plans to support the high street, including a much-needed reduction in business rates for retail, hospitality and leisure premises.

“However, the biggest risk to food prices would be to include large shops – including supermarkets – in the new surtax on large properties. This would effectively be robbing Peter to pay Paul, increasing costs on these businesses even further and forcing them to raise the prices paid by customers.

“Removing all shops from the surtax can be done without any cost to the taxpayer, and would demonstrate the Chancellor’s commitment to bring down inflation.”

The BRC says that unless ministers exempt large shops from the proposed surtax, food price inflation could remain above 5% well into 2026.