The Bank of England has cut Bank Rate by 0.25 percentage points to 3.75% following a closely divided Monetary Policy Committee decision that highlights the fragile balance between slowing inflation and weak economic growth.

At its meeting ending on 17 December 2025, the MPC voted by a slim five-to-four majority in favour of a rate cut, with four members preferring to keep Bank Rate unchanged at 4%. The narrow margin reflects ongoing uncertainty over the inflation outlook and the resilience of domestic demand.

Consumer price inflation has eased to 3.2% since the previous meeting. Although still above the Bank’s 2% target, policymakers now expect inflation to move back towards target more quickly in the near term.

Recent data points to subdued economic growth, growing slack in the labour market, easing pay growth and softer services inflation.

REDUCED INFLATION CONCERNS

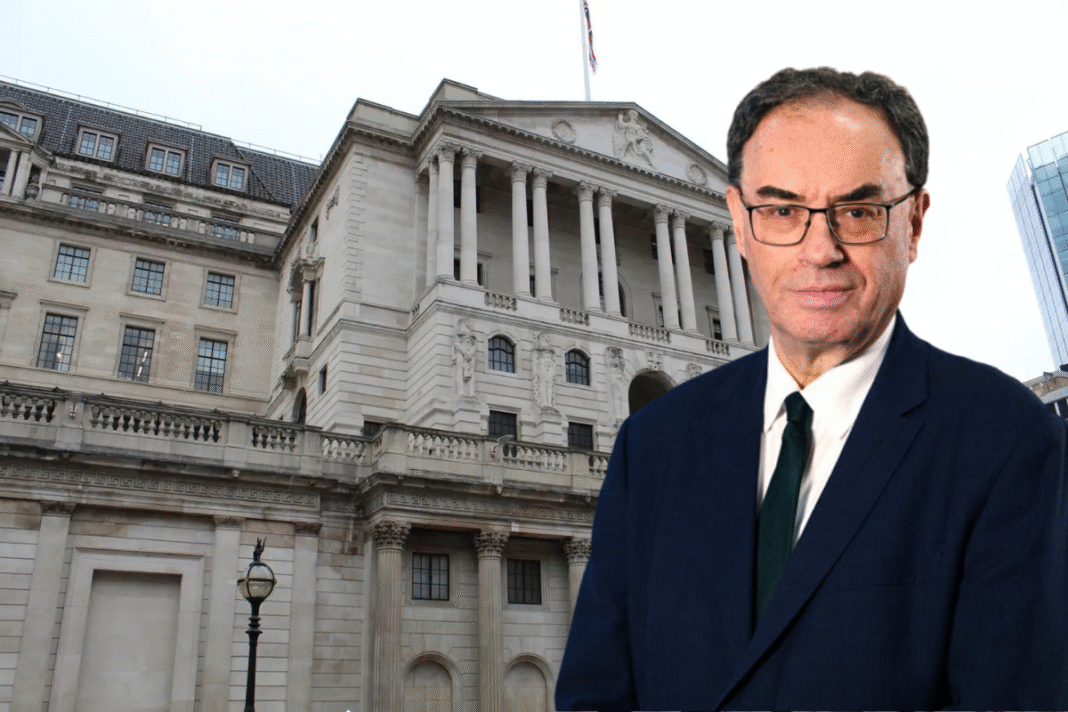

Andrew Bailey (main picture, inset), Governor of the Bank of England, said: “We’ve passed the recent peak in inflation and it has continued to fall, so we have cut interest rates for the sixth time [since August 2024].

“We still think rates are on a gradual path downward. But with every cut we make, how much further we go becomes a closer call.”

INDUSTRY REACTION

Nathan Emerson, Chief Executive of Propertymark, says: “As we round the year off, it is extremely positive to see the Bank of England in a position where it has the confidence to make what is now a fourth base rate cut within twelve months.

“Although mortgage agreements vary, today’s news could typically represent a saving of around £150 each month for those currently on a tracker mortgage, or for those considering a new mortgage deal, when compared to the start of 2025.

“This, coupled with the fact that we have also witnessed the rate of inflation dip further only yesterday, should help create a strong platform for consumer confidence and affordability as we progress into the new year.

“In addition, there is real potential for lenders to support first-time buyers with more focused products to help uplift the market over the coming weeks and months.”

UNLOCK PENT-UP DEMAND

Nicky Stevenson, Managing Director of Fine & Country, says: “This cut will be welcomed by households and lenders alike.

“While inflation remains above target, the direction of travel matters, and today’s decision should help unlock pent-up demand.

“Lower rates, combined with a more benign Budget backdrop, are likely to translate into stronger enquiries and transactions in the New Year.

“We anticipate momentum building as affordability improves and confidence returns, setting a positive tone heading into spring.”

POSITIVE BOOST

Guy Gittins, Chief Exectuive of Foxtons, says: “Today’s base rate cut is a positive boost for the housing market and should help maintain the momentum we’ve seen building throughout 2025 as we head towards the new year.

“Lower borrowing costs will improve affordability for buyers, while giving additional confidence to sellers that demand will continue to strengthen following the removal of Autumn Budget uncertainty.

“With the end of the year fast approaching, we expect the market’s steady performance to continue as motivated buyers and sellers push to complete before the festive period.”

WARMING NEWS

Kevin Shaw, National Sales Managing Director, LRG, says: “Today’s reduction in interest rates is very welcome news – for homeowners, buyers, property professionals, and no doubt Government ministers.

“This warming news is set against a chilly backdrop: unemployment has increased to 5.1%, while the November Budget tightened the fiscal screws.

“Inflation, however, has eased to 3.2% and, thanks to today’s cut, looks likely to continue on that trajectory.

“With a reduction in interest rates we expect an increase in activity and therefore transactions. Across LRG brands, applicant numbers are already up 15% year-on-year in December and we’re seeing a significant number of vendors ready to launch in early January.

“In the run up to the November Budget it felt like the market has been driving with the handbrake on.”

“In the run up to the November Budget it felt like the market has been driving with the handbrake on, but it was released following the Chancellor’s speech on 26 November.

“In fact from a property perspective the Budget proved more neutral than the rumour mill was suggesting.

“In the meantime, we anticipate a busy start to 2026, which will then gain momentum potentially two further rate cuts to come resulting in greater affordability and less volatile market conditions.

POSITIVE START TO 2026

John Phillips, Chief Executive at Spicerhaart and Just Mortgages, says: “The central bank has delivered a festive boost for borrowers, confirming a rate cut a week before Christmas.

“Given the timing, we may not see an instant reaction from potential buyers or movers, but combined with the positive news on inflation yesterday, it will certainly go a long way in boosting confidence and encouraging more clients to get their plans back on track.

“With Boxing Day always busy for property searches, we could certainly be in for a positive start to the new year.

“Now is absolutely the time for brokers to be communicating these positive headlines to borrowers and reminding potential buyers and movers of everything the mortgage market has to offer – particularly recent activity from lenders on rates and criteria. While the signs look promising, a new year bounce is far from a given.

“We have to play our part in achieving this by educating clients, nurturing confidence and facilitating transactions.”

EARLY CHRISTMASN PRESENT

Iain McKenzie, Chief Executive of The Guild of Property Professionals, says: “Today’s Bank Rate cut to 3.75% is a timely confidence boost for the housing market.

“With headline inflation easing to 3.2%, below expectations, this move brings borrowing costs to their lowest level in nearly three years and sends a clear signal that conditions are stabilising.

“For buyers and movers eyeing the New Year, it feels like an early Christmas present.

“We expect sentiment to continue to improve, supporting activity through the spring 2026 selling season, particularly as the Budget landed lighter than many feared.”

HAPPY ATMOSPHERE

Jason Tebb, President of OnTheMarket, says: “As expected, the Bank of England cut interest rates to 3.75%. With inflation falling to 3.2% in the year to November, this gave the rate setters the impetus they needed to cut rates for the sixth time in 17 months.

“This news will be welcomed by borrowers, particularly those due to remortgage in the coming year, who will be hoping that the rate shock will not quite be as exaggerated as it otherwise might have been.

“Previous rate reductions have been hugely welcomed by buyers and sellers alike, boosting confidence, easing affordability and giving much-needed impetus to the market, particularly since the stamp duty concession ended and the Budget did not offer anything to replace it.

“With the Budget now out of the way, the atmosphere of uncertainty has lifted and this rate cut delivers a real pre-Christmas boost for the housing market which bodes well for activity in the new year.”

IMPROVED FORECAST

Matt Smith, Rightmove’s mortgages expert says: “The financial markets and mortgage lenders have been expecting today’s Bank Rate cut for a while, and therefore responded early with mortgage rate cuts in December to round off the year.

“Bank Rate cut headlines are always positive for home-mover sentiment, even if this one has already been baked into mortgage rate cuts and won’t drive further drops.

“However, what will have more of an impact on the future direction of mortgage rates is the better than expected inflation figure reported earlier this week, which has improved the market’s forecast for next year.

“Don’t expect any big rate drops before Christmas while the property market is quieter, but it does mean we could now see a fresh round of rate cuts in the new year as lenders look to start the new year with a bang.

“Home-movers are likely to see the most notable rate drops for 2-year fixed products rather than 5, and next year we expect the gap between 2-year and 5-year deals to grow.”

NO GREAT SURPRISE

Jeremy Leaf, north London estate agent and a former RICS Residential Chairman, says: “This cut is not a great surprise given the news that has come out this week which isn’t all good for the economy.

“The encouraging news is that the housing market has been relatively resilient despite many concerns about the contents of the Budget, which turned out not to be as bad as anticipated.

“We don’t expect fireworks after the new year but now interest rates are a little lower, we do expect a gradual improvement with property price increases tempered by continuing concerns about the economy and the amount of choice available.

“Many of our customers have been sitting on their hands, not knowing which way to turn but they haven’t withdrawn from the market altogether. Many are now saying since the Budget – ‘why not?’ rather than ‘why?’, which is what they were saying previously.”

MORE RATE REDUCTIONS

Amy Reynolds, head of sales at Richmond estate agency Antony Roberts, says: “This 25 basis points cut was almost nailed on, with markets also pricing in the possibility of a further reduction early next year.

“That would bring us closer to the widely-anticipated neutral rate of around 3 to 3.5%.

“For London buyers, this is already feeding through into more competitive mortgage pricing and renewed confidence, which should underpin transaction volumes and support modest price growth rather than a sharp rebound or further correction.”

A RETURN TO STABLE GROUND

Sarah Thompson, Group Financial Services Director, Mortgage Scout, Part of LRG, says: “The Bank of England has now confirmed what the mortgage market has been moving towards for months: a reduction in the base rate, and a return to more stable ground.

“This time last year, interest rates were starting to come down from their historical highs. Which meant mortgage affordability was under immense pressure, and buyer confidence had taken a hit.

“Throughout 2025, we’ve seen a steady improvement in financial conditions. Swap rates have eased, lenders have re-entered the market with sharper pricing, and affordability criteria have been relaxed. Today’s decision reinforces that momentum.

“It won’t bring rates back to where they were before rates began rising, but it does mark a clear shift in tone.”

“It won’t bring rates back to where they were before rates began rising, but it does mark a clear shift in tone.

“And that matters, particularly for the thousands of borrowers whose ultra-low fixed rates expire in 2026. While their repayments will still increase, today’s cut softens the landing.

“Just as importantly, it sends a signal to buyers who have been holding back – the market is stabilising.

“Combined with greater product choice and rising lender competition, this should give people more confidence to move, refinance, or step onto the ladder, helping unlock demand and support a healthier, more active sales market in 2026.”

BALANCED ENVIRONMENT

Elliot Castle, Chief Executive of We Buy Any Home, says: “This is genuinely positive news for the UK housing market. For many buyers this will mark the turning point they have been waiting for after a prolonged period of uncertainty.

“The immediate impact will be felt in mortgage pricing. Lenders have already been competing aggressively and this rate cut gives them further scope to reduce fixed and variable deals.

“That means lower monthly repayments for homeowners and improved affordability for first-time buyers, who have been under intense pressure over the past two years.

“Confidence is just as important as cost and this move sends a clear signal that the direction of travel for interest rates is now downward.

“When buyers believe the worst is behind us, activity tends to pick up quickly, particularly among those who have been sitting on the sidelines waiting for stability.

“For sellers, increased buyer confidence should translate into stronger demand and more completed transactions, rather than the stop-start market we’ve seen recently.

“This is not about reigniting unsustainable house price growth but about restoring a healthier level of market activity.

“A base rate of 3.75% creates a more balanced environment. It supports responsible borrowing, encourages mobility and helps the housing market underpin consumer confidence and the wider UK economy.”

UNDERPIN CONFIDENCE

Matthew Thompson, Head of Sales at Chestertons, says: “Many house hunters use December to review their finances, so a rate cut is well-timed.

“Recent data points to subdued economic growth, growing slack in the labour market, easing pay growth and softer services inflation.

“Alongside easing mortgage rates, it should help underpin buyer confidence and support activity as the market moves into 2026.”