UK house prices rose sharply at the start of the year, pushing the average property value above £300,000 for the first time as the market shrugged off a dip in December.

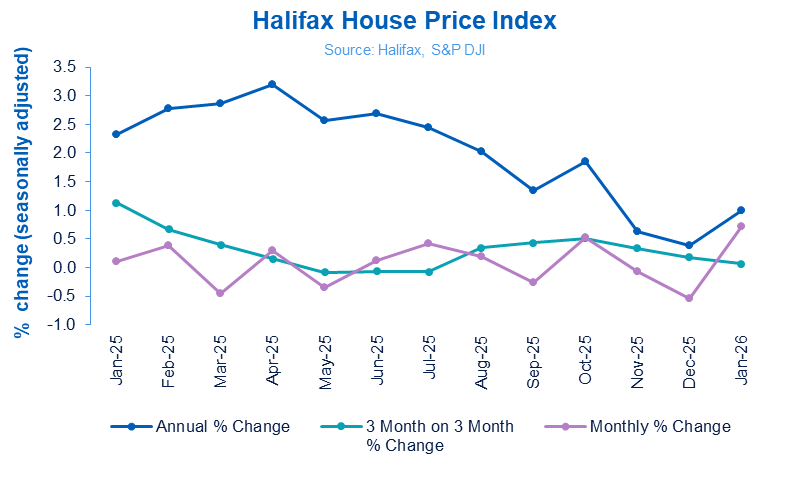

Figures from Halifax published on Friday show prices increased by 0.7% in January, more than reversing December’s 0.5% fall. The typical UK home now costs £300,077.

Annual growth accelerated to 1.0%, up from 0.4% in December, suggesting renewed momentum despite affordability pressures and higher borrowing costs compared with the pandemic era.

The £300,000 threshold marks a symbolic milestone for a market that has cooled significantly since the surge in activity triggered by ultra-low interest rates and the “race for space” during Covid.

STEADY FOOTING

Over the past three years, prices have risen by 5.7% – about £16,000 – a marked slowdown compared with the near-19% increase, or more than £44,000, recorded between 2020 and 2023.

Amanda Bryden (main picture, inset), Head of Mortgages at Halifax, says: “The housing market entered 2026 on a steady footing, with average prices rising by +0.7% in January, more than reversing the -0.5% fall seen in December. Annual growth also edged higher to +1.0%, pushing the cost of the typical UK home above £300,000 for the first time.

“While that’s undoubtedly a milestone figure, and activity levels show a resilient market, affordability remains a challenge for many would-be buyers.”

PRICES EDGING UP

And she adds: “Broader economic conditions continue to provide some support. Wage growth has been outpacing property price inflation since late 2022, steadily improving underlying affordability. That’s a positive trend for buyers, and the long-term health of the market.

“And we’re now seeing more mortgage deals below 4%. If inflation continues to ease, there should be further gradual reductions as the year goes on.

“All in all, we still think house prices are likely to edge up between 1% and 3% this year.”

REGIONAL DIVIDE

The data points to a growing regional divide. Northern Ireland recorded the strongest annual growth, with prices up 5.9% to an average of £217,206. Scotland followed with a 5.4% rise to £221,711.

In England, momentum remains concentrated in the north. Prices in the North West increased 2.1% year-on-year to £244,329, while the North East saw growth of 1.2%, taking the average to £181,198.

By contrast, southern markets have softened. The South East, South West, London and the East of England all recorded annual declines of more than 1%. As the most expensive parts of the country, these regions are typically more exposed to higher mortgage rates and transaction costs, which have weighed on demand.

UNEVEN RECOVERY

Halifax says that although headline prices may appear daunting, first-time buyers often target smaller properties and more affordable regions, particularly in parts of northern England where homes can still be found for under £200,000.

With wage growth continuing to outpace house price inflation and mortgage rates edging lower, lenders expect modest price gains over the remainder of 2026 but any sustained recovery is likely to remain uneven across the country.

INDUSTRY REACTION

Nathan Emerson, CEO of Propertymark, says: “As we progress further into the year, it is encouraging to see the housing market gathering pace. We are witnessing an increased flow of homes being brought to market, alongside growing confidence among buyers and sellers as they approach the moving process.

“Taking a broader view, lenders are also becoming increasingly competitive, expanding their range of mortgage products and improving access for those planning their next home move.

“Last week’s base rate decision, which saw the Bank of England’s Monetary Policy Committee vote to keep rates steady at 3.75%, will provide a sense of reassurance for those considering a house move.

“However, affordability remains a key issue for many. To turn improving market conditions into meaningful access to homeownership, buyers need targeted support, a stable lending environment and policies that directly address affordability pressures across all tenures.”

FIRMER FOOTING

Iain McKenzie, CEO of The Guild of Property Professionals, says: “January’s Halifax HPI reading shows the housing market has started 2026 on a firmer footing, with the 0.7% monthly rise more than offsetting December’s dip and pushing average values above £300,000 for the first time.

“While annual growth remains modest at 1.0%, this steady improvement reflects a market that is regaining confidence rather than overheating.

“The wider backdrop is supportive. Mortgage rates have stabilised at levels below last year and competition among lenders is delivering increasingly attractive deals, particularly for buyers with stronger deposits.

“The direction for interest rates and wages continues to improve affordability.”

“Although inflation’s recent uptick has delayed further base rate cuts, the overall direction for interest rates and wages continues to improve affordability. Crucially, transaction levels remain robust, with activity through 2025 comfortably above pre-pandemic norms, suggesting there is plenty of underlying demand.

“Looking ahead, we expect this momentum to carry through the year, with sales volumes gradually picking up. Price growth is likely to remain measured, however, as higher stock levels give buyers more choice and keep a lid on rapid rises. For both buyers and sellers, 2026 is shaping up to be a more balanced and active market.”

DEMAND ON A KIFE-EDGE

Tom Bill, Head of UK Residential Research at Knight Frank, says: “House prices rose in January as decisions delayed ahead of the November Budget were activated either side of Christmas.

“However, momentum has since faded and mortgage approvals are running 9% below the five-year average, which shows demand is on a knife-edge.

“Mortgage lenders have pushed their rates higher in recent weeks as the chances of multiple Bank Rate cuts this year recede, although a reduction next month seems likely.

“As inflation comes under control, we expect demand and activity to steadily improve over coming months, although a challenge to the Prime Minister’s position could derail that recovery.”

SUSTAINABLE AND POSITIVE GROWTH

Guy Gittins, CEO of Foxtons, says: “The UK property market has once again started the year positively, with house prices climbing on both a monthly and annual basis.

“At Foxtons, we’ve already seen the expected seasonal uplifts from buyer enquiries and viewings booked, to offers being made and accepted, particularly in our North West and Hertfordshire regions.

“With borrowing conditions improving and momentum building, our outlook for the year ahead is for sustainable and positive growth.”

MARKET ON THE MOVE

Jeremy Leaf, north London estate agent and a former RICS Residential Chairman, says: “There is no question now that the housing market is on the move. Enquiries and sales agreed have increased markedly and the market is demonstrating resilience.

“On the other hand, the rise in listings this year, reluctance of the Bank of England to cut interest rates more rapidly and ongoing concerns about the economy mean that house prices are unlikely to increase significantly, which will be welcome news for first-time buyers in particular.”

DON’T RUN BEFORE WE CAN WALK

Damien Jefferies, Founder of Jefferies London, says: “All signs are currently pointing to a property market that is on the up, with the average house price breaching the £300,000 mark for the first time.

“However, it’s important that home sellers, in particular, don’t exceed the pace being set, especially in more inflated regions such as London where higher market values naturally temper recovery and returning demand takes time to cultivate.

“The outlook for the year ahead is far more positive than it has been in recent years, with greater pricing stability and improving confidence laying much stronger foundations for sustainable growth.

“However, it’s important we don’t run before we can walk, as over pricing and stubborn seller expectations have been contributing factors to the slower market conditions seen in recent years.”

PRAGMATISM REQUIRED

Verona Frankish, CEO of Yopa, says: “The latest Halifax data reinforces building evidence that the market has found a more stable footing at the start of 2026, with homebuyers returning in greater numbers after the seasonal slowdown seen in December.

“These figures also suggest that they are doing so with renewed purchasing power, with the increase seen in mortgage approved house prices being driven by improvements to the lending landscape.

“However, a degree of pragmatism is still required on the side of the nation’s home sellers, as trying to price above current market values will inevitably see them struggle to secure interest, even with improving market sentiment.”

THE GROUND IS RUNNING

Marc von Grundherr, Director of Benham and Reeves, says: “The latest Halifax figures mirror those from Nationwide also last week and provide further evidence that the housing market has hit the ground running in 2026, with the seasonal month-on-month decline seen in December now giving way to green shoots of positive house price growth.

“This shift suggests that buyers are re-entering the market with greater confidence and a stronger willingness to transact at higher price points, supported by improving affordability and greater clarity around mortgage costs.

“While some buyers may have been disappointed not to see interest rates cut yesterday, the ongoing stability provided by a hold will help to drive market momentum forward as the year progresses.”

CONSIDERABLE RESILIENCE

Jason Tebb, President of OnTheMarket, says: “Post-Budget clarity has given the housing market a boost, with buyers and sellers who put moves on hold resolving to press ahead.

“Six interest rate reductions in the past 18 months have helped ease affordability and encourage activity. While the Monetary Policy Committee voted to hold rates this month, the vote was narrower than expected suggesting further reductions to come, which should give those planning to move this year some confidence.

“While affordability concerns and increased stock levels keep property prices in check to an extent, nevertheless the housing market continues to demonstrate considerable resilience. While 2025 was a tough year, the early signs for 2026 are encouraging.”

IMPROVED CONFIDENCE

Amy Reynolds, Head of Sales at Richmond estate agency Antony Roberts, says: “Halifax’s data reinforces what we’re seeing on the ground: prices are broadly stable, with modest growth where supply is tight and homes are priced realistically.

“This is not a market being driven by speculative price inflation, but by improved confidence and genuine need to move.

“Activity since the start of the year has been noticeably stronger, and as we head into spring, that underlying demand is supporting prices rather than pushing them sharply higher.”

NEW INCENTIVES

James Nightingall, Founder of property search service HomeFinder AI, says: “January’s property market was boosted by improved buyer and seller confidence but the Bank of England’s recent decision not to cut interest rates could dampen demand.

“First-time buyers on the other hand continue to benefit from new-build incentives whilst Santander just introduced a new 2% mortgage for first-time buyers that will motivate more people to make the step towards homeownership this year.”

STRUCTURAL FORCES

Daniel Austin, CEO and Co-founder at ASK Partners, says: “Today’s modest rise in UK house prices points to underlying resilience, but momentum remains constrained by affordability pressures and a ‘higher for longer’ interest rate backdrop.

“While recent rate cuts signal easing inflation, they are unlikely to transform market conditions overnight. Mortgage pricing has improved, yet buyer and developer confidence remains fragile following a Budget that offered little direct stimulus for housing.

“The market is increasingly being shaped by structural rather than cyclical forces. The UK’s forecast 1.4% growth rate, relative outperformance versus the eurozone, and sustained interest from Gulf and Southeast Asian capital continue to support long-term confidence.

“Mainstream buyer activity remains subdued.”

“However, mainstream buyer activity remains subdued, with demand instead flowing into structurally undersupplied rental markets, particularly build-to-rent and co-living in well-connected suburban and commuter locations.

“While proposed planning and affordable housing reforms may improve scheme viability at the margin, elevated construction and financing costs will continue to pressure margins in the near term.

“A clearer downward path for rates towards the 3.5% range would help unlock stalled projects. Until then, capital is favouring resilient, income-led segments such as logistics, data centres, storage and other operational real estate, with real estate debt offering an attractive way to generate secured income while managing downside risk in a still-cautious market.”